Alternative investments can encompass a wide variety of investments. By the purest definition of alternative, it simply means a type of investment that does not fall into one of the traditional categories, such as equity, fixed income, or cash. It is an alternative type of investment. These alternatives include private equity, venture capital, commodities, hedge funds, futures, options, precious metals, and many others. Often these types of alternative investments require that either the investor or the advisor is very knowledgeable in that asset category.

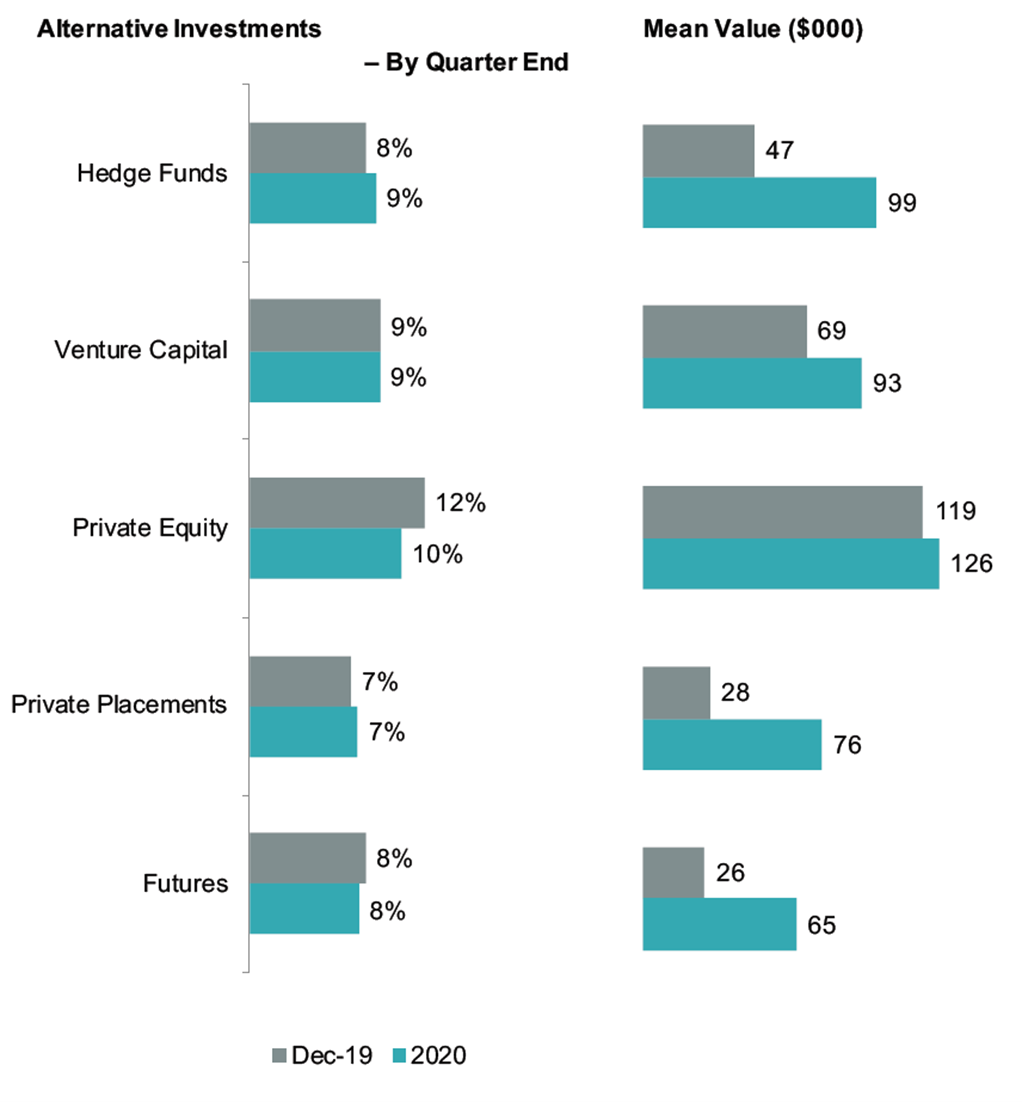

Alternative investment ownership has gone down slightly within some categories since 2019, according to recent research by Spectrem Group. Ownership of commodities decreased one percent, and ownership in precious metals and private equity decreased two percent. Despite these slight declines in ownership, values have increased significantly since 2019. Values in hedge funds, private placements, futures, and options have more than doubled since 2019 according to Spectrem. Who owns these investments?

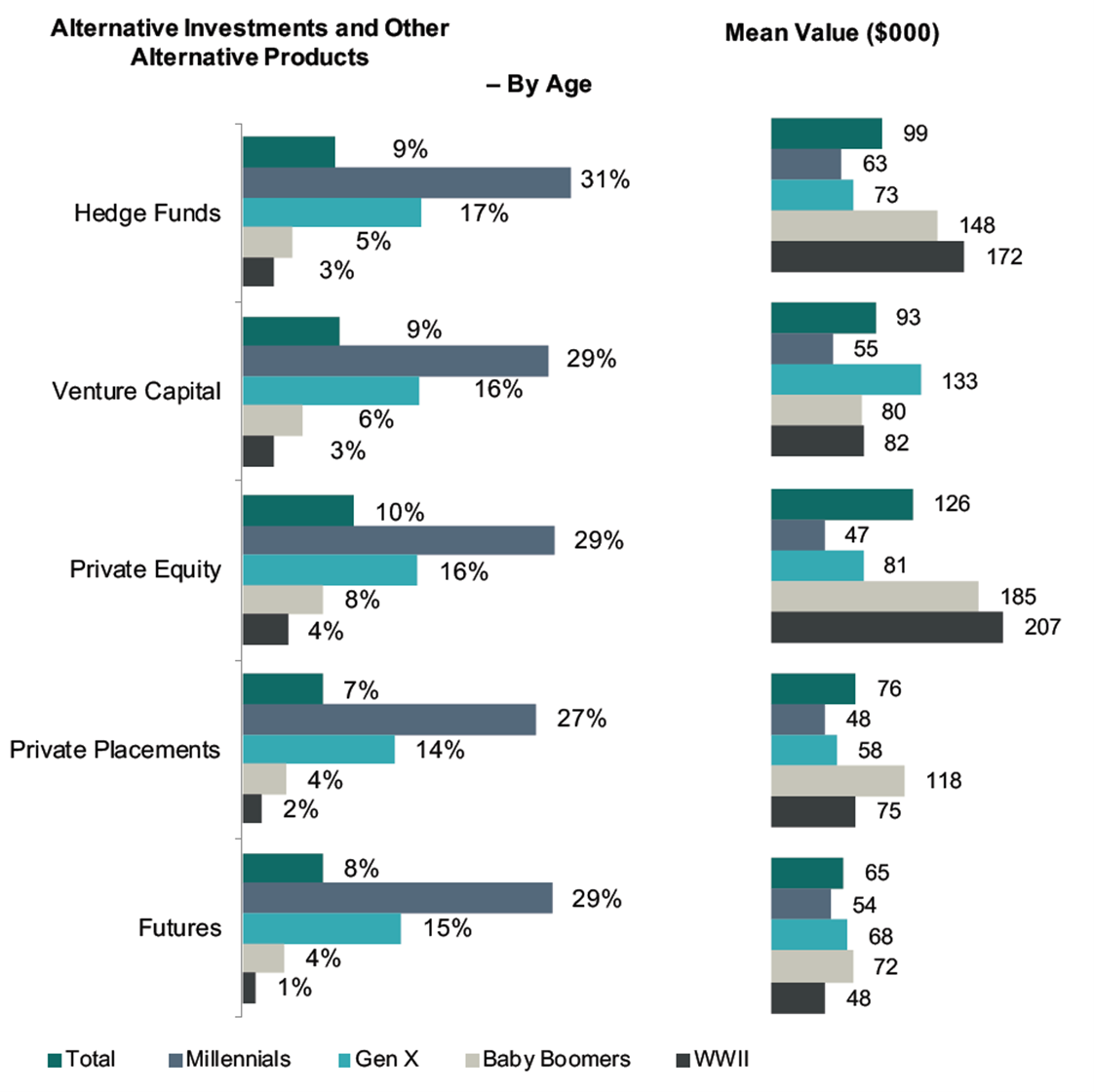

Millennials are the age segment most likely to own alternative investments. Thirty-one percent of Millennials own hedge funds, while 29 percent own venture capital, private equity, and futures investments. Not surprisingly however, values of those investments are much lower than that of older investors. Investors at higher levels of net worth are also more likely to own alternative investments. Wealthy investors who have a net worth between $15 million to $25 million dollars are the most likely to own alternative investments, with over a quarter of those wealthy investors owning hedge funds, private equity, and precious metals.

Investment knowledge also impacts alternative investment ownership. Those investors who consider themselves to be very knowledgeable about investments are more likely to own alternative investments than those investors who feel they are only fairly knowledgeable or not at all knowledgeable. Working investors are more likely to be invested in alternatives than those investors who are retired. Retired investors however have higher values in alternative investments than working investors. Those investors with a more aggressive risk tolerance have a higher percentage of ownership in alternative investments than more conservative investors.

It is likely that the proclivity to invest in alternatives is in pursuit of higher rates of return or a desire to have investments that act differently than the other holdings in a portfolio. Even though these wealthy investors own alternative investments, the overall percentage that investors own in alternative investments as a portion of their overall portfolio is very small. Only six percent of investable assets of wealthy investors are held in alternative investments. It is beneficial to work with a financial professional when developing an investment strategy that includes alternative investments.