When one has a few dollars to spare it’s ok to be aggressive in terms of investment risk. But recent research conducted by Spectrem Group indicates that the risk levels that the Super-Wealthy (those with more than $25 million of net worth) are willing to take on is extremely aggressive - and is contradictory to some of their other beliefs. What drives these investors to believe that high risk levels are acceptable? To learn more about Spectrem's recent research on $25 Million Plus investors, click here.

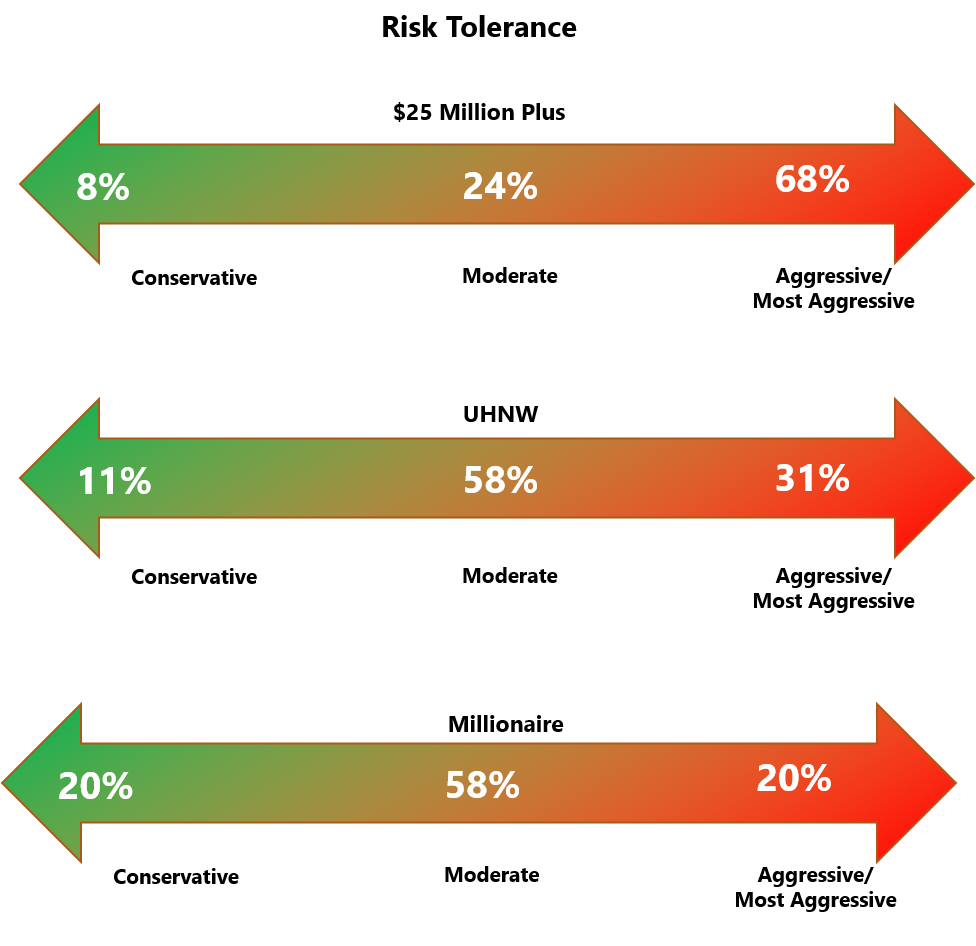

When investors were asked to identify their tolerance for investment risk, 68% indicated their risk tolerance was “Aggressive” or “Very Aggressive”. Not surprisingly, their risk tolerance levels were much higher than those with lower levels of net worth. Risk levels today, however, are even higher than the last time this research was conducted in 2018.

A review of the total portfolios of these investors indicates that more than a quarter of their investable assets are invested in hedge funds and other alternative investments. The largest portion of their investable assets are invested in equities. These investors have high expectations regarding the returns they will receive on these assets. Over a quarter of these investors indicate that an annual rate of return over 14 percent is expected. Twenty-four percent expect an annual rate of return from 10 to 14 percent.

As a financial advisor it would be difficult to consistently meet the expectations regarding ROI for these investors. That would be compounded by the fact that 71% of these Super-Wealthy investors believe they are very knowledgeable about investing. That may be true, however, Spectrem’s research often indicates that investors generally believe their knowledge levels are higher than they actually are regarding investments. But most of these investors control a large portion of their assets (44 percent) without any assistance from a professional advisor. This is because most enjoy investing and like to be involved in the day-to-day management of their assets. These may be difficult clients with very high expectations.

Yet despite the fact that the Super-Wealthy are super-aggressive regarding their risk tolerance, 65 percent indicate that they want to protect principal more than they want to grow their assets. Contradictory? Perhaps. Add to that the fact that 67 percent of these wealthy households believe the U.S. may have an extended downturn due to the pandemic, and it seems that these investors may be somewhat volatile regarding their expectations. Thankfully, the recent market performance may be proving them wrong.

Thus, it may be that the Super-Wealthy might be super-difficult to have as clients, although the long-term efforts might be worthwhile.

Related: What the Wealthiest Americans Aren't Helping Their Kids With