This year has been characterized by a decline in equity market valuations against a backdrop of improving earnings expectations. While rising interest rates and a more hawkish Federal Reserve (Fed) help to explain what has gone on with valuations, it was not as clear why earnings estimates continued to move higher. Interestingly, however, companies have begun guiding earnings expectations lower in recent weeks, as it appears too difficult to continue ignoring rising costs and economic growth that is decelerating back toward trend.

Companies have cited a number of different headwinds - rising wages, higher commodity and input costs, a stronger dollar and softer demand to name a few. At the end of the day, all of these impact profit margins. Certain costs - such as higher commodity prices and inputs - can be passed along to the end consumer via higher prices. While eventually this will begin to weigh on demand, it helps preserve margins in the short-to-medium term. Wages, on the other hand, cannot be passed along to the end consumer, meaning companies need to either reduce their employment footprint via layoffs or a focus on automation and efficiency.

While consensus estimates calling for 10% earnings growth in 2022 were likely too high, we do not believe that the base case should be for an earnings recession this year. Demand has only just begun to soften due to higher prices, and more labor-intensive industries have announced hiring freezes and layoffs in response to cost pressures. Furthermore, some of this weaker guidance is very normal; analysts tend to over-estimate earnings in the run up to the actual quarter, but importantly, by the time earnings are reported, they are underestimating what the profit number will be. This is the never-ending game of earnings management, but also serves as a reminder that what we are seeing today may be more normal than people appreciate.

Our expectation is that margins will prove more resilient than expected, as an active reduction in labor costs should help address some of this downward pressure. Furthermore, while the cure for higher prices is higher prices, it seems like price increases will be more modest going forward. As a result, we continue to expect S&P 500 operating earnings growth in the mid-single digits for calendar year 2022; while this will be insufficient to push equity returns into positive territory, it should provide a base against which risk assets can stabilize during the second half of this year.

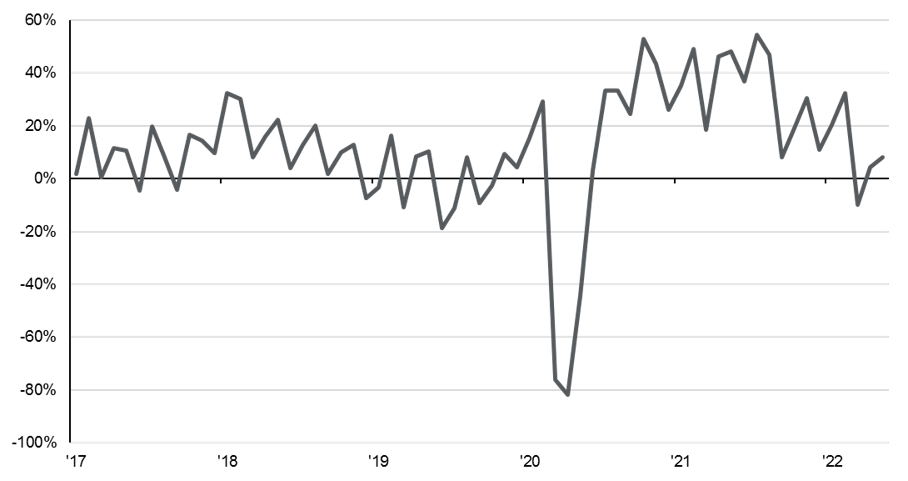

Earnings estimates have come under pressure in recent months

Upward revisions - downward revisions/total revisions*, current year, monthly

Source: FactSet, J.P. Morgan Asset Management. *Total revisions include upward, downward and unchanged revisions. The above analysis is from January 2017 through May 2022. All data are as of June 1, 2022.

Related: Should I Time the Bottom in Today’s Market?