The mission was clear… don’t let the Russians get their hands on these devices.

Sanctions rained down on Russia after it invaded Ukraine last year.

Europe stopped importing its oil… America froze it out of the financial system… and hundreds of Russian oligarchs had their luxury yachts and private jets seized.

But one set of devastating sanctions slipped under the radar.

These penalties didn’t make front-page news. But they could cost Vladimir Putin the war.

This is Russia’s Achilles heel…

Most of the country’s weapons run on microchips.

I’ve pounded the table on “chip” stocks for years. I recommended NVDA back in 2018. And today, I’ve got a few new names for you to consider, so read to the end.

All modern weapons—from drones to GPS-guided missiles and armored vehicles—run on microchips. And that’s a BIG problem for Vladimir Putin.

Russia doesn’t make chips. It imports them from Western firms. But these companies cut ties with Russia after it invaded Ukraine.

US microchip sales to Russia collapsed 90% last year. And now Russia’s cache is almost empty.

Putin’s army is running short on everything from precision missiles… to handheld radios… to drones. And that deficit is putting Russia on the back foot on the battlefield.

Politico reported Russia drew up a “shopping list” of around 25 different chips needed to fuel its war efforts.

Many of these thumbnail-sized devices cost ten bucks or less. But you can’t make a $4 million tank or a $500,000 missile without them.

This hiccup may cost Russia its victory.

Remember smoking on airplanes?

The “smoking” section used to occupy the last few rows of airplane seats.

But smoke naturally wafted up the cabin, and you’d leave the plane smelling like you’d spent the night in a dive bar.

Then, in-flight TVs and Wi-Fi replaced cigarettes.

I’m in Montreal for a few days on business. I can confirm nobody lit up a ciggy on the flight here. But all my fellow flyers were glued to their TV screens.

And all those screens run on microchips.

From credit cards to electric scooters to pacemakers—the whole world runs on chips.

Even ketchup dispensers....

A few years ago, Heinz debuted its Keystone Automatic Condiment Dispenser. To most people, it’s a clean way to squeeze out half an ounce of red sauce. Just wave your hand over the machine, and it’ll automatically garnish your burger.

But as longtime semiconductor investors, we see a machine powered by different types of chips… just like the ones Russia is scrambling to get its hands on.

Source: Heinz

Ditto for cars.

Twenty years ago, most motors didn’t even have one microchip. Today, your average electric car is packed with roughly 3,000 of them.

Most of these chips only cost a few bucks, but you can’t ship a new car without them. Everything from your car’s power steering to its dashboard to its automatic windows runs on them.

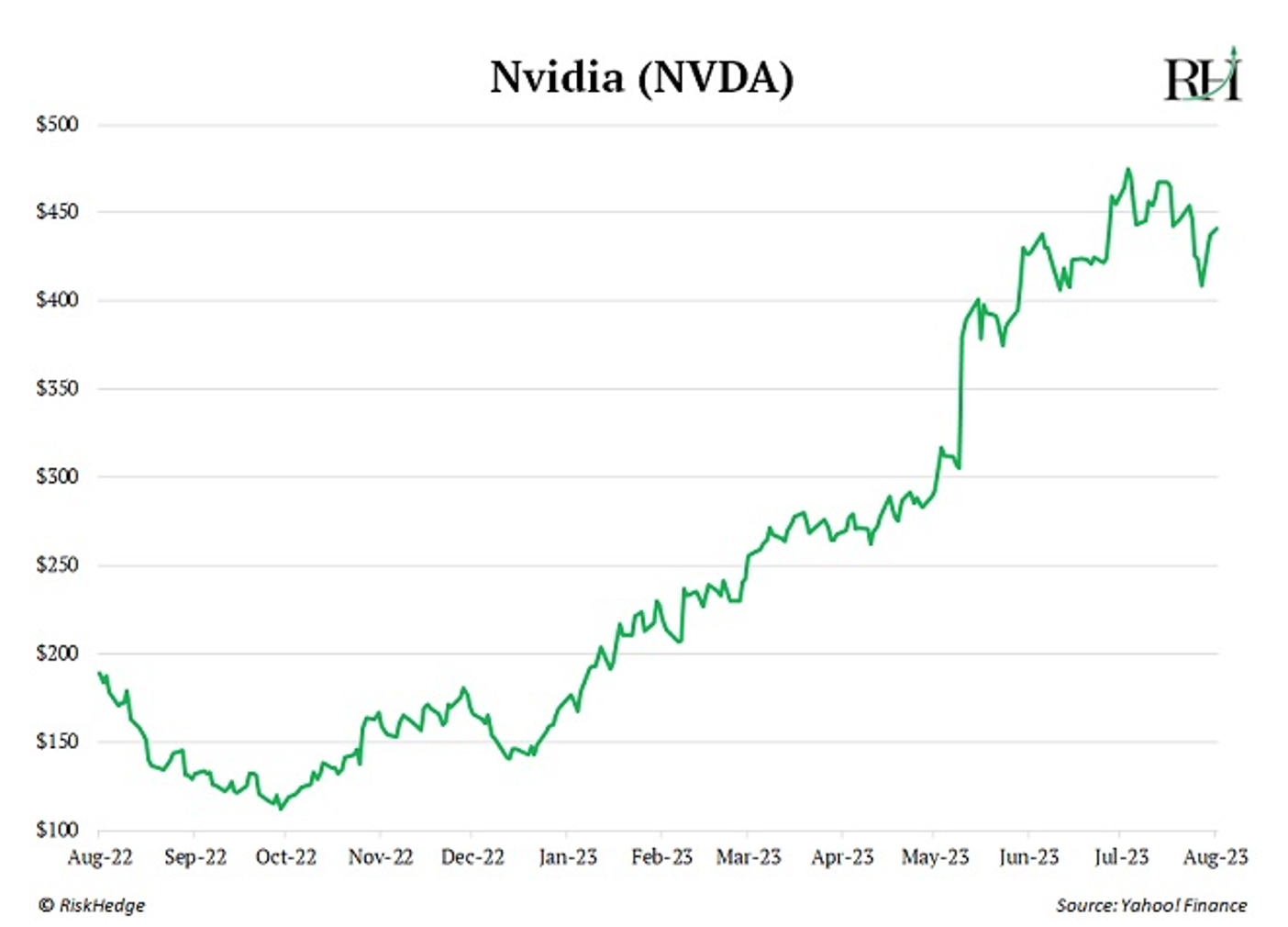

Nvidia’s chips cost a pretty penny.

Nvidia’s (NVDA) graphics chips power the world’s most powerful AI systems, like ChatGPT.

Nvidia sells its state-of-the-art semis for $40,000 apiece. It’s raking in boatloads of cash and has rewarded investors handsomely:

But what about the companies making the “cheap” chips... which make up the vast majority of semi sales?

Data from TechInsights shows chipmakers will ship roughly 580 billion semis this year. Almost two-thirds of them are the kind which go into toasters and toothbrushes.

These “dollar chips” also power military equipment like drones, guided missiles, and helicopter navigation systems.

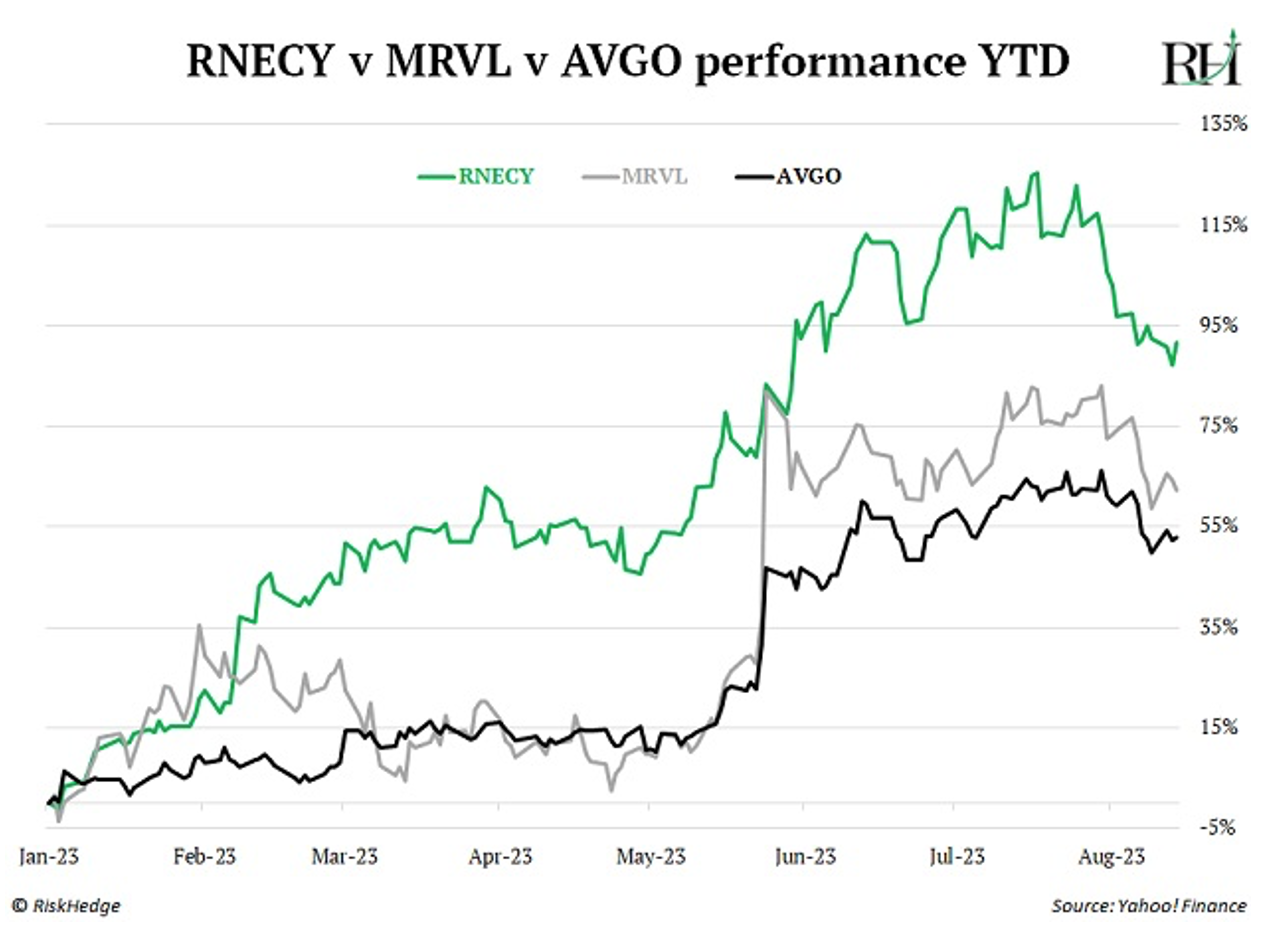

The chipmakers cranking out these older semis—like Marvell Technology (MRVL), Broadcom (AVGO), and Renesas Electronics Corp. (RNECY)—are all up 50%+ this year:

Here’s the surefire way to make money as chips continue to take over the world.

Unlike Nvidia’s near monopoly on AI chips, churning out these $10 semis is a competitive business.

There are roughly half a dozen companies making similar products. And every few years, these firms start price wars with each other and compete away all their profits.

They’re not the type of businesses you buy and hold for five years.

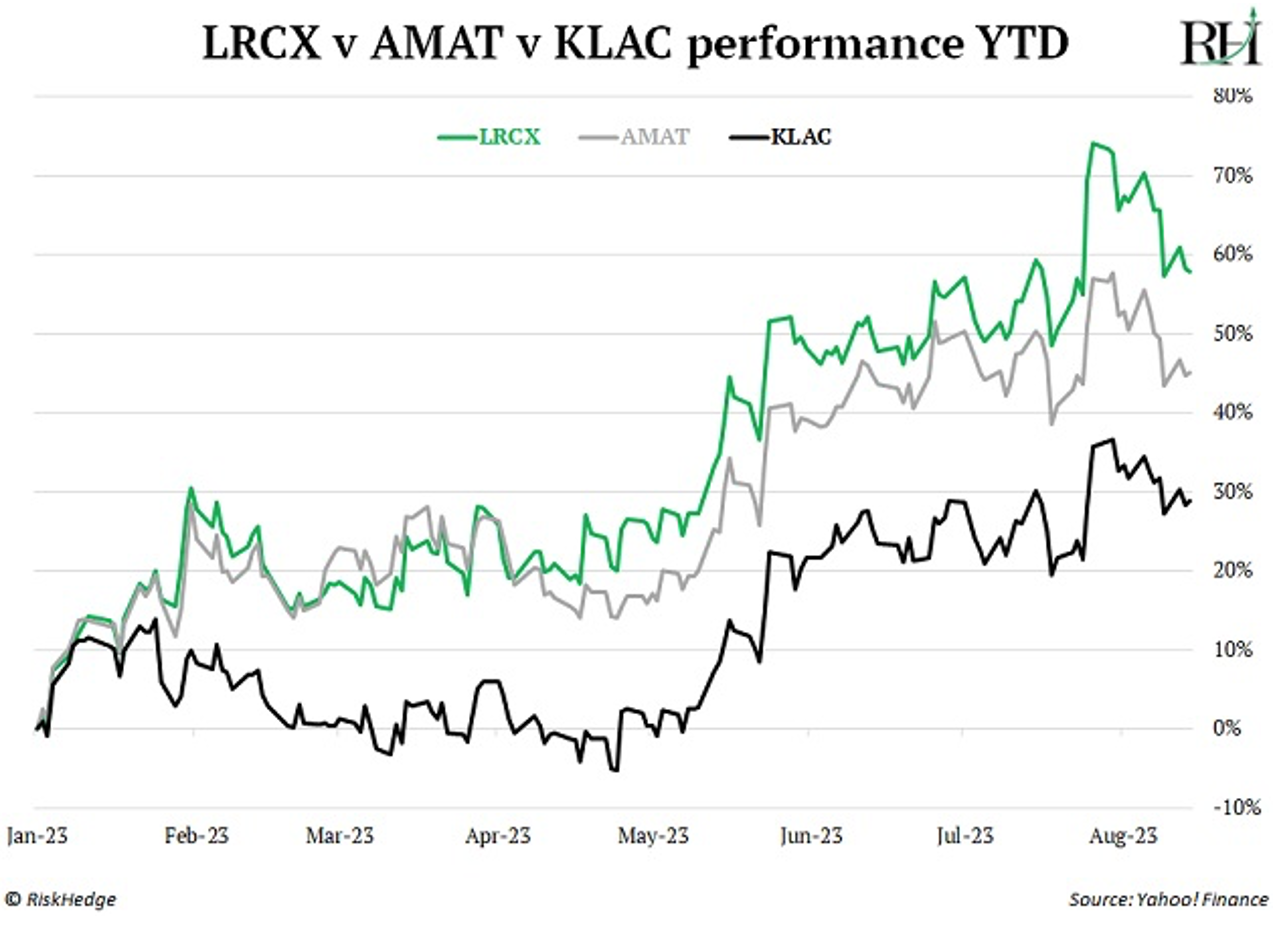

Instead of buying these chipmakers… you should buy the companies manufacturing chipmaking machines.

Many older chipmakers are rushing to build new chip plants as demand for their devices ramps up. Roughly 70% of the money spent building new plants goes toward chipmaking machines.

Companies producing these machines—like Lam Research (LRCX), Applied Materials (AMAT), and KLA Corp. (KLAC)—stand to make a killing.

Chip equipment companies are among my favorite stocks to own for the next five years.

Related: How to Double Your Money From “Oppenheimer”

To get more ideas like this sent straight to your inbox every Wednesday and Saturday, make sure to sign up for The RiskHedge Report, a free investment letter focused on profiting from disruption.