Trusts have long been perceived as secret devices used only by the super-wealthy. Wood-paneled rooms full of bankers, luxurious parties and events, expensive art - these are all the pictures conjured in the minds of those that don’t really understand the concept of a “trust”. In fact, a trust is merely a legal tool that can help investors with multiple levels of wealth to ease their estate planning and the process of passing their assets to the next generation.

What makes a Millionaire more likely to create a trust? While there are a significant number of households that should create a trust, many choose to ignore this important estate planning tool. The most common reason is “I don’t have enough assets to create a trust” while others “don’t want to lose access to their assets” and finally some investors “just haven’t gotten around to it.”

Spectrem recently conducted research with Millionaires and found that one of the most compelling reasons for a Millionaire to create a trust is to ease the inheritance process. In fact, those who have either inherited assets themselves or who have been involved in the administration of an estate are more likely to use a trust for their own estate planning.

Of the Millionaires interviewed by Spectrem, 53% had created a trust. When asked who they had chosen as trustee, 37% had appointed themselves, 22% a spouse and 18% appointed a child. In most cases they had already chosen a successor trustee who was also a family member.

When asked why they had decided to have a trust, 53% indicated that the trust was created to ease the inheritance process. As wealth increases so does the likelihood of having a trust to increase the ease of inheritance with 58% of households with more than $5 million of net worth having created a trust for this purpose.

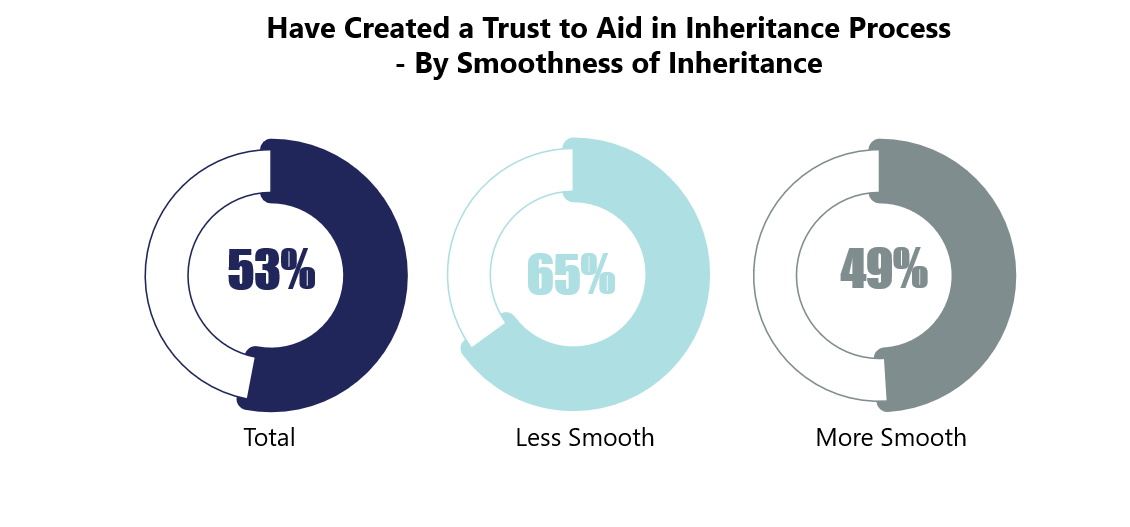

One of the most interesting findings of the research was that those who had experienced a rough inheritance process in their own past were more likely to create a trust as part of their own estate planning.

Why is this important? Because many individuals who don’t believe they have enough assets to create a trust could still benefit by using this tool as part of their estate planning.

Financial advisors and their firms need to work with their clients to understand the more administrative parts of the inheritance process. While tax planning is certainly an important consideration, the actual ease of distributing the estate is something most individuals don’t understand. The reality is that liquidating assets, changing titles and other required tasks are often time-consuming for beneficiaries and the intentions of a grantor can be unclear. In many cases this confusion can be eased by the use of one or more trusts as part of the estate plan.

Trusts can be an important tool even for those who can’t afford a luxury yacht.