Written by: Samantha Azzarello

Who’s buying and who’s selling? And why does it matter?

The recent U.S. equity market drop and subsequent swings in prices have been dramatic. With volatility well above normal and markets moving more in a day than they usually move in months, investors with vivid memories of 2008 may be tempted to sell out of equities and hide. But despite this temptation and sound intentions, that may in fact be exactly the wrong thing to do, at exactly the wrong time.

This current bear market and recession are both very different from those in 2008: they are event-driven, not structural or cyclical. Moreover, recent buying and selling pressure has been amplified by systematic flows – from risk parity, CTA and long/short hedge funds – rather than massive shifts from retail investors. Indeed, it seems that trend or momentum-based trading strategies are responsible for a substantial part of the selling, while long-term investors, retail and institutional, have been providing support by “buying the dip.”

Of course, it is possible that this dynamic may change – the situation is rapidly evolving – but it is nonetheless important to understand. Historically, retail money leaving the market has signaled the bottom, suggesting that we may have more pain to feel in the equity market before we truly approach fair value. But more importantly, history also tells us that such large declines in markets can be followed by large, sustained bull markets, much like the one that followed the 2008 crash. Recency bias is a strong force in behavioral finance and many retail investors saw a large and sustained bull market post-2008, one that many investors who exited the market in 2008 regret missing out on, implying we might not see the same magnitude of outflows from those same investors this time around.

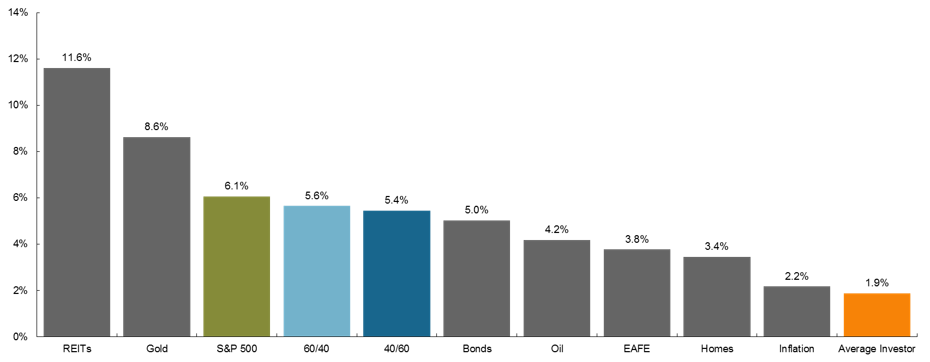

Ultimately, investors would do better not to succumb to some of the classic behavioral pitfalls that are so tempting in today’s turbulent market environment. Represented well by the data shown in the chart below, the average investor doing the exact wrong thing at the exact wrong time, for what they think are the right reasons, ultimately hurts returns. Instead, they should remember that prudent asset allocation and time in the market are both key to long-term investing success.

Beware of behavioral biases especially in times like these:

20-year annualized returns by asset class (1999-2019)

Source: Dalbar, J.P. Morgan Asset Management