Not surprisingly, customers have high expectations regarding how long it should take a financial advisor or provider to respond when they have questions. In the past, many financial firms adopted a “sundown” rule…. you needed to respond to a customer before the end of the day. But that rule changed as more information became available online. And despite the fact that more information is available online, customers still find that sometimes they need to speak to a “real” person because the available online tools do not adequately address their needs.

In recent research conducted with investors with $100,000 to $25 million of net worth, Spectrem asked their agreement with the statement “A financial institution has an absolute obligation to answer their customers questions in a timely manner.” Overall, 88 percent of investors agreed or strongly agreed with that statement. In fact, 92 percent of retired investors agreed with that statement compared to 77 percent of those investors who are still working. This highlights the importance of having non-technological resources available to answer questions, especially for older investors.

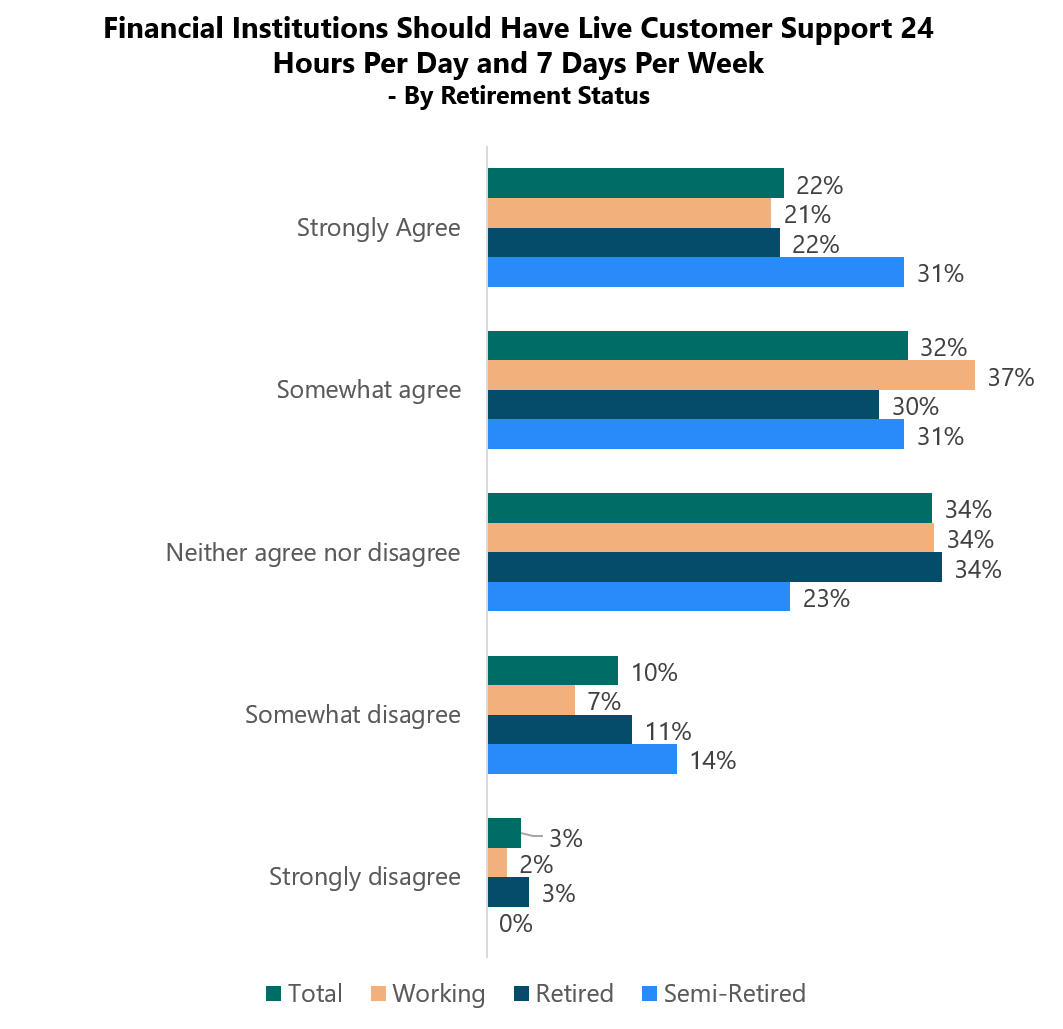

Additionally, these investors were asked their agreement with the statement, “Financial institutions should have live customer support 24 hours per day and 7 days per week”. Overall, 54 percent of investors agreed with this statement. It is interesting to note, however, that 52 percent of retired investors agreed with this statement compared to 58 percent of investors that are still working.

Almost three-quarters (74 percent) believe that failure to have adequate customer support can have a devastating impact on customers that need information.

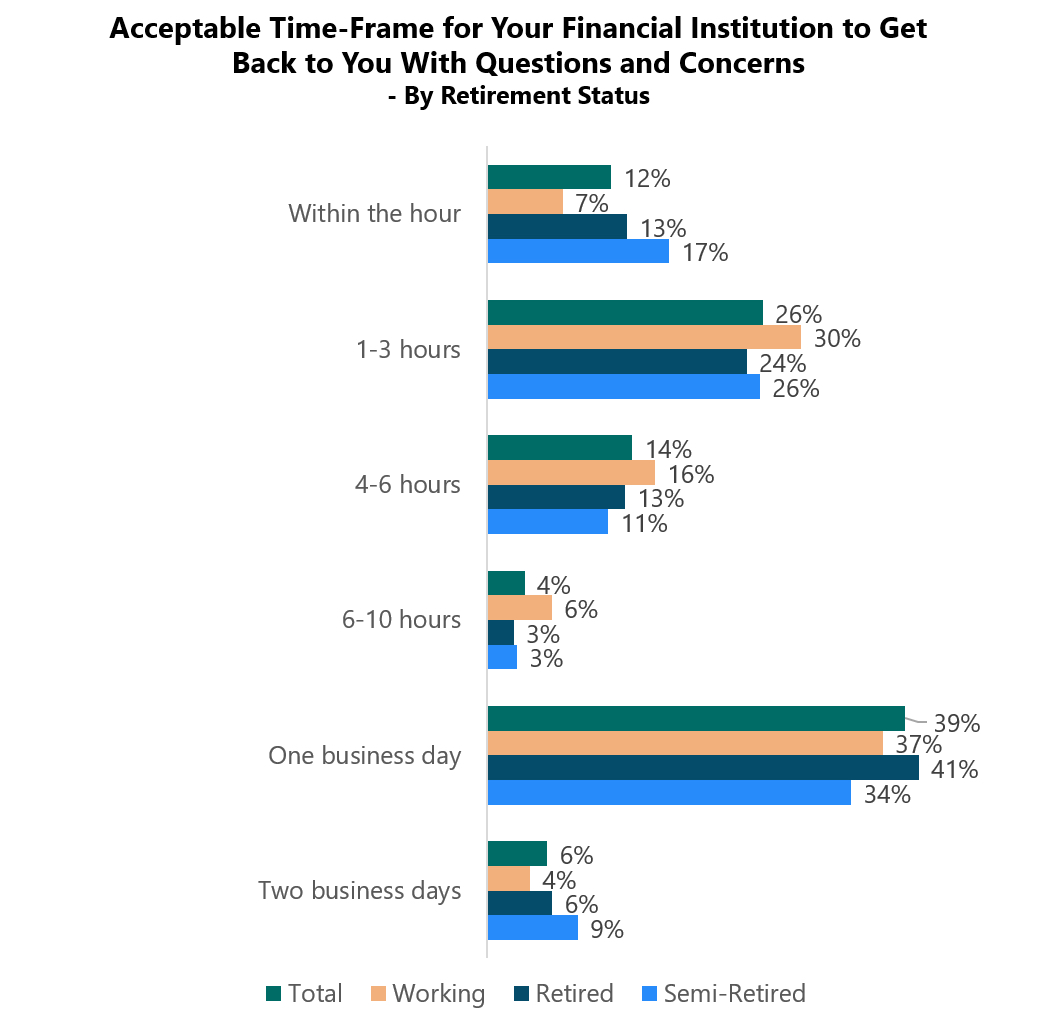

What is an acceptable timeframe for financial institutions to respond to customers regarding questions and concerns? While 12 percent of investors expect a response within an hour, a larger percentage (26 percent) are satisfied with a 1 to 3 hour timeframe. Thirty-nine percent are satisfied with the financial institution responding within one day.

While some retired investors expect a response within an hour, a larger percentage are satisfied with a response within a day.

Financial advisors and providers need to continue to monitor their levels of responsiveness. Despite the fact that information and instructions are available online, nothing is more frustrating to investors when they cannot get an answer to an investment question immediately. Dependent upon the circumstances and the individual, lack of responsiveness can lead to devastating results, especially in a volatile market.