My standard opening:

“Hang in there! As expected, more evidence of the economic fallout, combined with a continued ramp up in global coronavirus cases, has resulted in a 24/7 stream of disturbing headlines.”

New Home Sales, Durable Goods Orders, and Consumer Sentiment all plunged, while Initial Jobless Claims surged. Those readings were in-line with expectations, given that most of the country remained under stay-at-home orders. Meanwhile the number of new COVID-19 infections and deaths in the U.S. remained near peak levels, but did seem to flatten out during the week.

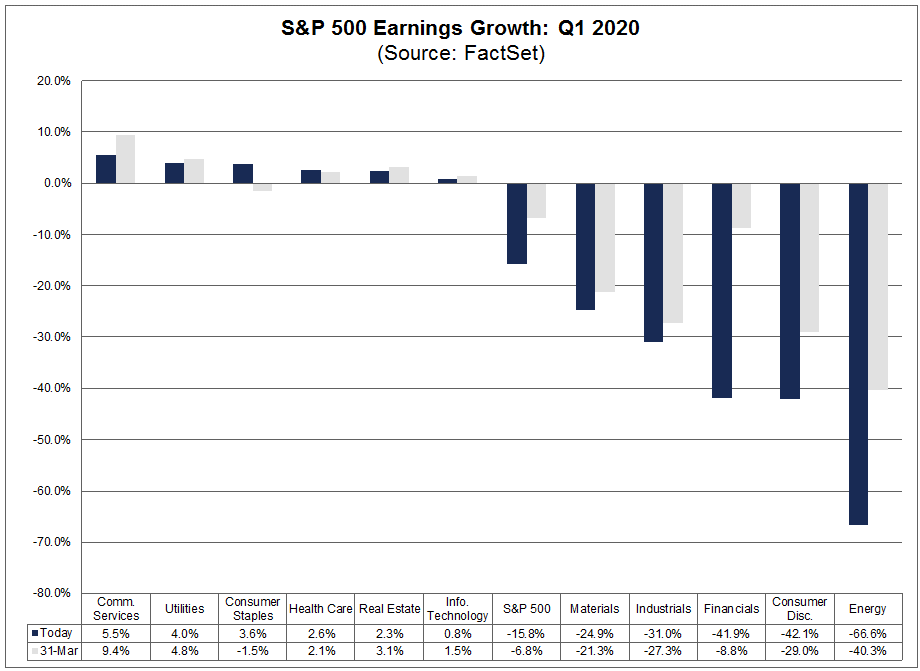

Corporate earnings also suffered, as the blended earnings decline for the first quarter grew to -15.8%, from -14.8% last week. Negative earnings surprises reported by companies in the Financials sector were mainly responsible for the increase in the overall earnings decline during the week. If -15.8% is the actual decline for the quarter, it will mark the largest year-over-year decline in earnings for the index since Q2 2009 (-26.9%). The declines are very uneven, with six of the eleven sectors still showing profit growth as indicated in the following chart:

Unfortunately the June quarter will be much worse, keeping in mind that through mid-March the coronavirus had not shutdown the economy.

Given all the bad news, the stock market performed reasonably well, with the S&P 500 slipping 1.32% and the Russell 2000 gaining 0.32%. Crude Oil prices collapsed early in the week, but bounced back to finish down 7.3%. Curiously the Oil & Gas sector was the best performing group in the market, posting a 1.89% gain. Gold moved up another 2%, while the Dollar remained steady. The yield on the Ten-Year Treasury reached its lowest level ever, closing the week at 0.59%.

So far, the yield on the U.S. Ten-Year Treasury has been the most predictive of coming economic data, as the yield declined from almost 2% at the end of 2019 to roughly 1.5% by mid-February and then current levels near 0.6% by early March; all this decline in yields occurred prior to economic shutdowns at the direction of federal, state and local governments. These sharp yield declines certainly pre-dated the equity market declines that began in late February and which accelerated into late March. A decline in U.S. Treasury Bond yields is considered a bearish indicator because it suggests that consensus investor opinion is that U.S. Treasury bonds returns are more attractive than other more risky asset classes such as equities and real estate; in other words, one interpretation of recent trends is that consensus investor sentiment is that an approximately 0.6% nominal annual return is better than alternate investment opportunities for savings. If yield changes in the U.S. 10-year treasury are a fairly accurate reflection of near-term economic changes, then perhaps a sustained increase the yield over a few weeks or months might signal a more consistently-positive economic backdrop.

On the other hand, these extraordinarily low rates buffer the long-term impact on the economy of the massive increase in the Government debt. Paradoxically, rising rates would be both a positive signal and generate an increase strain on the economy.

This Week:

Earnings season will be in full swing with 172 S&P 500 companies (including 12 Dow 30 components) scheduled to report results for the first quarter. Once again, the focus will be on the ability of balance sheets to withstand the downturn as investors anticipate a decline in Q1 with even grimmer, or withdraw, guidance for Q2. The economic calendar includes the initial estimate for Q1 GDP, which is forecasted to show a 4% contraction. Later in the week, the BEA report on personal income and spending as well as the ISM Manufacturing Purchasing Managers’ Index for April are both expected to show steep declines.

The Federal Open Market Committee will announce its monetary-policy decision on Wednesday. Federal-funds rates are already near zero and the Fed has been very aggressive with a “whatever it takes” approach to supporting the economy. It will be interesting to see what other policies are on the drawing board. In the Barron’s Big Money Poll, 90% of the respondents indicated that they had confidence in the Fed’s actions following the coronavirus crisis.

Final Thoughts:

I had a number of responses to my request for relevant songs to reference. Interestingly there was a combination of pessimistic and optimistic tunes suggested. I will pair them together each week, and hopefully this crisis will be behind us when we run out of material. The most downbeat was the eerie theme music from “Jaws”, with the coronavirus being the shark. That was my least favorite movie of all time. We used to vacation in Martha’s Vineyard, and the joy of frolicking in the ocean was permanently ruined. On the other end of the spectrum we have “Smile” famously performed by Nat King Cole.

“Smile though your heart is aching

Smile even though it’s breaking

When there are clouds in the sky, you’ll get by

If you smile through your fear and sorrow

Smile and maybe tomorrow

You’ll see the sun come shining through for you”

So smile and keep breathing, but not on anyone. We will survive.

Related: The Reduced Growth Rate in the Spread of the Virus Could Be the Trigger for Market Buyers