From jobs to savings to retirement plans, the coronavirus pandemic has upended many Americans’ financial lives. While millions are still unemployed, many have seen their emergency savings run dry and others are figuring out ways to cope with the financial burden of the economic recession. However, not all aspects of the financial impact of the pandemic are necessarily negative.

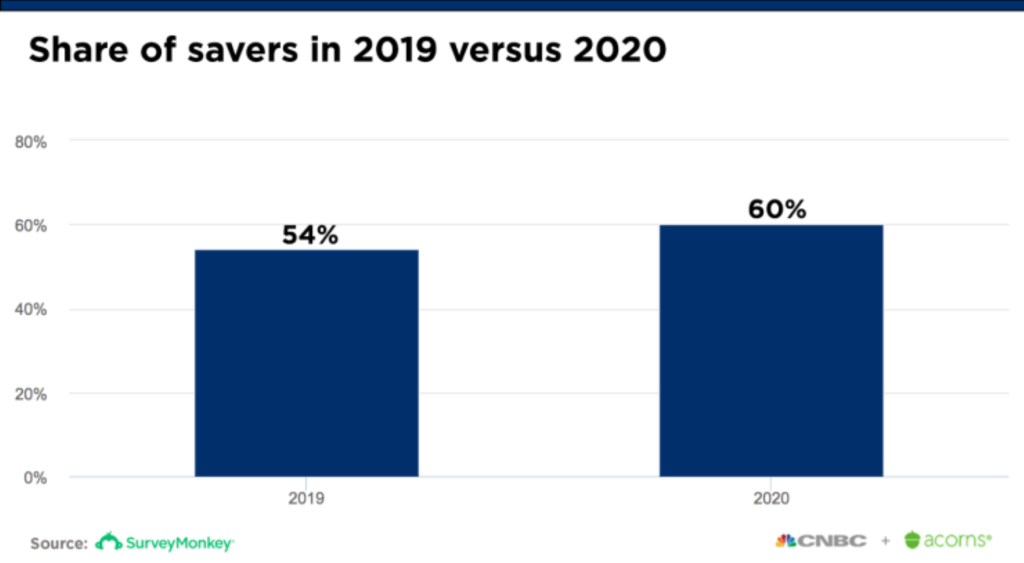

According to CNBC and an Acorns Survey, many are saving more and spending less. In fact, 46% of the respondents said they are “more of a saver now” compared to before the pandemic. Additionally, 60% consider themselves “savers,” up from 54% last year. The poll, conducted by SurveyMonkey Aug. 13-20, surveyed 5,401 U.S. adults and has a margin of error of +/-2%.

About half, or 49%, said their monthly spending has decreased, compared to 33% last year. Some of those savings can be attributed to the fact that people stayed home and didn’t do things like dining out, said personal finance expert Jean Chatzky, co-founder of HerMoney.

While many have been struggling to get by these last few months, many have learned how to manage their money better despite the economic recession. People have learned how to go to the grocery store less and have utilized meal planning and money saving-skills, such as coupon-clipping and deal searching. They also have begun to really take a look at their monthly or annual subscriptions, removing themselves from services they don’t really use or need. By prioritizing wants versus needs and taking a look at how much money is going out each month, people have picked up better spending habits that will help them navigate these bumpy waters ahead.

With extra cash and savings in the bank, it’s important to talk with an advisor about options and investing that makes the most sense for you, whether it be saving for retirement, college tuition, or something else. If you have any questions for us, please reach out at info@shermanwealth.com and we would be happy to set up a time to discuss a financial plan for your future.