In a recent report, Goldman Sachs highlights the potential for commodities to rally when interest rates decline. This insight is particularly relevant now, as a number of major financial institutions predict a series of rate cuts this year, perhaps as many as three, though some Federal Reserve officials are reportedly questioning the appropriateness of that number given the persistence of higher-than-average inflation.

The Goldman report maintains a positive outlook on commodities, projecting attractive total returns of 15% by year-end, with some sectors expected to deliver returns exceeding 20%.

For investors seeking to diversify their portfolios and potentially capitalize on these market dynamics, I believe commodities may offer compelling opportunities.

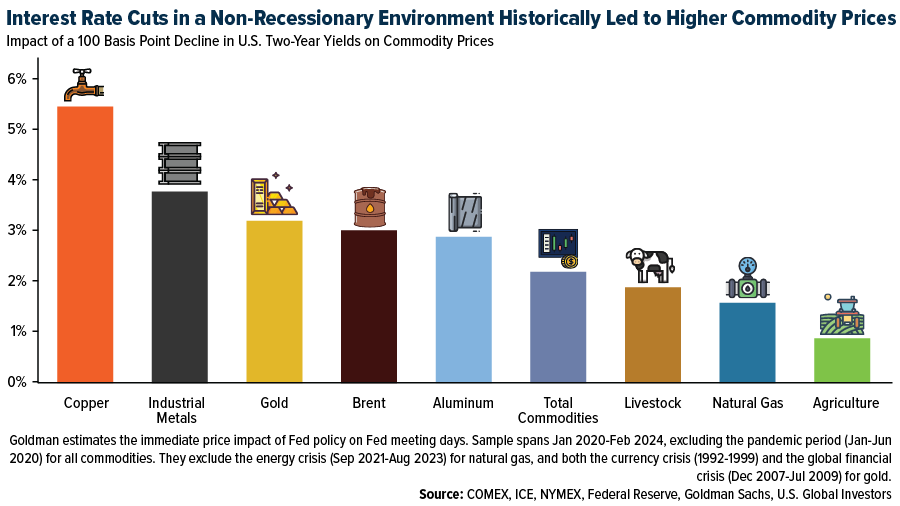

One of the bank’s most significant findings is the historical relationship between commodities and interest rates. Goldman analysts note that materials have historically rallied when interest rates have been lowered in a non-recessionary environment, a trend that could bode well for the sector. The chart below shows the potential price change for a variety of assets following a 100 basis point (bp) drop in rates, with copper and gold being the biggest metal beneficiaries.

The correlation, Goldman says, can be attributed to several factors. These include increased demand for raw materials as borrowing costs fall and the potential for investors to seek out alternative assets in a low-yield environment.

Key drivers in more recent days include the recovery in global manufacturing as companies restock inventories, ongoing geopolitical risks and the possibility of a soft landing for the U.S. economy, where recession is avoided. Additionally, demographic trends, such as aging populations and higher levels of public debt, point toward a more inflationary backdrop for the wider economy. This, in turn, may prompt investors to allocate more to commodities as a hedge against inflation.

Rate Cuts On Both Sides Of The Atlantic?

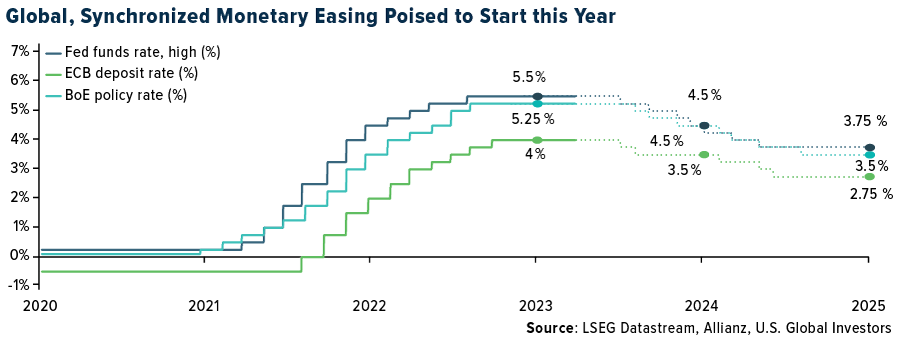

Forecasts for a series of rate cuts, both in the U.S. and elsewhere, certainly support the case for commodities this year. Allianz, the financial services giant, expects the Fed to pivot in July and deliver a total of 100bps in rate cuts by the end of 2024, and a further 75bps by the end of 2025. The firm’s outlook is based on the Fed’s more dovish stance and the progress made on the inflation front. Allianz notes that the Federal Open Market Committee’s (FOMC) “reaction function” has become more accommodative, as they have upgraded their gross domestic product (GDP) growth and core personal consumption expenditures (PCE) inflation forecasts for the end of the year without changing their rate outlook.

The firm expects the European Central Bank (ECB) to take the lead in this rate-cutting cycle—also initiating interest rate reductions in July, but several days before the Fed. This divergence from the historical pattern of the ECB following the Fed is justified by the contrasting economic conditions in the eurozone and the U.S. The eurozone, for instance, faces lower inflation but persistent economic stagnation and the risk of overtightening. As a result, the ECB may find itself compelled to act more urgently than the Fed, a good sign for commodities.

How Global Events Are Redrawing The Map Of Commodity Trading

In addition to the potential impact of interest rate cuts, the commodities market is being influenced by forecasts of rising oil and energy demand.

The International Energy Agency (IEA) recently raised its estimate of 2024 oil demand growth by 110,000 barrels per day, citing an improved economic outlook for the U.S. and higher bunker fuel consumption due to attacks in the Red Sea. The ongoing crisis, exacerbated by attacks by Yemen’s Houthi forces on commercial vessels, has led to increased journey times and higher shipping costs, as many ships are forced to take the longer route around Africa. This increased demand is expected to keep oil prices elevated throughout the year, especially when coupled with ongoing OPEC+ production cuts.

And speaking of OPEC, it’s being reported that the Houthis have threatened Saudi Arabia’s oil installations in the event that the kingdom allows the U.S. to use its airspace to combat the group. Saudi Arabia, the world’s number one oil exporter, has been at war with the Houthis since 2015.

Another near-term factor is the temporary closure of the Port of Baltimore due to the recent tragic collapse of the Francis Scott Key Bridge. The port is the second-largest coal exporting hub in the U.S., accounting for 28% of total U.S. coal exports in 2023, according to the Energy Information Administration (EIA). The closure is expected to decrease bunker fuel consumption and may impact the volume of U.S. coal exports in 2024. While other nearby ports, such as Hampton Roads, have additional capacity to export coal, factors such as coal quality, pricing and scheduling will affect how easily companies can switch to exporting from another port.

The Importance Of A Selective And Informed Approach

I believe it’s essential to approach the commodities sector with a selective and well-informed strategy. The Goldman Sachs report advises investors to consider both cyclical and structural factors, as well as geopolitical risks, when making investment decisions. By carefully analyzing the various factors at play and maintaining a diversified portfolio, investors may be well-positioned to benefit from the potential opportunities presented by the commodities market.

Related: Investors Eye Commodities as Fed Prepares to Pivot on Interest Rates