Written by: David Waddell | Waddell and Associates

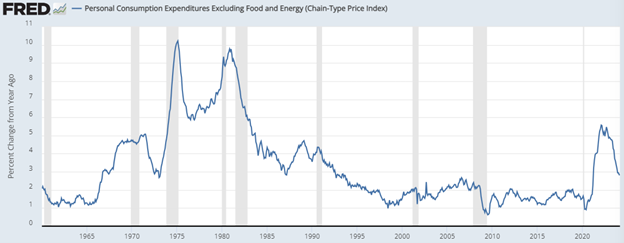

The US Federal Reserve operates with a dual mandate. Per Congress, they must pursue policies that support “stable price levels” (2% inflation), and full employment (currently estimated at 4.2%). Historically, the Fed has used interest rate policy as an accelerator and a brake on economic activity to influence the labor market and, therefore, price levels in an iterative dance. Over time, the relationship between the labor market and inflation has declined. GDP has grown faster than employment growth (also known as productivity gains), while the labor market has become more fluid and less unionized. When the Fed began its tightening cycle two years ago, we hypothesized that inflation could fall back to target without requiring labor market dislocations and recession. We expected white-collar layoffs to offset blue-collar hirings as companies struggled to hire and fund front-line workers while rightsizing bloated corporate bureaucracies to preserve earnings. This labor force reallocation suggested that price levels could “stabilize” despite employment levels remaining “full”, a near impossibility according to my economic textbooks. And yet… that is what has happened since inflation peaked in June of 2022:

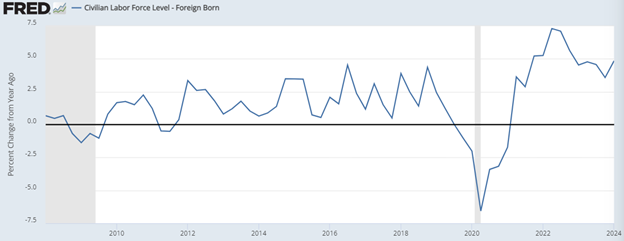

Notice that historically, inflation (the blue line) only fell meaningfully during recessionary periods (the shaded areas). This go-round, inflation has fallen without triggering recession thanks to increasing economic supply rather than Fed-forced decreases in economic demand. The economic supply expansion hasn’t just reopened supply lanes and post COVID production expansion, it has also included labor and energy supply expansions. For example, note the growth in size of the foreign-born US labor force:

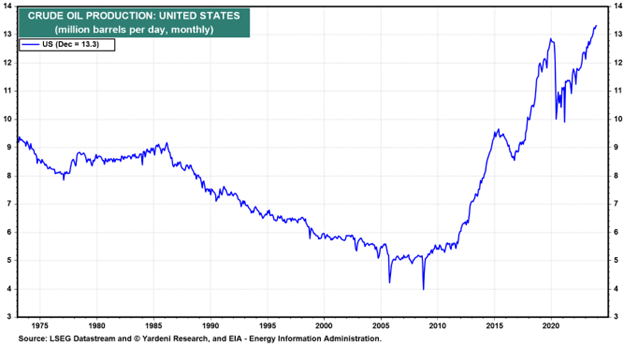

While I am not suggesting that a porous southern border is an anti-inflation policy decision, the 5% growth in immigrant labor does double previous expansion levels and has helped satiate elevated labor demand. Additionally, US oil production has quietly reached record levels:

While I am not suggesting that increasing oil production is an anti-inflation policy decision, the half a million more barrels per day than pre-COVID levels (mostly on Federally leased land) has added more energy supply to help satiate elevated energy demand, but I digress.

Refocusing on labor conditions, we received two reports this week that strengthened the case for the uncommon pairing of disinflation with full employment. First, the JOLTS report offered this encouraging data point:

While the US economy continues to have 1.3 job openings per unemployed worker (implying a labor shortage), that number has fallen back toward pre-COVID levels from its peak. This rebalancing of labor supply and demand should theoretically reduce wage pressures and overall inflationary pressures. Per the Bureau of Labor Statistics jobs report delivered Friday, average hourly earnings dropped to the lowest level seen since March of 2021 and within striking distance of pre-COVID levels:

All of this has happened concurrently with a US unemployment rate continuing to register below the Fed’s 4.2% target:

In sum, the economic supply additions to the US economy combined with advanced technology integrations and corporate labor restructurings have produced welcome disinflation without recession. Chairman Powell acknowledged this unusual relationship earlier in the week at his FOMC presser, expressing confidence that these goldilocks dynamics will continue. Markets rallied in response, then rallied even further as Friday’s jobs report validated his optimistic perspective. The S&P 500 now stands within 2.5% of its closing high. Just as economic textbooks require revision given the extraordinary pairing of disinflation with full employment, investment textbooks also require revision to change their sell in May maxim to… don’t sell in May!

Have a great week!

Sources: FRED, LSEG Datastream and Yardeni Research, and EIA – Energy Information Administration

Related: Why Annuities Belong in Clients’ Retirement Income Plans