Written by: Gabriela Santos

Coming into this year, we expected an improvement in global economic growth, as 2019’s policy uncertainty clouds dissipated. Unfortunately, the global economy was quickly hit by two new shocks: the COVID-19 outbreak and the steep fall in oil prices. As the COVID-19 storm moves west from China, the “social distancing” measures enacted around the world have the potential to cause significant short-term pain, especially for service sectors like travel, tourism and leisure. In addition, the fall in oil prices will likely hit the energy sector hard, with some offsetting positives coming from lower gasoline prices for consumers. In general, concerns are rising about the credit and liquidity implications from these two interacting shocks, with the severity and length of negative impacts still unclear.

The rapid change in outlook and the uncertainties around it have caused a sharp repricing in global markets, including in equities, fixed income, commodities and currencies. What can global policy makers do to provide some support to the global economy – and to help stabilize markets? The first response that comes to mind is from monetary policy. Indeed, the Federal Reserve and the Bank of England have cut interest rates by 50bps at emergency meetings. More than cuts to interest rates, however, the most important role for central banks to play is to ensure that liquidity remains ample, which several central banks have done over the past few days.

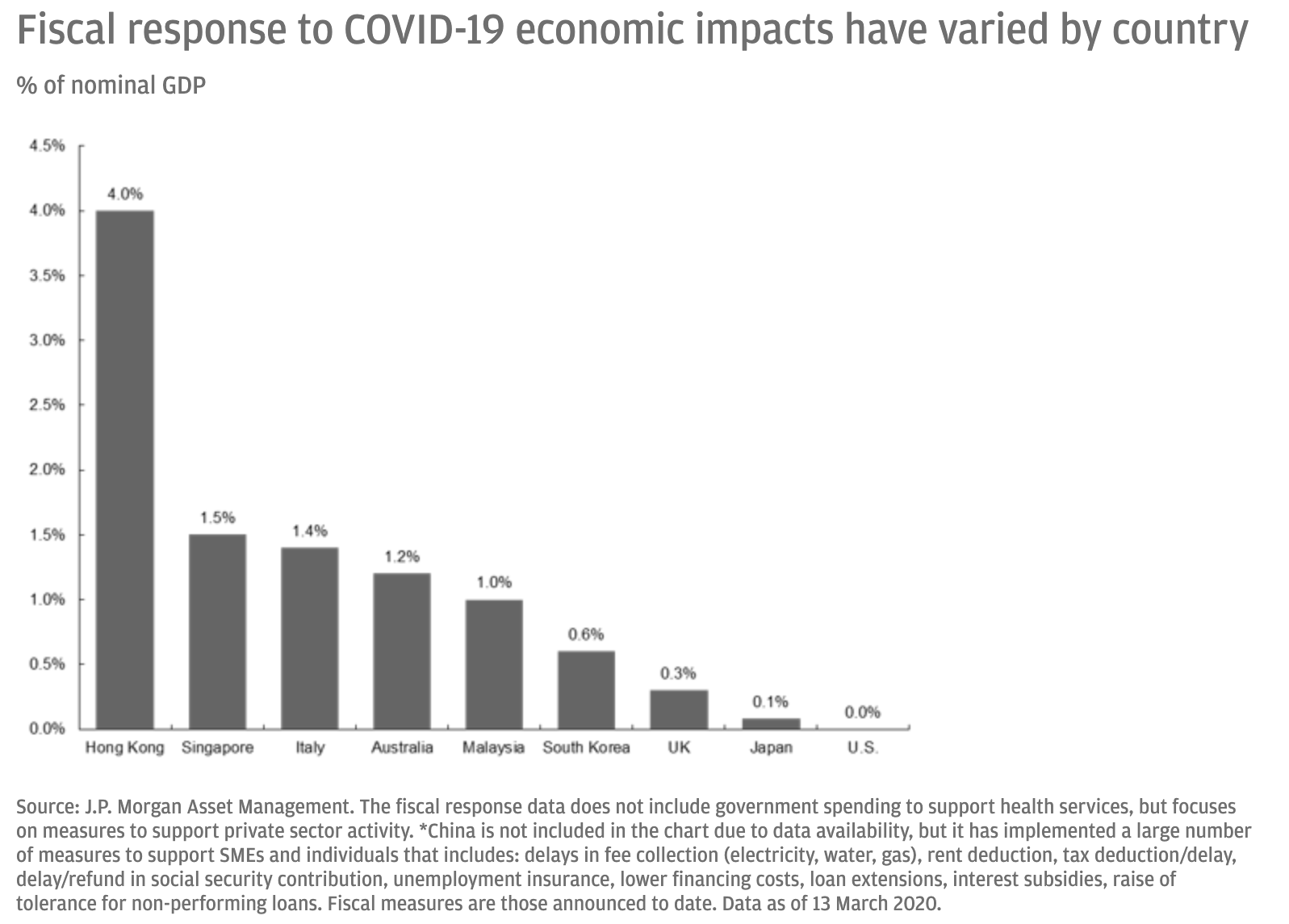

While investors have gotten addicted to monetary policy responses during this cycle, the more important reaction is actually from fiscal policy. Substantial measures are required from governments around the world in order to prevent second order effects, especially from “social distancing”, such as job losses and bankruptcies. This would include several microeconomic measures that can provide support to affected small and medium businesses and their workers. This would help to soften the short-term negative impacts of COVID-19, and would help to strengthen the eventual rebound. It is crucial for people to have jobs to return to and businesses to go back to when life goes back to normal.

We have seen mixed responses around the world, with certain countries acting more proactively than others. In particular, we have seen countries in Asia enacting significant fiscal stimulus measures, which has allowed markets there to already focus on the eventual rebound. Although the storm began in China, its equity market is the best performing major market this year, as some glimmers of sunlight are emerging on the horizon. Europe has been moving to enact significant measures, especially in Italy and the UK, but more is needed. Crucially, the U.S. has yet to move aggressively on the fiscal side.

A combination of liquidity provisions from central banks and significant microeconomic measures from the fiscal side would help to stabilize markets – in addition to a stabilization in the number of new COVID-19 cases around the world and greater visibility on its impact on demand.

Related: What Does the Latest Oil Price Collapse Mean for Investors?