The DJIA has plummeted by over 6,000 points in the past year, with huge swings throughout the process, causing concern amongst even the wealthiest of investors. The market decline has caused many investors to reevaluate their investments and their financial plans. Investors are needing to make choices regarding what they will do as a result of the market volatility, and how concerned they should be regarding this issue.

Spectrem Group discovered in recent research that 59 percent of investors are concerned about the current stock market volatility. Business Owners are not as concerned as other investors regarding the stock market volatility, with only 43 percent being concerned about the current stock market volatility. Millennials are more concerned about the current market conditions than older investors. This level of concern often leads to investors taking action.

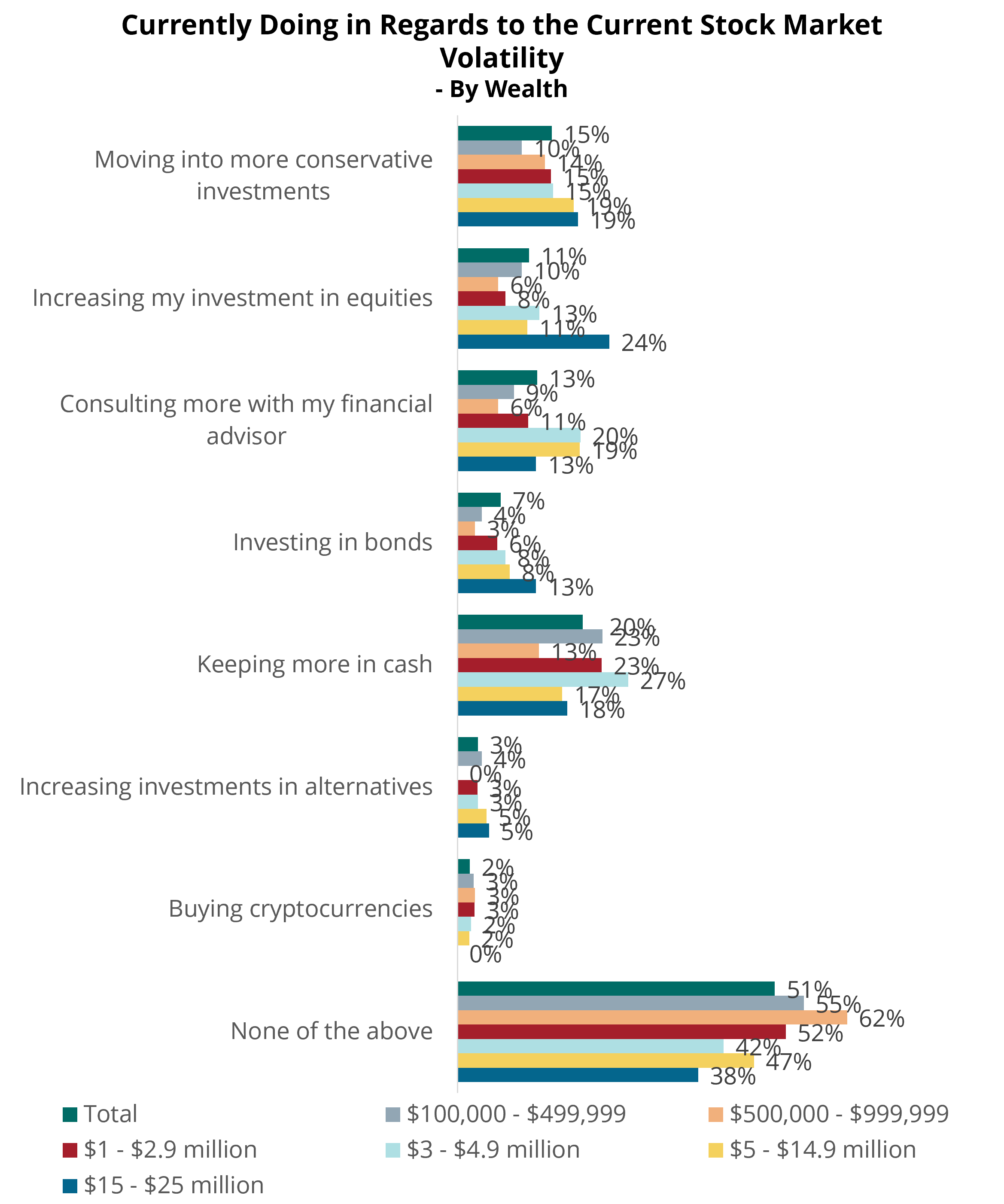

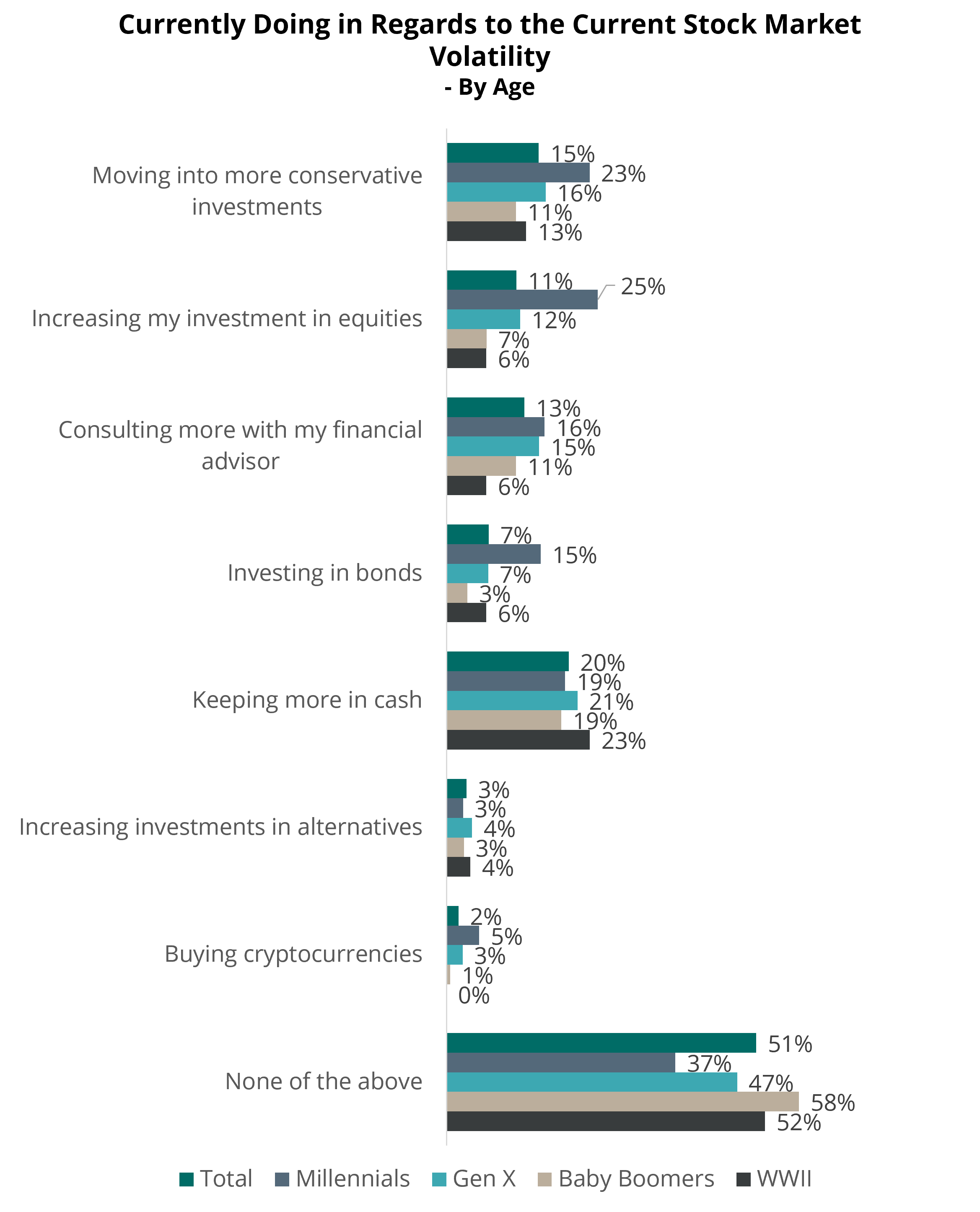

The most common action investors are taking as a result of the current stock market is keeping more investments in cash. Many investors make this choice without consulting an advisor, which could cause them to not be allocated in the correct manner, making it important for all investors to speak with an expert before making changes to their investments. Another action taken by 15 percent of investors is moving into more conservative investments. Investors at higher levels of wealth are also more likely to move assets to more conservative investments as a result of stock market volatility.

Interestingly, younger investors are more likely to be moving their assets to more conservative investments than older investors. In contract to that, younger investors are more likely to increase their investments in equities. This illustrates the dichotomy of Millennials, with some choosing to take a more conservative approach to handling the current stock market conditions, while others are going more aggressive and increasing their equity exposure. Millennials are also consulting with their financial advisor more as a result of the stock market volatility compared to their older counterparts.

The actions investors are taking often requires investors to be looking at their investments more often. Over a third of investors are looking at their investments more often, while 13 percent are looking at their investments less frequently. Investors at higher levels of wealth are more likely to be looking at their investment portfolio than those at lower levels of wealth. That is not surprising given that they are more likely to be investing in equities, which may require more attention to their investments. Over forty percent of Millennials are looking at their investments more frequently, likely for the same reason.

Stock market volatility is something that has been around for quite some time, and investors have to determine what reaction, if any, they will have. Making the decision to change investment allocation is an important one that can have significant positive and negative consequences, so it should be done with careful consideration and with the guidance of a financial professional.