Written by: Jack Manley

While geopolitical tensions have reached a boiling point overseas, American investors have recently faced a set of potentially market-moving events at home: President Biden’s first State of the Union address and Federal Reserve Chair Powell’s testimony in front of Congress on monetary policy. As a result, many may be asking: between these speeches and with the backdrop of global unrest, has the outlook for monetary and fiscal policy in the United States changed?

To help answer this question, it is worth understanding what was said – and not said – in each of these respective speeches.

On fiscal policy, in addition to a strong condemnation of the Russian invasion of Ukraine and highlighting the renewed sense of unity among western powers, President Biden briefly touted his legislative agenda. However, while last year’s bipartisan infrastructure package was mentioned specifically, the President did not mention his “Build Back Better” initiative by name. The absence of this commentary could be interpreted as a signal that he is abandoning the package as a comprehensive single proposal. However, his mention of a number of items within “Build Back Better”, such as cutting the costs of prescription drugs, making childcare more affordable and promoting green energy, indicates that he is still interested in keeping the bill alive, albeit in piecemeal fashion and perhaps through the reconciliation process.

Moreover, while the U.S. may see some fiscal aid this year should energy prices continue to rise, more aggressive spending is not a base case, especially with November’s midterm elections likely resulting in divided government.

On monetary policy, Chair Powell’s Congressional testimony was simultaneously cautious and reassuring. Powell made clear that he was prepared to “propose and support” a 25 bp rate hike at the March meeting – effectively eliminating the possibility of a 50 bp hike this month – and stated that the committee would likely agree on a path forward for balance sheet reduction in a “predictable manner.”

At the same time, he highlighted the tightness of the labor market, persistence of supply chain disruptions and the inherent uncertainty surrounding the U.S. economic fallout from the crisis in Ukraine. For these reasons, Powell reminded market participants that the Fed could hike more frequently or with greater magnitude should the situation require it. However, even if uncomfortable inflation persists through the summer, the Fed may be wary of overreacting with hyper-aggressive policy normalization, and 25 bp hikes alongside a steady reduction in the balance sheet are likely given the current situation.

All told, fiscal policy in 2022 may not be easy as some investors feared, though monetary policy could be tighter. However, given the unpredictability and instability of the geopolitical situation, investors should remember that trying to make tactical moves in portfolios would be unwise. Instead, investors should continue to focus on quality across asset classes, avoid timing the market and broadly diversify to dampen the potential impact of the heightened volatility expected throughout the course of this year.

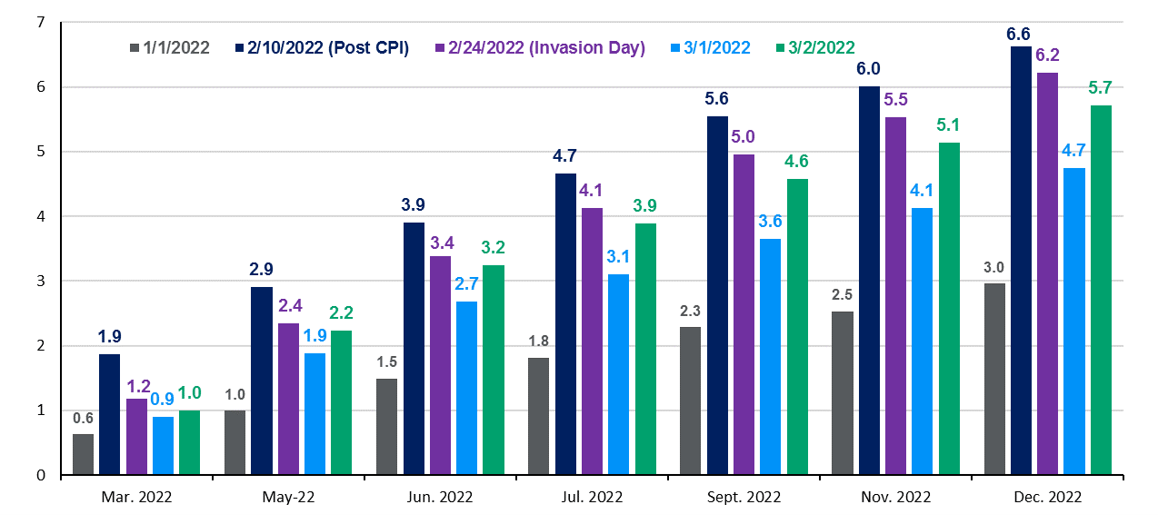

Market expectations for rate hikes recently took a hawkish shift

Related: How Should I Think About Geopolitics and Volatility?

Source: Bloomberg, J.P. Morgan Asset Management.