Written by: Stephanie Aliaga

Much has been said about the “Magnificent 7” stocks that dominated market returns last year, ending 2023 up 107% and accounting for around two-thirds of the S&P 500’s performance. In the aftermath of stellar performance and a healthy dose of AI optimism, some worry around the sustainability of the Mag 7’s ascent and its implications for broader investment performance.

Despite higher valuations we do find that the leading U.S. tech companies continue to offer some of the highest quality growth exposure, boasting robust cash balances, capex spending and profitable business models. But we also expect to see a broadening out in market performance this year, for a few key reasons:

1. Elevated expectations and concentrated positioning create a high bar for the Magnificent 7 to beat.

Enthusiasm around generative AI provided a major catalyst for AI-linked stocks in 2023, but while last year was about excitement, the road ahead will be about results. So far in 4Q23 earnings season, Big Tech has continued to deliver but after massive outperformance last year, these names do appear vulnerable to pullbacks if subsequent quarters disappoint elevated expectations around adoption speed and profitability. The bar keeps getting raised. So far this year, the Mag 7 has seen an average upward earnings revision of nearly 5% for 2024, compared to a 1.3% decline for the S&P 500.[1]

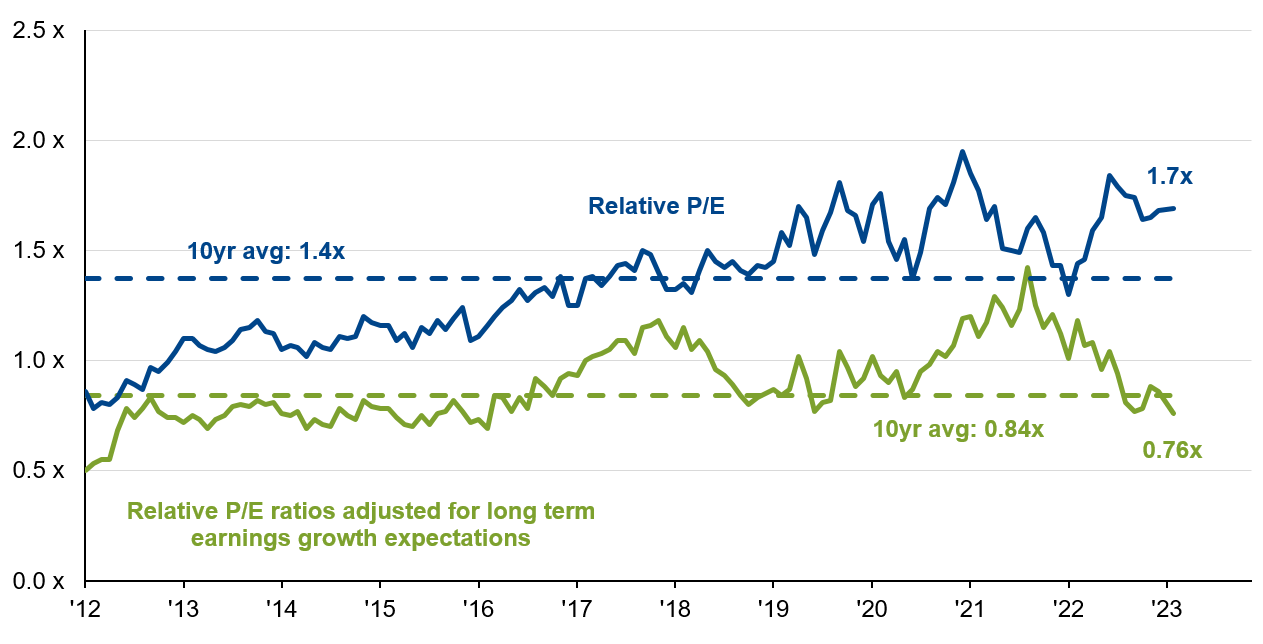

Markets also tend to over-appreciate the near-term implications of transformative technologies while underappreciating the long-term, which can lead to market corrections if patience is not a virtue. Indeed, while Magnificent 7 stocks appear expensive relative to the rest of the market on a 1-year forward P/E basis, when accounting for long-term expectations for earnings growth, relative valuations are much more in-line with recent averages (see chart).

2. AI will be investable for the long-haul and its beneficiaries will include far more than chipmakers.

An AI-led technology supercycle is underway but is still in its nascency. While the companies selling the necessary semiconductor chips and computing infrastructure (the “picks and shovels”) will remain important, the long-term winners will include a much broader set of beneficiaries that enable mass business adoption. Indeed, the commercialization of AI will require customized solutions across software, infrastructure and cybersecurity, areas where general purpose models (like ChatGPT) often fall short. This ongoing progress of business discovery, implementation and reorganization will dominate the next 5+ years in AI, revealing winners that may not even be familiar to us yet. Over the long-term, we also think that AI could meaningfully boost labor productivity, accelerating the potential growth rate of the U.S. economy and therefore earnings growth (See: The transformative power of generative AI). As such, investors will want to be open minded about the AI opportunity set, and an emphasis on active management should better enable investors to capture emerging winners in a fast-evolving landscape.

3. A soft landing and declining interest rates should bode well for a “catch up” by sectors and companies left behind in last year’s rally.

Market performance eventually broadened out in the back half of 2023 as optimism around a soft landing and an earlier Fed pivot provided new wind behind the sails of “everyone else” outside of the Mag 7. In 2024, we think this can continue. Broad valuations do not appear overstretched – while the S&P 500 is trading 1 standard deviation above its 30-year valuation range (see GTM page 5), the market’s valuation excluding the top 10 stocks is more in-line with historical averages. Moreover, areas such as healthcare, industrials and mid-cap companies look attractively priced and supported by cyclicality or favorable catalysts.

All told, some investors may naturally feel a dose of performance anxiety after last year’s double-digit stock market returns. However, markets could see both the Magnificent 7 retain its magnificence and performance broaden out in the year ahead. Against a favorable macro backdrop, continued support for high-quality tech names and a ripe environment for active management, investors still have plenty of reason to step out of cash and into risk this year.

[1]Source: FactSet, Data Trek.

When accounting for expected growth, the Magnificent 7 trade at more reasonable valuations

Valuations of Magnificent 7 stocks vs. median S&P 500 stock

Source: FactSet, Goldman Sachs Global Investment Research, J.P. Morgan Asset Management. The Magnificent 7 trade at a P/E multiple of 29x, this is 1.7x the 17x P/E multiple of the median S&P 500 stock. The green line shows that on a relative PEG ratio basis, relative valuations are in line with the 10-year average. Data are as of January 24, 2024.

Investments that are concentrated in a single industry, region, or issuer do not represent a complete investment program and may lead to a higher degree of market risk.

Related: Large Caps, Mid-Caps, or Small Caps?