With thousands of investment choices, it is often challenging to choose the investments, and the allocation that would be ideal for each individual. Some people like to be involved in that process, and other investors enjoy the process of investing and managing their assets. Has stock market volatility impacted investor interest in being involved in their investment management process?

In 2018, 58 percent of investors liked to be actively involved in the day-to-day management of their investments, according to Spectrem Group research. Just over half of wealthy investors also indicated that they enjoyed investing and it was something they did not want to give up. This process may be done by themselves, or they may be utilizing a financial professional to work with them. Given that 35 percent of investors attribute their wealth to simply being in the right place at the right time, the selection of assets, and choosing when to invest in them, is a significant part of whether the investment portfolio will perform in the manner they expected.

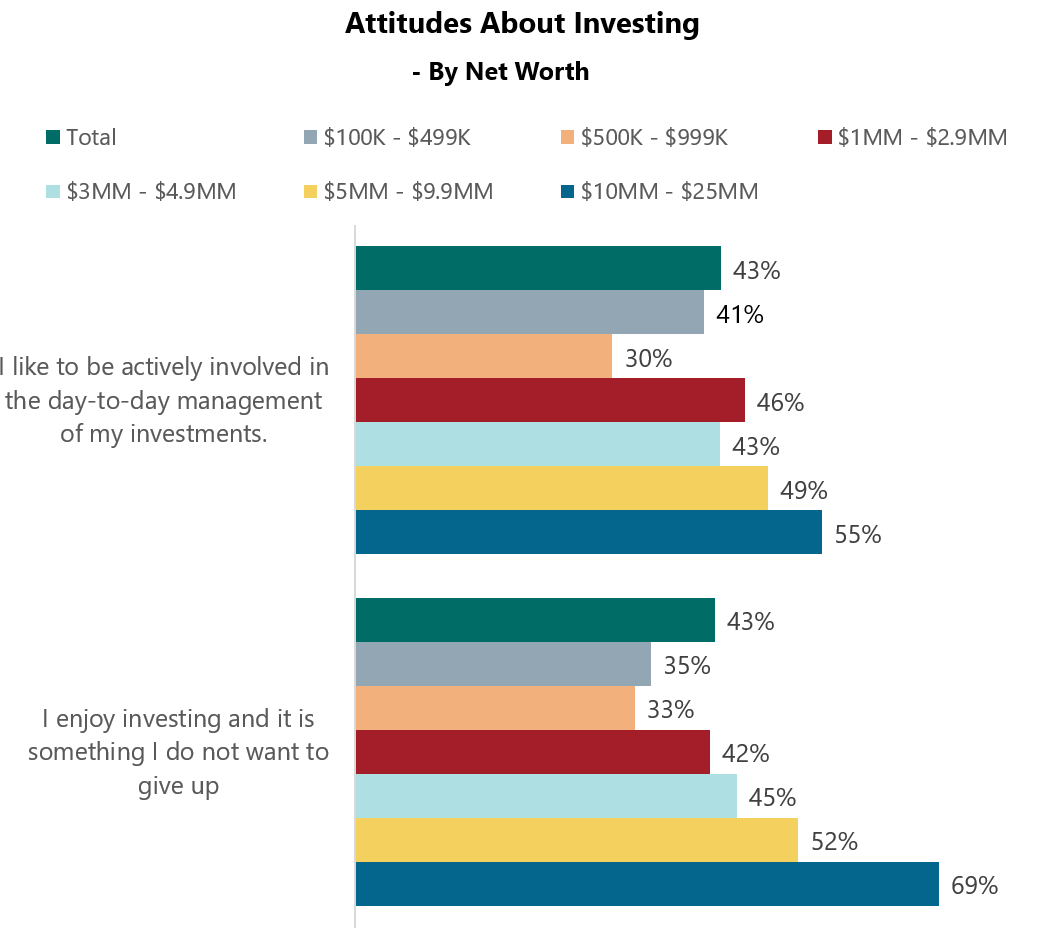

What has happened since 2018 in terms of investments and the desire to be actively participating in the day-to-day management of their investments? Over the past two years those numbers have been steadily declining. In early 2021, only 43 percent of investors like to be actively involved in the day-to-day management of their investments. The percentage of those investors who enjoy investing also dropped to 43 percent, based on research conducted in Q1 of 2021 by Spectrem Group.

Wealth dramatically impacts that desire. Only 30 percent of investors with a net worth of $500K-$999K like to be actively involved in the day-to-day management of their investments. This is in stark contrast to those investors with a net worth between $10M-$25M, with 55 percent who like to be actively involved in their daily investment management. It is possible that since there is far more to actively manage it is more enjoyable to work with on a daily basis. There are also investment options available to investors at higher levels of net worth, so the options can be more interesting as well.

Those reasons are also possible reasons why wealthier investors enjoy investing. Sixty-nine percent of investors with a net worth between $10M-$25M enjoy investing and do not want to give it up. Only 35 percent of investors with a net worth between $100K-$499K enjoy investing. These investors at lower levels of wealth are not as confident about their ability to retire when they want.

Financial professionals will become even more critical for those investors who do not like to be actively involved or those who do not enjoy investing. These advisors may need to take a bigger role in the asset allocation and investment selection process with these investors than other investors. Investors who are not interested in daily management of their investments should reach out to their advisor for additional support.

Related: More Than Ever Super-Wealthy Are Super-Aggressive Regarding Risk