Written by: Steven Vannelli, CFA | Knowledge Leaders Capital

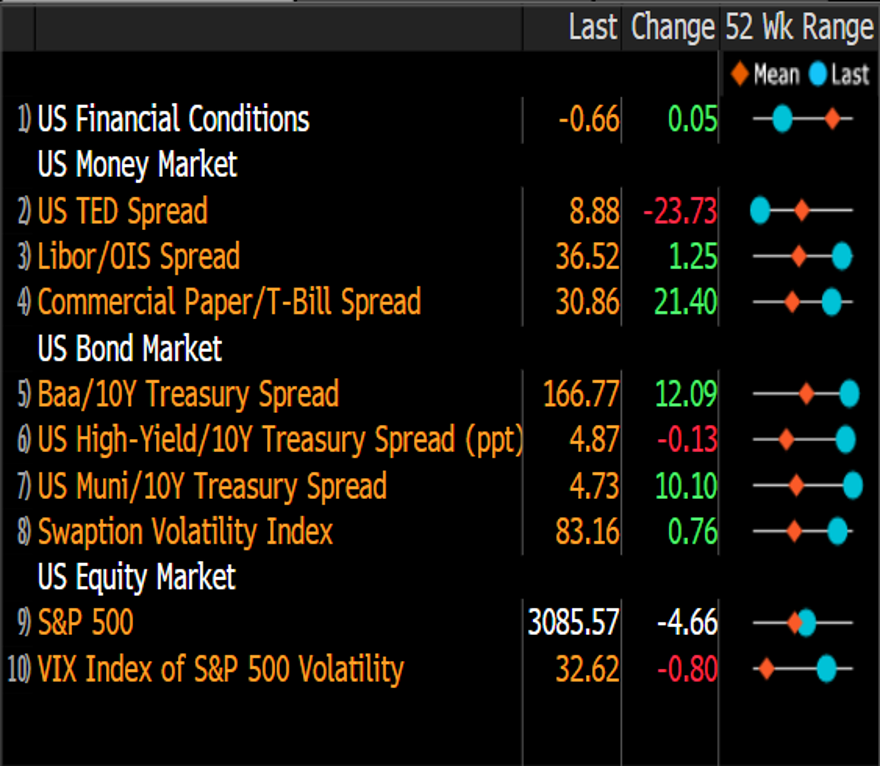

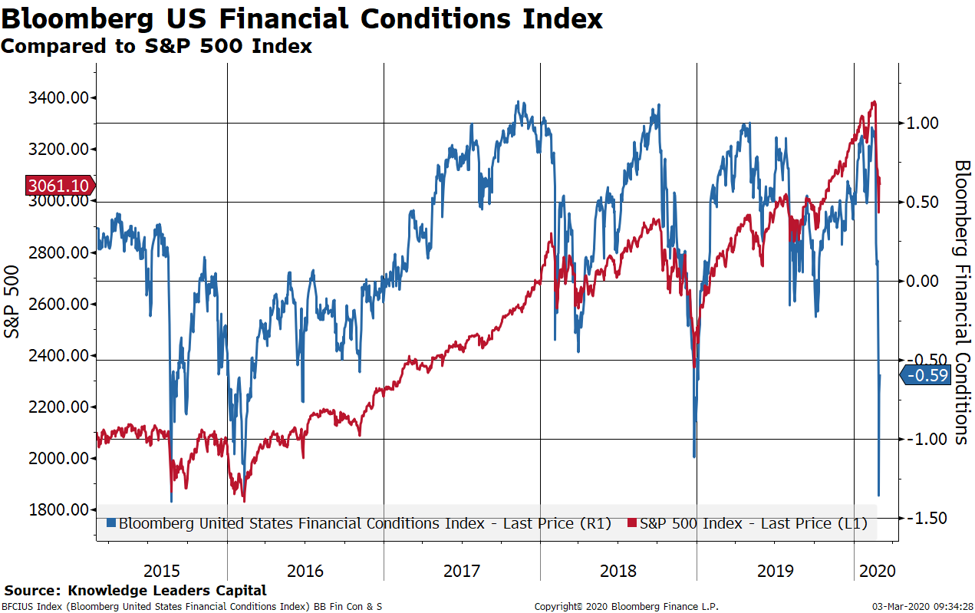

Despite the relief rally yesterday, financial conditions have tightened significantly in the last couple weeks. This likely explains why the Fed just made an emergency 50bps cut to the fed funds rate. The graph below highlights that the two main areas of weaker financial conditions are: 1) corporate bond spreads, 2) the VIX.

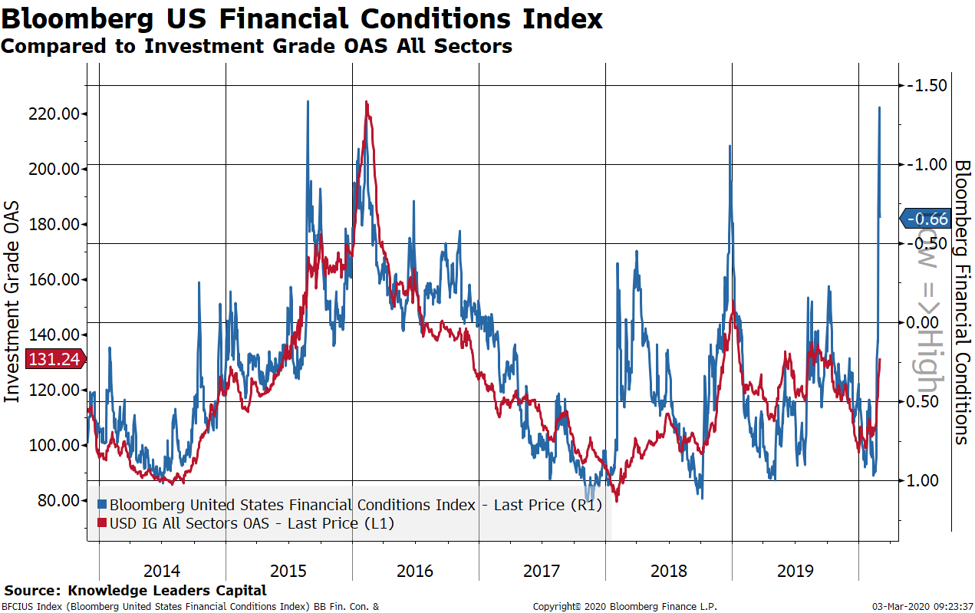

Starting with corporate bond spreads, the graph below illustrates the Fed’s concern if they let conditions remain in such ragged shape. Since financial conditions are tightly linked to corporate spreads, it seemed likely that investment grade corporate spreads would surge to around 200bps absent action.

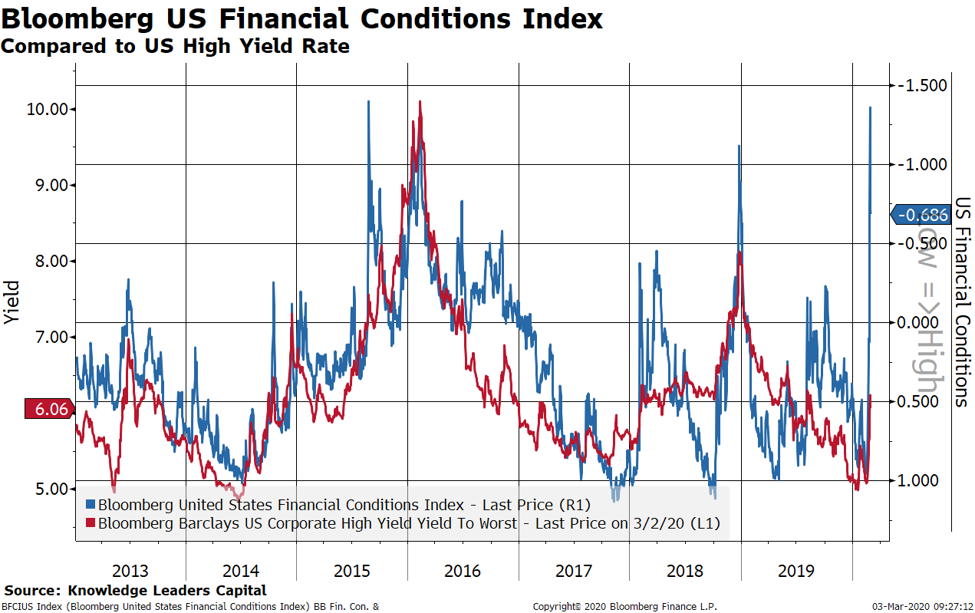

Similarly, high yield spreads, absent a move to stabilize financial conditions would likely surge to 9-10%.

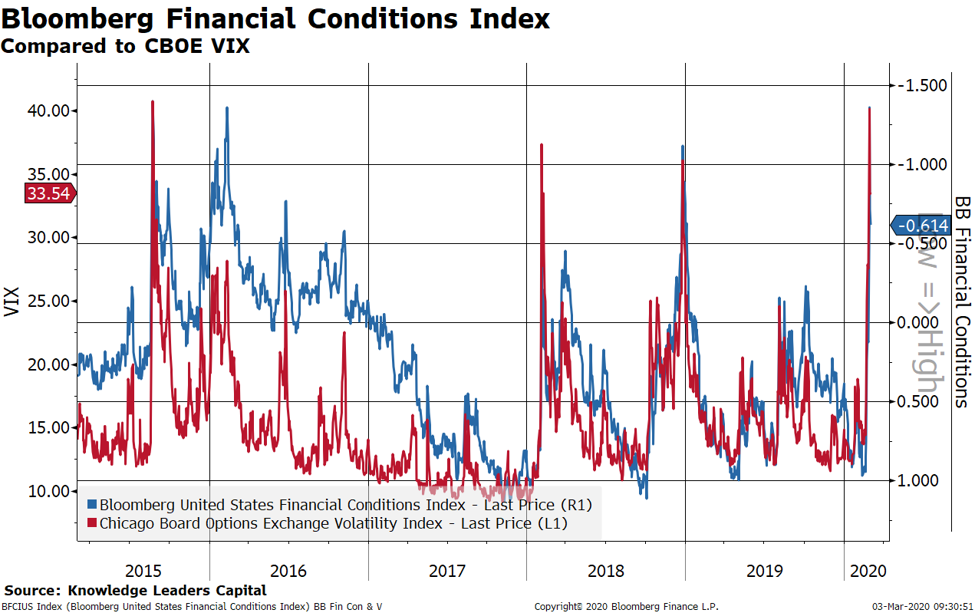

The VIX, a proxy for equity volatility, is probably the one variable that most caught the Fed’s attention, having surged to almost 40 lately.

The concern, of course is that eventually the deterioration of financial conditions—especially the rise in the VIX– would knock down the stock market. While financial conditions are a little more loosely related to the stock market, the plunge in financial conditions does raise the meaningful possibility of large decline in stocks.

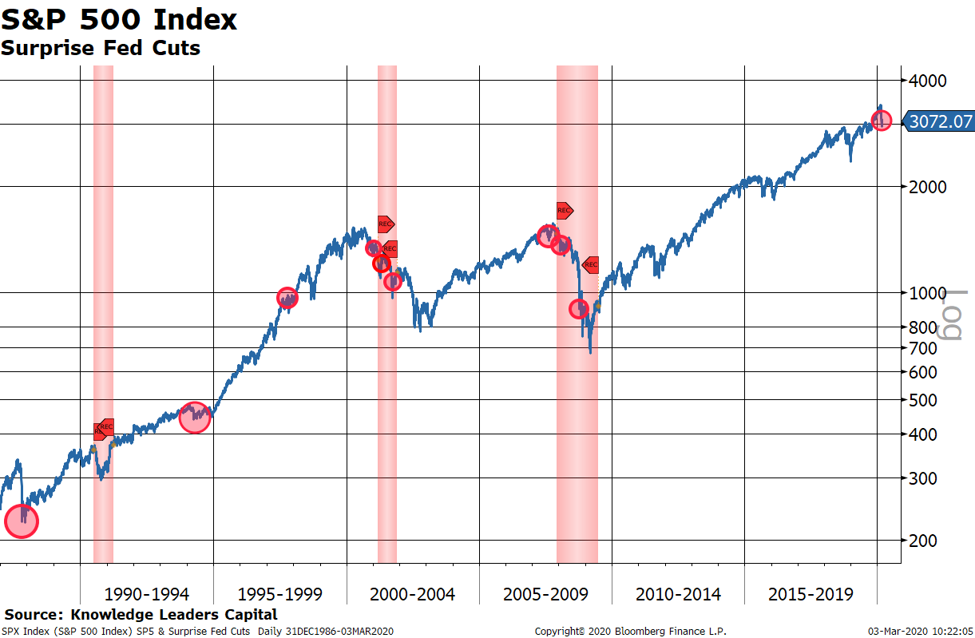

So, the Fed likely cut rates to try to stem the bleeding in the corporate bond and equity markets. But, the Fed’s history of emergency rate cuts has a somewhat spotty record.

Related: New All-time Highs on Declining Breadth is Reason for Caution