Written by: Steven Brod, Senior Partner, Chief Executive Officer & Chief Investment Officer | Crystal Capital Partners

The Prime Minister of India, Narendra Modi, intends for India to be a developed country by 2047, the 100th anniversary of Indian independence. Some experts have considered that goal to be a bit too ambitious, but few deny the fact that there are several exciting reasons for investors to consider investment opportunities in India1. India’s gross domestic product is expected to increase 6 percent this year, faster than the United States or China4. Relative to other emerging markets, India’s valuations are attractive, and forward earnings growth looks more attractive than it has been in a while2.

In this article, we will discuss the demographics, increased urbanization, and financialization that underpin the investment opportunities in India before contrasting them with the investment opportunities in China, its emerging market peer.

Demographics

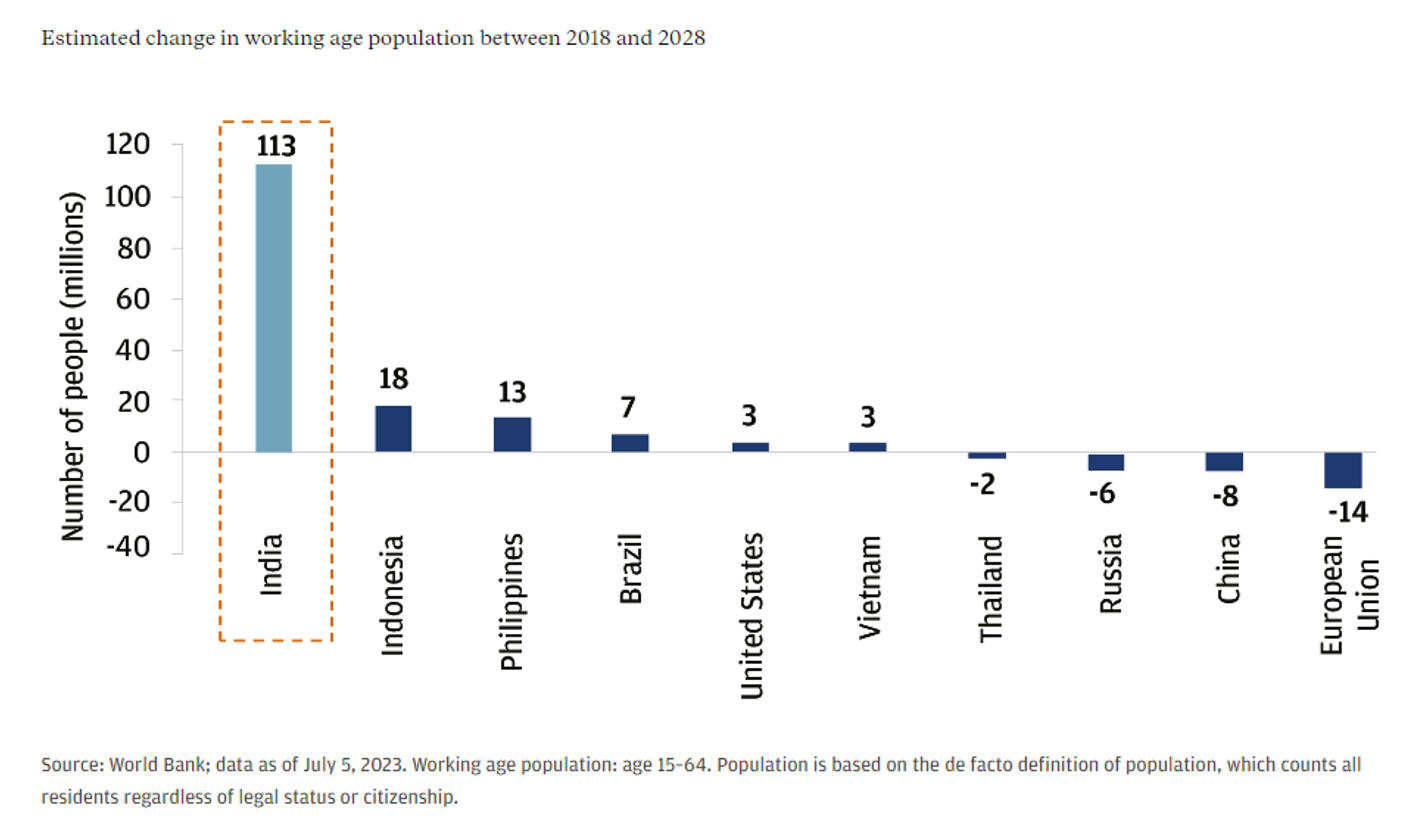

India’s demographics and labor statistics are perhaps the strongest tailwinds for potential investment opportunities. India has 16% of the global population, yet only produces 7% of the world’s output2. One of the reasons we expect this gap to close is that India’s population is younger. The Indian population has a median age of 28 years old compared to both the US and China, which have a median age of 38 years old. India’s working-age population is also increasing and is set to see a long period of growth over the next two decades, whereas this group has peaked in other BRICs like Brazil and China3. The robustness of the Indian labor force should be a positive factor for potential investment opportunities, and as shown in the below chart, India is far outpacing many of its peer nations – especially as some countries are experiencing labor force declines.

India’s labor force is projected to grow, while others stagnate or shrink

Urbanization

In the next 15 years, India’s urban population is set to increase by 125 million people. The average annual household consumer wallet size is expected to increase by 2.4x between 2020 and 2030. This increase in household wealth would allow discretionary spending to rise from 24% to 40%, according to research conducted by Wellington Institutional Asset Management3. The Indian government seems to be supporting these trends as well by making huge investments in urban infrastructure. The Modi-led government has improved airports, roads, and bridges throughout the country, as well as prioritizing clean energy infrastructure that is visible almost everywhere4. Additionally, a 50% decrease in interest rates over the last decade has driven strong demand for and affordability of urban housing. According to the same research report from Wellington, they expect that this demand strength will persist for years to come3.

Increased Financialization

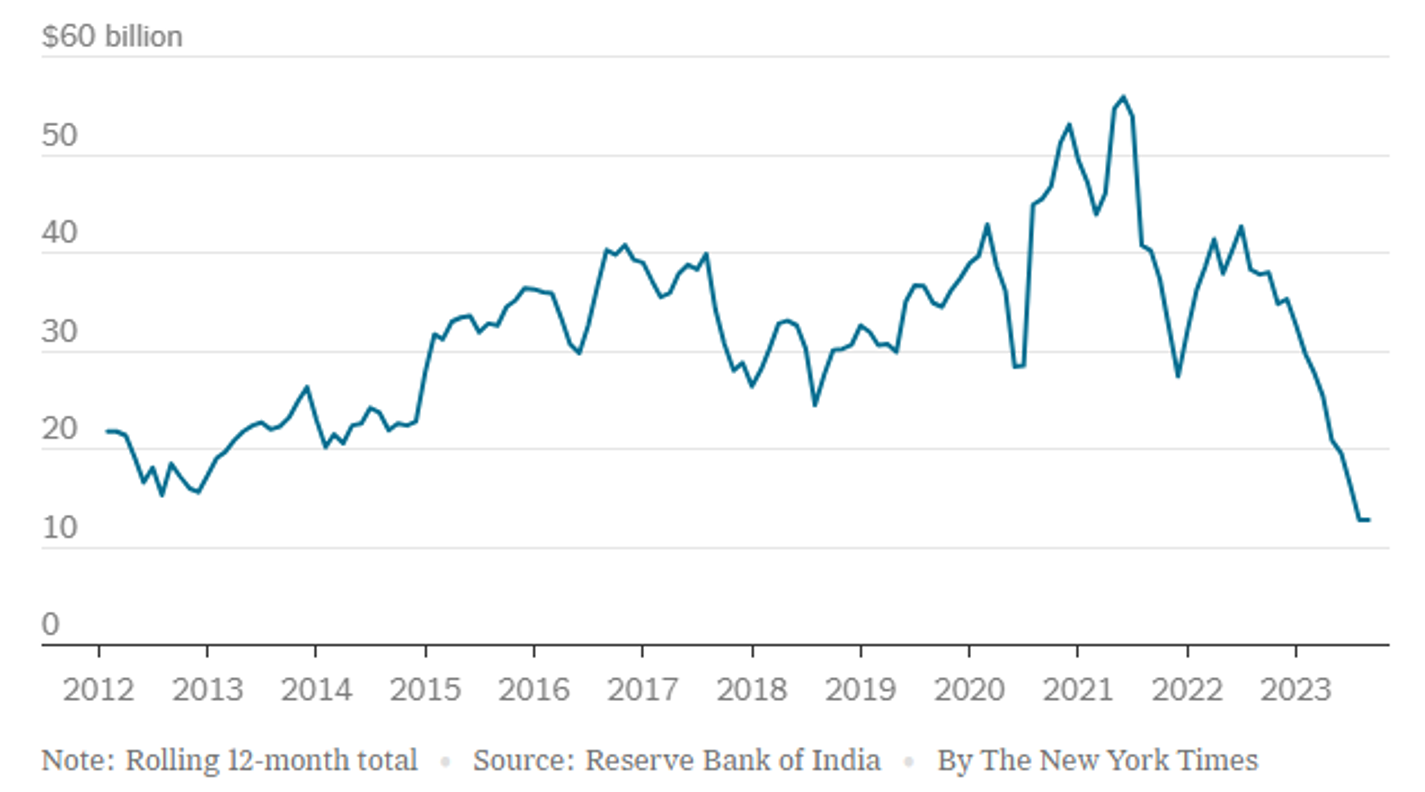

Market capitalization of the NSE, India’s main stock exchange, is now worth nearly $4 trillion (up from approximately $3 trillion a year ago), making it more valuable than Hong Kong’s, one of China’s three major stock exchanges4. The Indian market has grown even though foreign direct investment in India has declined, hitting a multi-year nadir as show by the graph below.

Foreign Direct Investment in India

Source: Indian Stocks Are Booming. Why Is Long-Term Investment Lagging? - The New York Times (nytimes.com)

A reversion to the mean and pick up in foreign investment into India could be the catalyst for investment opportunities in India. While foreign investment into China has at times been characterized as riskier due to uncertainty in regulations and government intervention, India has instituted structural reforms that facilitate the business environment for U.S. exporters and investors1.

Even if foreign investment does not pick up meaningfully, Indian middle-income households have only 10% of assets invested in capital markets6. This implies that there may be significantly more demand for investment from the Indian middle class as they move towards Modi’s target of becoming a developed nation.

Comparison to China

Many have compared the investment opportunities in India to those we have seen in China in the 21st century. In some ways, the comparison is apt. Investment opportunities in India may be taking the baton from China. Some experts reference the slowing Chinese economy and potential trade tensions with the United States as bullish for the Indian economy4.

Perhaps the major difference between the investment opportunities in India and China is that the Indian Government has not taken aggressive pro-growth measures. Prime Minister Modi has been supportive of economic growth but in contrast to China, the Modi-led government has also increased the ease of business for foreign companies, modernized the bankruptcy code, and revamped monetary policy to focus on reducing risk to the Indian rupee5. Investors generally trust data coming out of India and don’t expect some of the structural issues they have seen in China’s commercial real estate sector.

Conclusion

The potential opportunities in India are exciting and could be a long-term investing trend that plays out within emerging markets. Investors trying to access the Indian market through alternative investment funds should look to utilize platforms that allow investors to create portfolios with exposure to large fund managers with local expertise and long-term experience investing in Indian markets. As one of the fastest-growing and most exciting markets in the world, we expect we will see both private markets and hedge fund managers continue to allocate to investment opportunities in India.

Related: The World Is Breaking Out

Sources:

1 India - United States Department of State

2 Investment Case for India Economy (morganstanley.com.au)

3 India investing upcycle | Wellington US Institutional

4 Indian Stocks Are Booming. Why Is Long-Term Investment Lagging? - The New York Times (nytimes.com)

5 Why now may be a good time to consider Indian equities | J.P. Morgan Private Bank U.S. & Canada (jpmorgan.com)

6 Consider This: Is India the new China? | Franklin Templeton