Written by: David Waddell | Waddell and Associates

THE BOTTOM LINE:

Economic data reflecting the downforce of the tariffs has started trickling in. Supply delays, shortages, and price hikes will soon shift from fear to fact, making trade policy frictions more home felt. Unfortunately, Trump’s sprint for 90 deals in 90 days hasn’t started off well with Japan seemingly confused, and China seemingly disengaged. Without compliance from our trading partners, Trump may have to de-escalate further to buy time. Markets have begun factoring this in with stock indices higher, the US dollar higher, and the 10-year treasury yield lower. Trump can either “win” his trade war through trade partner concessions, tariff delays, or policy retreat. Irrefutable economic pressure will soon force action. The markets are fine with either resolution… and are starting to sniff one out.

President Trump began his tough talk on tariffs years ago, but the marketplace vastly underestimated the brute force of the reciprocal tariffs initiated on “Liberation Day.” Unbelievably, there have only been 16 trading days since then for investors! Fortunately, Trump’s tariff totals have fallen from the Liberation Day rollout. But as it stands, the combination of the 10% universal tariff and tariffs of 145% levied on most Chinese goods takes the overall tariff rate on imports to over 20% compared with 2% before inauguration day. This shock to the system has impacted consumer, business, and investor sentiment significantly (the soft economic data), but hasn’t yet registered in the actual data (the hard economic data).

I received the yacht advertisement shown above on Thursday morning. After Schaefer sells the four yachts they have in inventory, the prices will likely rise 10% due to universal tariffs (origin: Brazil). This will certainly frustrate would-be yachtsman voters and might completely paralyze their purchase decision. The extra $100,000 tax seems worthy of “waiting and seeing.” Remember, economics is a study of incentives, and the tariff incentives suggest less economics. Let’s dig into the data and see where things stand.

Imports First

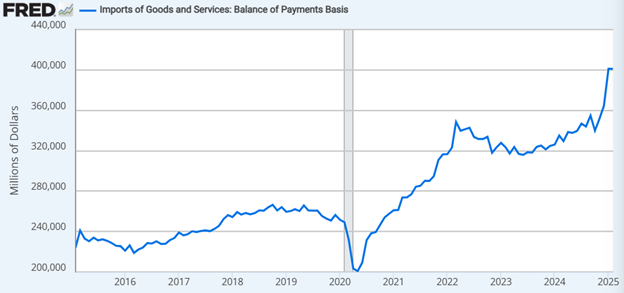

The first thing we should see resulting from the tariffs is inventory stockpiling ahead of the tariff declarations. This should result in a surge in imports…

Source: https://fred.stlouisfed.org/graph/?g=1Iwy5

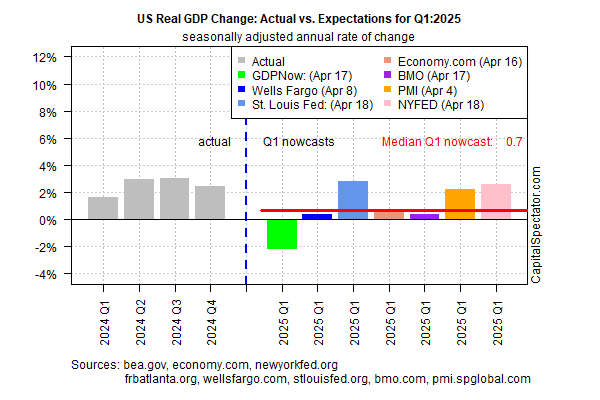

…and indeed, it has! We haven’t received the March data yet, but in February, the US imported $400 billion of foreign stuff. As a result, the trade deficit year-to-date (imports minus exports) has expanded 86% compared with the same period last year. Unfortunately, these tariff distortions weigh heavily on GDP as higher trade deficits subtract from GDP calculations. According to the Fed’s GDPNow calculation, first-quarter GDP could be negative overall. Other real-time projections aren’t as dire, but they are not good:

While trade distortions will drag on first quarter GDP, overall consumer, government, and corporate spending remained firm. US retail sales hit a record in March, seeing their biggest monthly gain since January of 2023. However, the purchases appear to suggest consumers were front-running tariffs as well, with auto purchases up 5.3% month-over-month as an example. Overall, consumer activity should contribute nearly 1% to Q1 GDP growth. While DOGE cuts gain headlines, the US Government has not lowered spending overall. In fact, so far this year, the Federal Government has spent $140 billion more than this time last year. This will likely yield a contribution of .3% or so to first quarter GDP growth. Lastly, while business sentiment has deteriorated, first quarter business investment remained resolute with industrial production higher compared with this time last year. Therefore, the story of Q1 for the US economy will be that the tariff front-running surge in imports detracted from GDP while consumer, business, and government spending kept us afloat. But with the tariffs in force, imports should collapse, leaving the direction of GDP largely up to consumers.

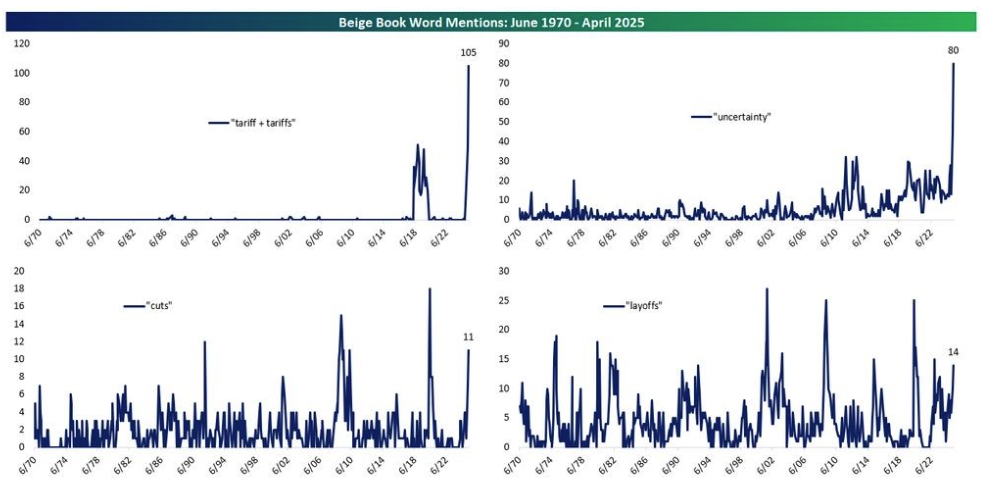

High-frequency economic data for April isn’t very encouraging. Freight volumes have collapsed. Airlines have provided negative guidance, reduced capacity, and lower fares. Consumer juggernauts, like Chipotle, have reported lower same-store sales, and job openings within leisure and hospitality sectors have declined. According to the Fed’s Beige Book—a compilation of anecdotal economic research—the use of the words “tariffs,” “uncertainty,” “cuts,” and “layoffs” surged in the last report:

Source: https://media.bespokepremium.com

This does not portend well for consumer and business activity in the second quarter… unless Trump starts making trade deals!

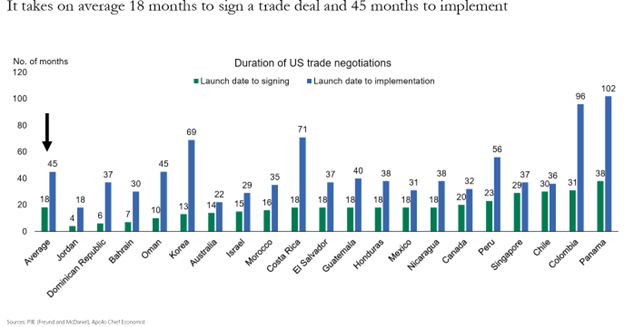

How Long Do Trade Deals Take?

Despite Trump’s 90 in 90-day forecast, trade negotiations between the US and other countries typically take about 18 months, on average:

This week, Treasury Secretary Bessent suggested talks with the Chinese had already begun. Markets rallied strongly on the report. Unfortunately, the Chinese didn’t corroborate and explicitly denied that any talks had occurred. Furthermore, they have indicated that talks wouldn’t occur until Trump removes his bilateral tariffs. High hopes for a trade deal with Japan also fizzled this week as a three-day stand at the White House ended without any triumphant press releases. Another attempt is on the books for later this month, but the Japanese have not indicated any trade deals are imminent. If other nations do not change their positions, Trump may have to change his stance in reaction to upcoming price hikes and supply shortages. Look for “hard” economic data incoming to start catching up with the “soft” economic data plumbing recessionary lows. Unlike the COVID pandemic, where antidotes had to be developed and broadly administered in tents with syringes, the cure for the tariff pandemic only requires a pen and an executive order. Now that economic fears are becoming fact, the pressure for a cure is mounting.

Extra Credit

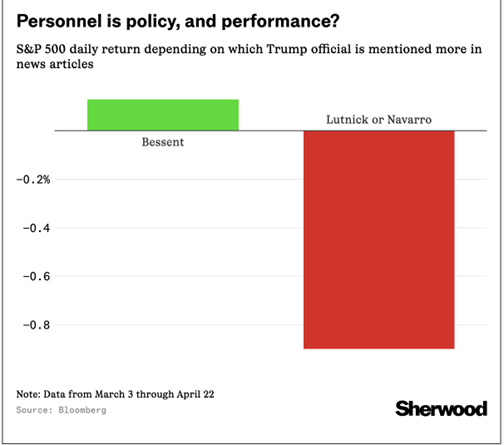

My favorite chart of the week, how the S&P performs when Bessent speaks vs. Lutnick or Navarro, is reminiscent of our last slide in last week’s Live edition:

This communication and its contents are for informational and educational purposes only and should not be used as the sole basis for any investment decision. The information contained herein is based on publicly available sources believed to be reliable but is not a representation, expressed or implied, as to the accuracy, completeness, or correctness of said information. Past performance does not guarantee future results.

Sources: FRED, CapitalSpectator.com, Bloomberg, PIIE, Apollo Chief Economist, Bespoke Media

Related: 3 Low-Beta Stocks to Anchor Your Portfolio in Volatile Markets