Consolidation of assets is something that many investors consider at some point in their financial lives. While it is possible to manage your investments on your own, it can be difficult to keep track of all your investments, as well as the different strategies and options available to you. A financial advisor can help you make the most of your investments, while at the same time helping you develop a comprehensive plan for your financial future. Many investors hire multiple advisors, with each of them managing different components of their financial life. While this approach can be beneficial, it can also pose some risks, such as duplicating asset allocation and overexposing the investor to risk they do not want.

Some of the benefits of working with only one person is that you can be sure that all of your investments are being properly managed and that your advisor is familiar with your overall goals and objectives. Your advisor will be able to provide valuable advice on how to best diversify your investments, including which asset classes and individual investments may be best suited for your particular situation. Making the decision to consolidate down to one advisor is something that investors will do only under certain circumstances.

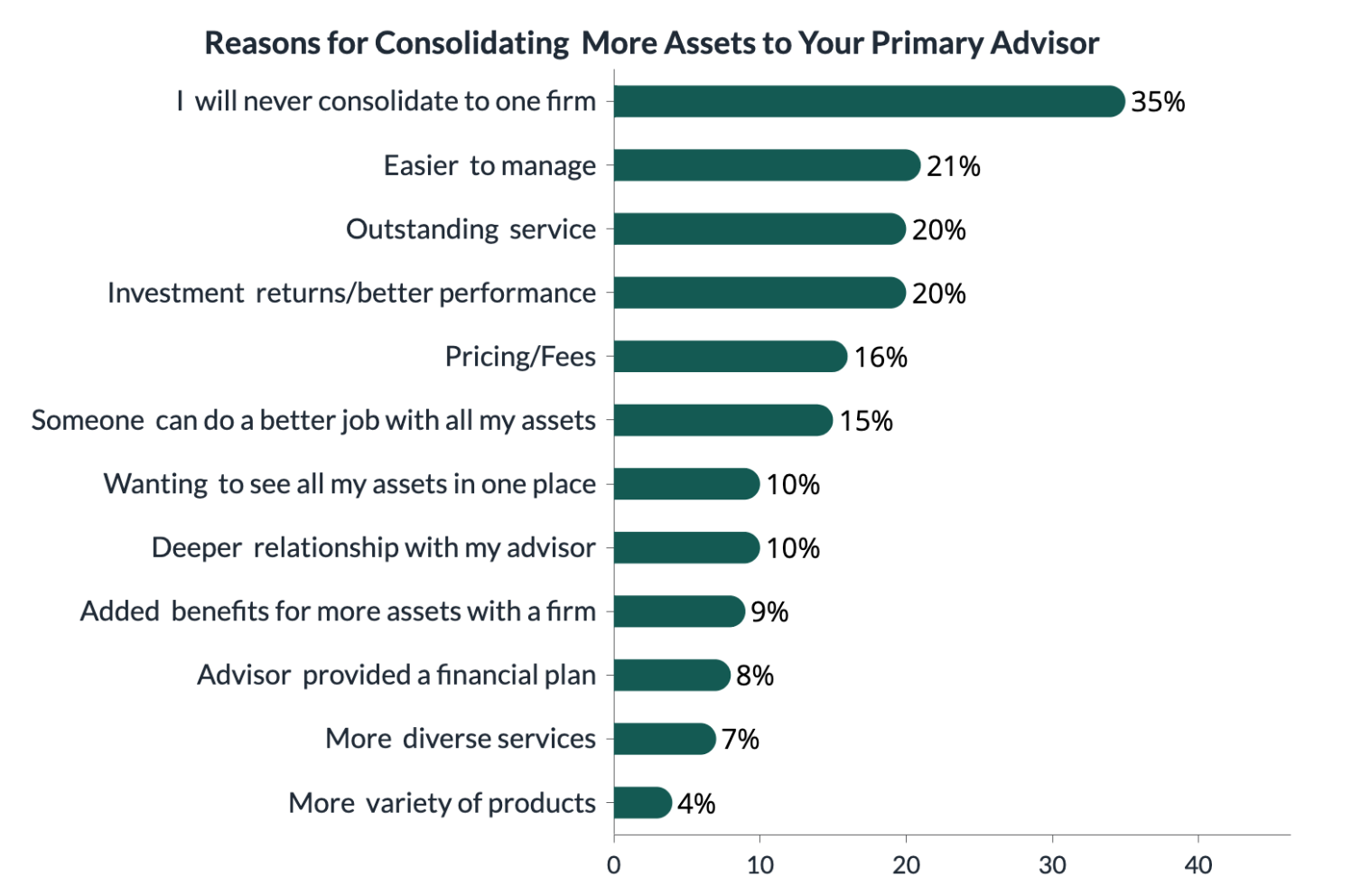

The most common reason investors consolidate assets to one primary advisor is to make things easier to manage, according to recent research from Spectrem Group. When an advisor provides outstanding service, 20 percent of investors would consider consolidating their assets to that advisor. Investment returns that exceed or have greater performance than other advisors would also be a reason for 20 percent of investors to consolidate their assets.

Just over 10 percent of investors would follow or have followed an influencer’s suggestions regarding finances on TikTok, Instagram, or other social media platforms. Millennials are again far more likely to be willing to do this, with 39 percent indicating they would follow or have followed the suggestion of a social media influencer. Some of this willingness comes from being more comfortable with social media platforms and the individuals on those platforms, while another component could be a lack of industry knowledge that leads to trusting knowledgeable experts on platforms the investor is comfortable with.

This industry and concept of social media influencers is very foreign to investors who do not regularly participate on social media platforms that lend themselves to influencers. These platforms, and the influence the individuals have who participate on these platforms, are likely to continue, so it is important to be aware of the impact these individuals have on the overall financial fabric of our country.