Sometimes it’s all about perspective. The market volatility and economic shutdown that occurred in the spring of 2020 had a significant impact on investors and households across the U.S. Months later, markets have rebounded but the economy is still slow to recover especially for business owners of all types. So how are investors feeling about their own financial recovery several months after the crash in March of 2020?

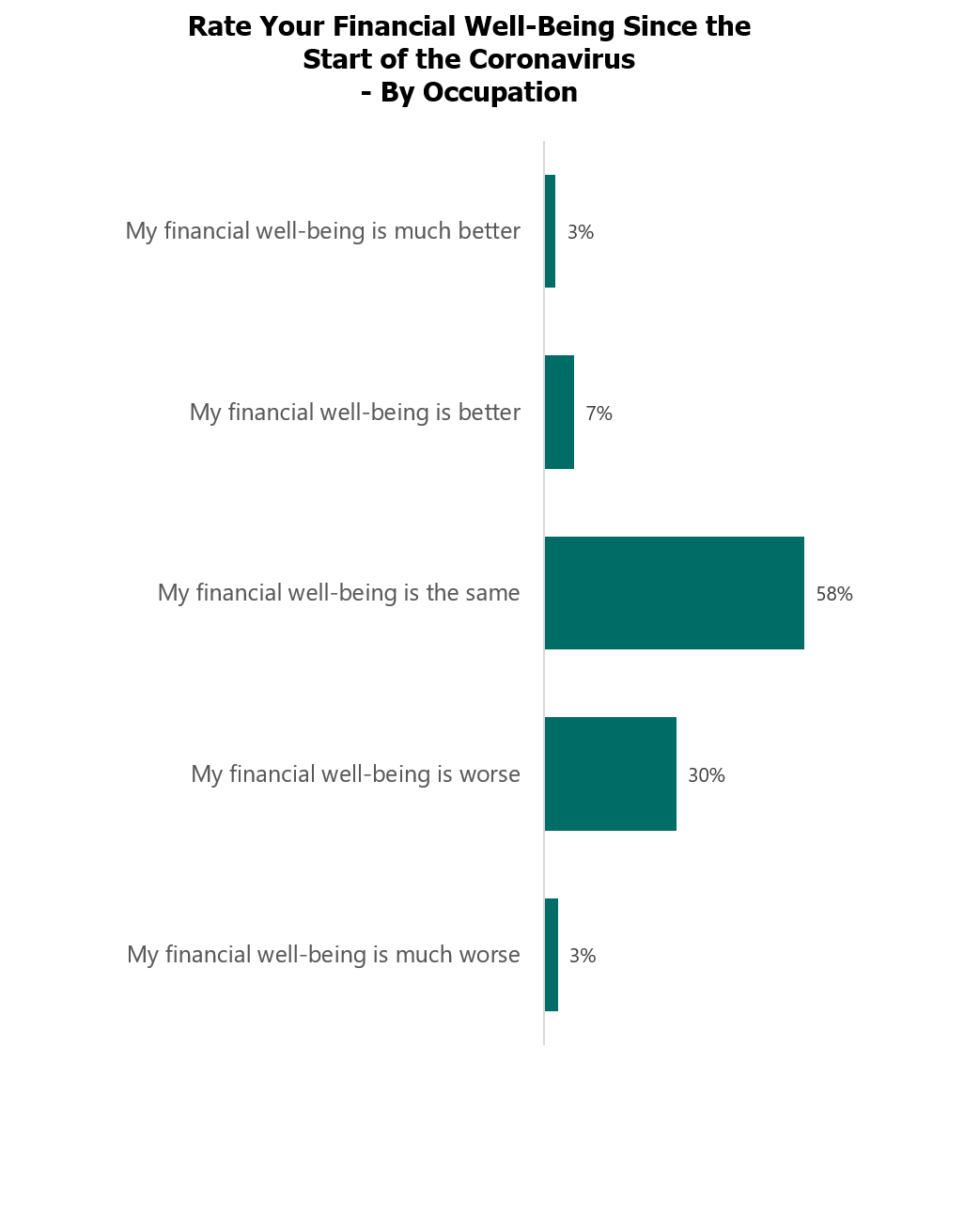

Overall, 58% of investors believe that their financial situation today is the same as at the start of the pandemic. This feeling varies dramatically, however, based upon net worth.

As you can see, 61% of households with $100,000 to $499,999 of net worth indicate their finances are the same and 68% of those with $500,000 to $1,000,000 feel similarly. (Spectrem defines the Mass Affluent as households with $100,000 to $1,000,000 in net worth, not including the value of their primary residence.) In contrast, only 35% of those with $15 to $25 million of net worth agree. Almost half of those with a higher net worth indicate that they are still worse off financially than at the onset of the pandemic.

Why is this?

- More retired investors on fixed incomes fall into the Mass Affluent segment. While they may have initially been impacted by the market crash, many may have recovered. Since they were not likely to have lost a job, the pandemic has been more likely to create fear than actual loss.

- Wealthier investors were more likely to have switched their asset allocation or they may have been invested in assets that are slower to recover. The wealthiest households may have lost more initially and may find that they are slower to recover to their pre-pandemic net worth.

- Business owners are still suffering more than other investors. Business owners often fall into the wealthier segments and, as many know, small businesses in particular have been slow to recover due to ongoing shutdowns in various states.

Despite the fact that the Mass Affluent may feel as if they have recovered, they still have many fears and concerns that financial advisors need to address. The Mass Affluent generally includes younger households as well as older retired households. These types of individuals are critical to many financial institutions. To ensure that your organization is meeting the expectations of these individuals post-pandemic, subscribe to the Mass Affluent Investor in 2020.

Related: Despite the Market Bounce, Investors Bleak on Economy