About five years ago I remember looking at our financial picture and thinking “by 2021 we will be ‘over the hump’ and things will be easier”. That is because at that particular time we were paying 4 tuitions. One was in law school, one in college and two in private elementary/high schools. I couldn’t wait for that time to come thinking then I could really start focusing on saving more for retirement.

And here we are in 2021 and the financial obligations may be somewhat smaller....but we are definitely not “over the hump”. I think it is because, like many women we recently interviewed in our report, Wealthy Women and Market Volatility in 2020, parents don’t automatically stop providing financial assistance once children reach a specific age, it’s more event-driven.

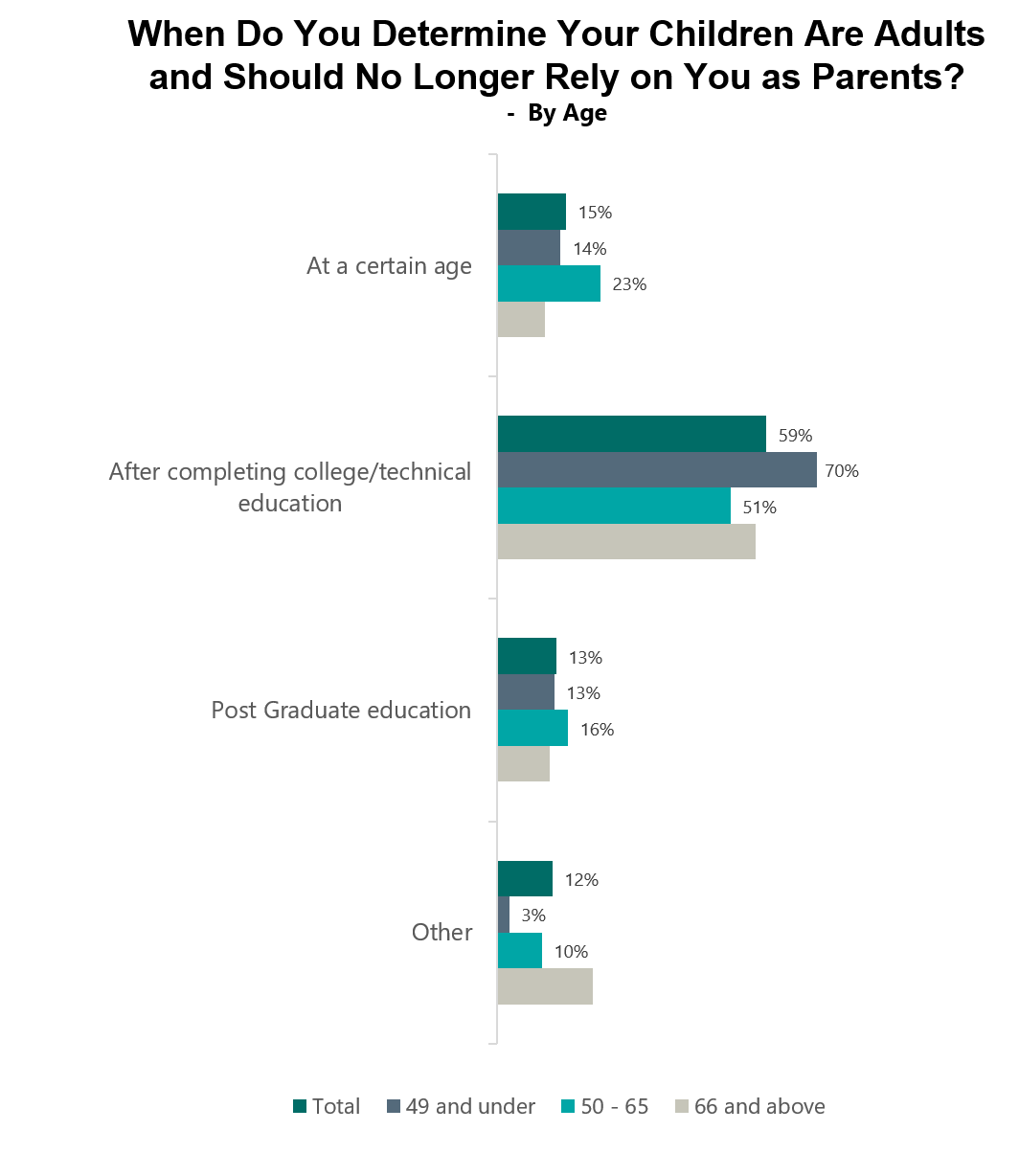

Most women believe that as children become older they have an obligation to become financially independent from their parents. In fact, on a 0-100 scale with "0" meaning "Disagree" and "100" meaning "Strongly Agree", women with children at home rated this concept at 77.29 and women with children no longer at home rated it at 84.64. That belief leads to the logical question "When Do You Determine Your Children Are Adults, and Should No Longer Rely on You Financially as Parents?". As you can see in the chart 59% of women believe that it is after the child has completed college/technical education. That opinion varies based upon age with younger women more likely to embrace that belief and older women slightly less likely to agree.

In my household we have supported our children through college as well as through post-graduate education. Of course, that doesn’t mean it was a gravy train. To the extent possible, they need to work to subsidize their education, but that generally adds up to basically their expenses...sometimes food but generally they didn’t make enough to cover rent and we paid their tuition.

While the tuition for all education is now covered for two of my four children, there are some additional expenses that I hadn’t thought about. So despite have two “grown” children my pocket is still being emptied. But there are many women who believe these contributions are also important. For example, 31% of women believe parents should assist with the purchase of the child’s “first home”. My son and his fiancée are in that process so we will attempt to provide maybe a small amount of assistance. Thirty-nine percent of women believe that parent’s should assist with the purchase of a “first automobile”. We did not really assist with this for our older children....we just gave them our old cars and let them drive them until they were no longer useful.