The ability to generate income is critical to many investor’s retirement plans. Interest rates have the potential to significantly impact income generation from investments. Interest rates have been extremely low for 16 years. Investors who are contemplating retirement may be concerned about the impact those low interest rates could have upon their long-term retirement income needs.

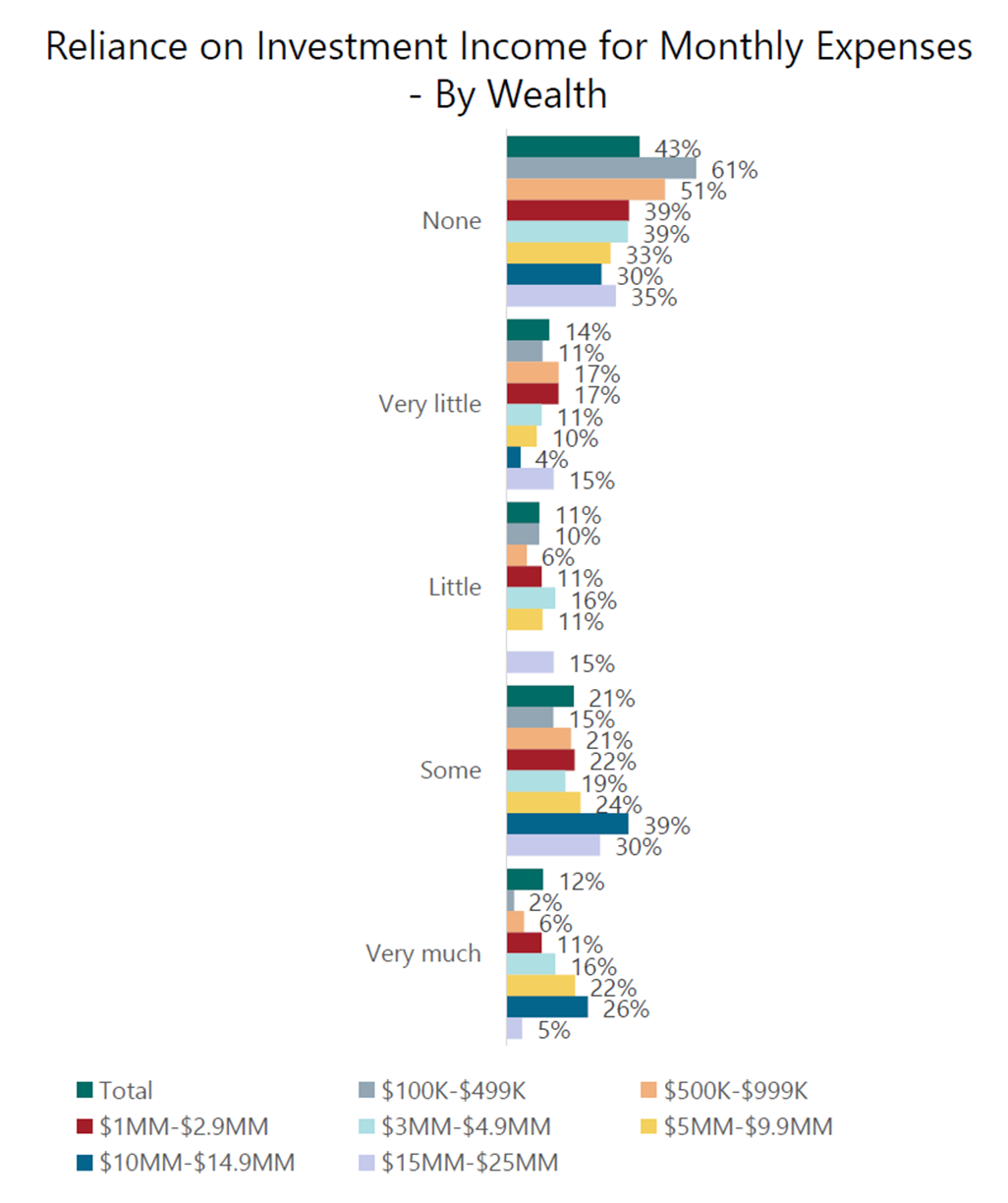

Over half of retired investors receive investment income from their portfolio either on a regular basis or when needed. Even 17 percent of working investors receive investment income distributions from their portfolio, according to recent research conducted by Spectrem Group. Nearly three-quarters of retired investors have at least a little reliance on investment income to pay for their monthly expenses. As wealth increases the reliance on investment income for monthly expenses decreases.

This reliance makes generating investment income potentially concerning for investors. Twenty-two percent of investors are worried about income generation compared to five years ago. Working investors are more concerned than retired investors, 37 percent and 13 percent respectively. Young investors are the most concerned about income generation compared to five years ago, with 49 percent indicating they are worried.

For 30 percent of working investors, that concern regarding income generation is causing concern regarding the potential need to delay retirement due to low interest rates. High levels of net worth does not insulate investors from the concern about needing to delay retirement. Twenty percent of investors with a net worth between $15-$25 million are worried they may need to delay retirement, while 28 percent of those with a net worth between $10-$15 million are concerned about potential retirement delays. Women are far more concerned about needing to delay retirement than men, 30 percent and 21 percent respectively.

Due to these income generation concerns and retirement delay concerns, investors are looking to other income producing investments that do not rely upon interest rates. When Spectrem Group asked investors for the three types of investments that are best for producing income, dividend paying stocks, preferred stocks, and annuities are the top three choices for investors, with dividend paying stocks being the most popular by a significant margin at 60 percent.

Investors that are concerned, and even those investors who do not have any worry at all should review their financial plan and retirement income plan to ensure that low interest rates are not going to negatively impact their income needs throughout retirement. Over half of investors have discussed concerns they have with their financial advisor, and among those investors who have had to make change feel their advisor was the most helpful in making those changes, so it is even more important to consult with an advisor regarding income generation in a low interest rate environment.