Since the March 23rd lows, retail investors have jumped into the equity market with little concern about the potential risk.

The “Pavlovian” response to the Fed’s massive monetary interventions has pushed “risk-taking” to extremes. Unfortunately, the odds are stacked against investors in a post-COVID economy.

In a recent newsletter, we discussed our process of “taking profits” in positions that had reached more extreme overbought conditions. As is usual in a market where “momentum” is in vogue, we received numerous emails about the “folly” of selling our technology holdings.

It Isn’t Folly.

It is a usual practice of mitigating risk to protect capital for our long-term investment cycle. Interestingly, while there is little doubt that patience is a virtue for investors, exercising prudence is equally important. Despite the basic math, and historical evidence proving its usefulness, investors typically ignore prudence, especially when it is required most. The “siren’s song” of a momentum-driven market fueled by a “speculative greed” is inevitably too compelling for many investors.

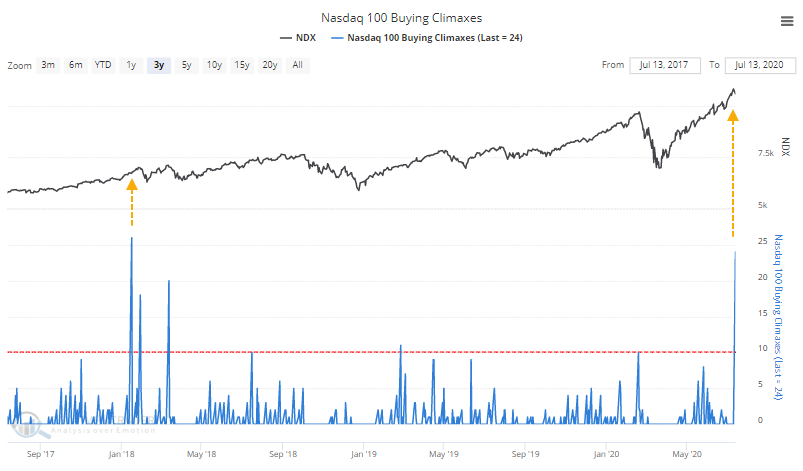

Such is particularly notable in the Nasdaq where several signals from option speculation to a buying climax last week. As noted by SentimenTrader:

“The reversal in the Nasdaq 100 coincided with the 2nd-largest number of buying climaxes in those stocks. Only early 2018 had more.”

However, for investors, there is a more significant concern longer-term. On the heels of the first quarter’s GDP release, it is clear the economy has slid into a recession. That recession will worsen markedly when we begin to see the second-quarter results here soon. What investors haven’t fully grasped is the corresponding relationship between the economy and corporate profits.

The Relationship

“There is currently a ‘Great Divide’ happening between the near ‘depressionary’ economy versus a surging bull market in equities. Given the relationship between the two, they both can’t be right.” – RIA

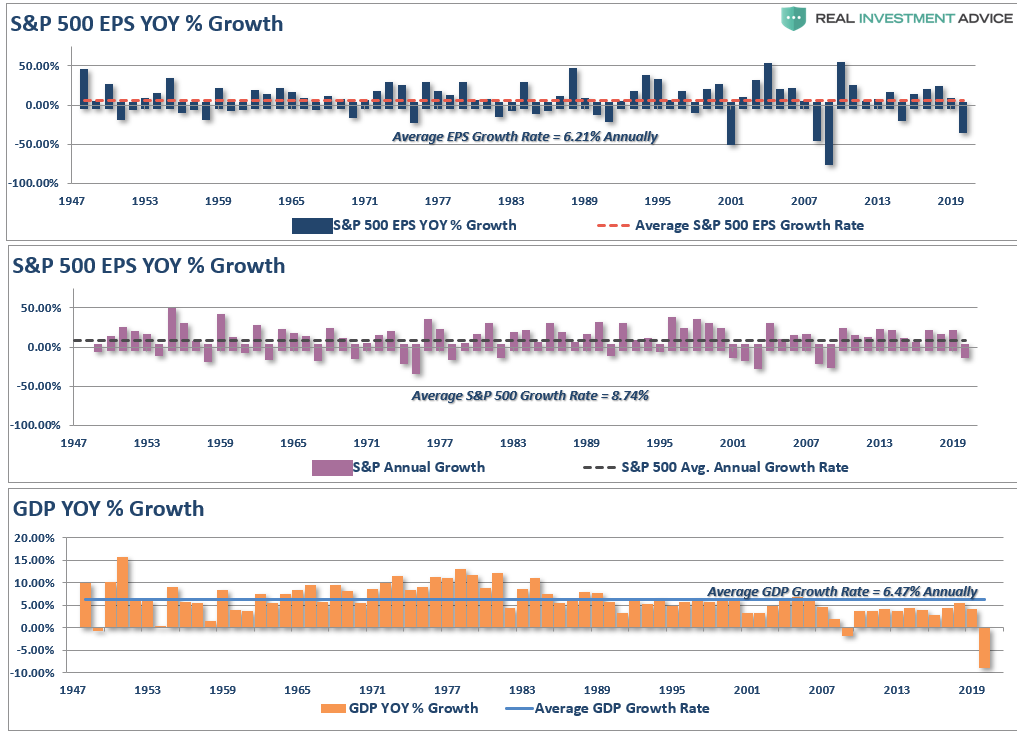

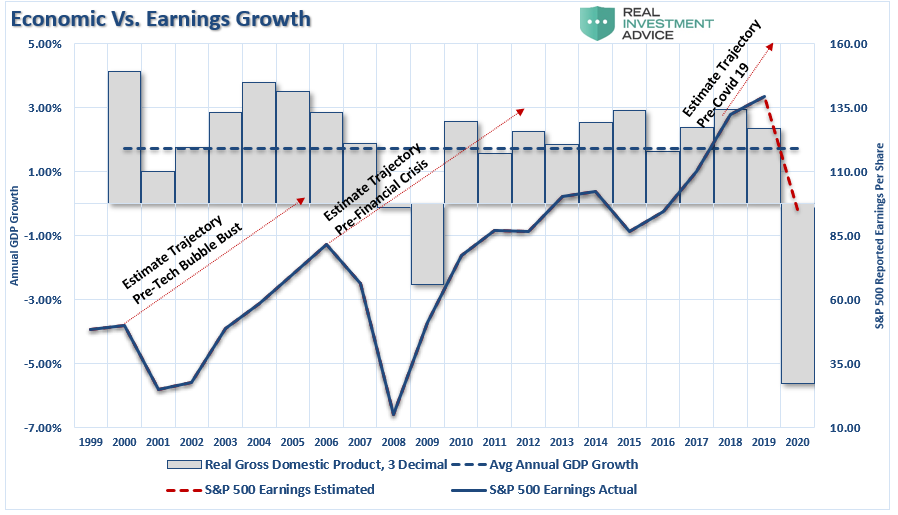

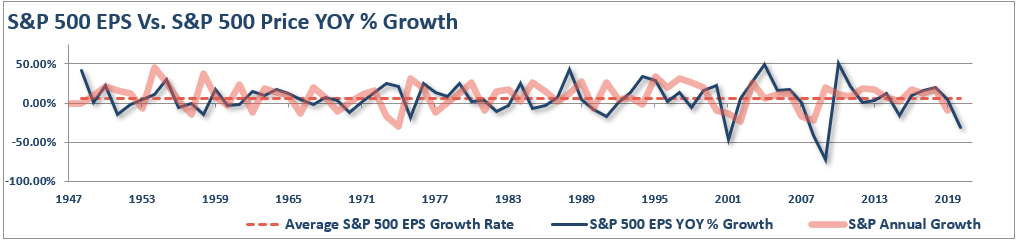

Throughout history, there has been, and remains, a close relationship between the economy, earnings, and asset prices over time. The chart below compares the three going back to 1947 with an estimate for 2020 using the latest data points.

Since 1947, earnings per share have grown at 6.21% annually, while the economy expanded by 6.47% annually. That close relationship in growth rates should be logical, particularly given the significant role that consumer spending has in the GDP equation.

The Consumption Function

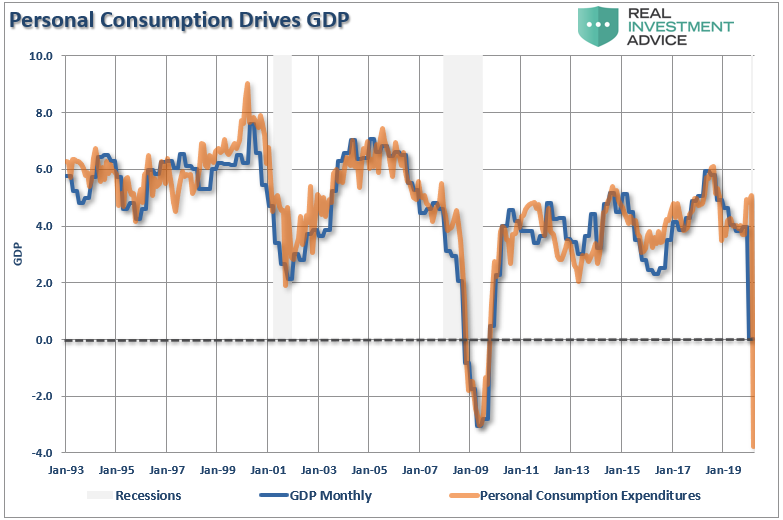

While stock prices can deviate from immediate activity, reversions to actual economic growth eventually occur. Such is because corporate earnings are a function of consumptive spending, corporate investments, imports, and exports.

Unsurprisingly, there is a precise correlation between PCE and GDP. If consumption contracts due to high levels of unemployment, then economic growth declines.

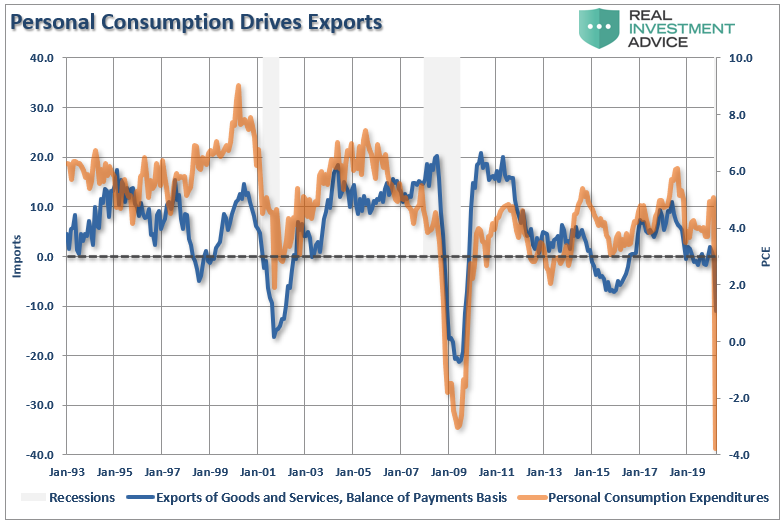

However, when it comes to investing, exports are a critical factor. Exports comprise roughly 40% of corporate profits, and also have a high correlation to consumption and related economic activity.

It should be evident that corporate earnings and profits correlate highly with economic activity. While Business Investment and Government Spending do have an input into the economy, consumption ultimately drives profits.

A Post-COVID Economic Recovery

While I have addressed these points above previously, they are an essential context for where we are in the current market and economic cycle.

Investors are currently under the assumption the economy will make a “V-shaped” recovery and return to pre-pandemic levels. Given the surge in debts and deficits, a continuing demographic shift, and the lag of employment recovery, it is unlikely such an optimistic recovery will be possible in the short-term.

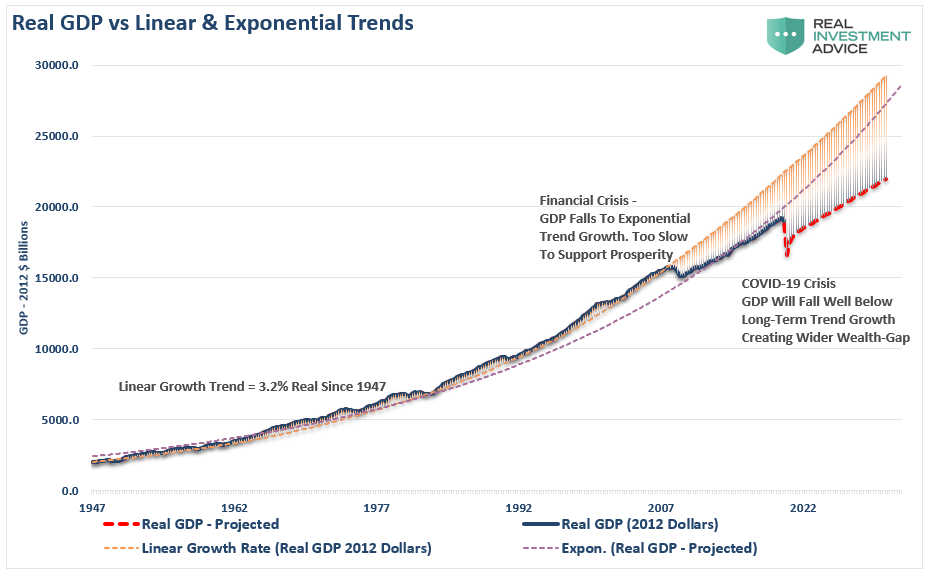

Furthermore, we have experience with post-crisis recoveries. Before the “Financial Crisis,” the economy had a linear growth trend of real GDP of 3.2%. Following the 2008 recession, the growth rate dropped to the exponential growth trend of roughly 2.2%. Instead of reducing the debt problems, unproductive debt, and leverage increased.

Given the “COVID-19” crisis led to a debt surge to new highs, such will retard future economic growth to 1.5% or less. As discussed recently, while the stock market may rise due to massive Fed liquidity, only 10% of the population owning 88% of the market will benefit. However, for corporate earnings and profits to fully recover, it requires 100% of the economy to participate.

Importantly, as noted above, the economy has not and will not grow at an annualized pace of 6.47%. As such, lower returns from the market long-term due to the inherent relationship between the market and the economy, will plague investors.

Stock Prices & The Economy

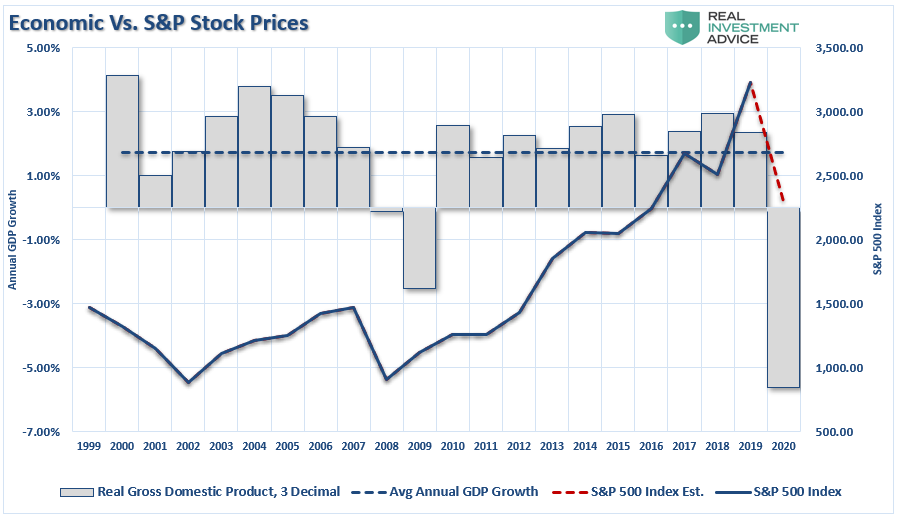

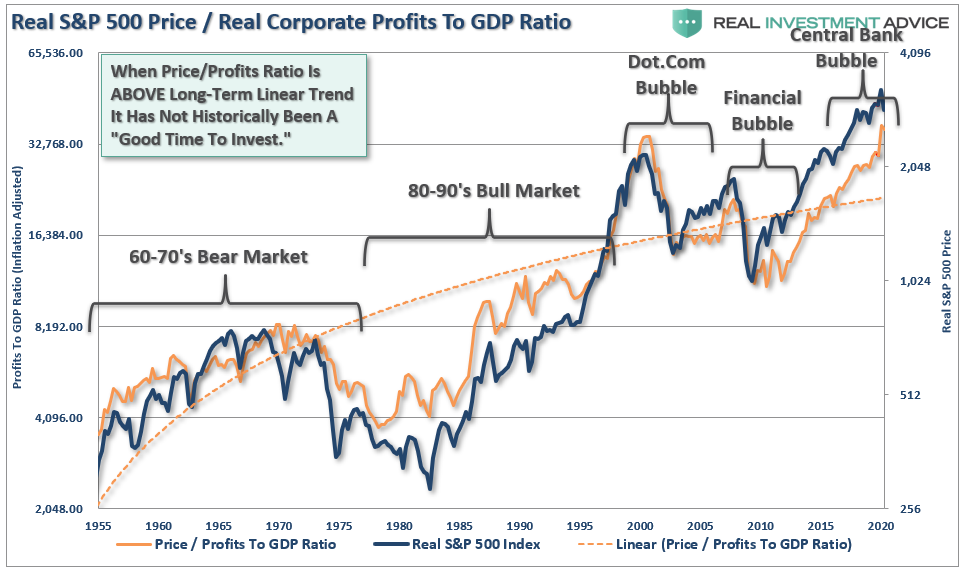

As stated, the stock market often detaches from underlying economic activity over short-term periods as investor psychology latches onto the belief “this time is different.”

Unfortunately, it never is.

While not as precise, a correlation between economic activity and the rise and fall of equity prices does remain. In 2000, and again in 2008, as economic growth declined, corporate earnings contracted by 54% and 88%, respectively. Such was despite calls of never-ending earnings growth before both previous contractions.

As earnings disappointed, stock prices adjusted by nearly 50% to realign valuations with both weaker earnings and slower earnings growth. While the stock market is again detached from reality, looking at past earnings contractions, suggests it won’t be the case for long.

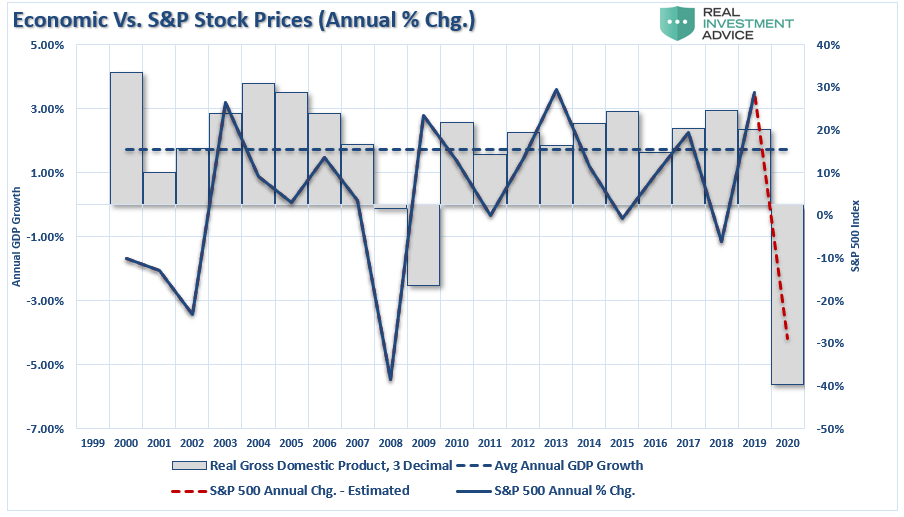

The relationship becomes more evident when looking at the annual change in stock prices relative to the yearly GDP change.

Again, since the “psychology” of market participants drives prices, there can be periods where markets become detached from fundamentals. However, there is no point in previous history, where the fundamentals catch up with stock prices.

The Future Of Low(er) Returns

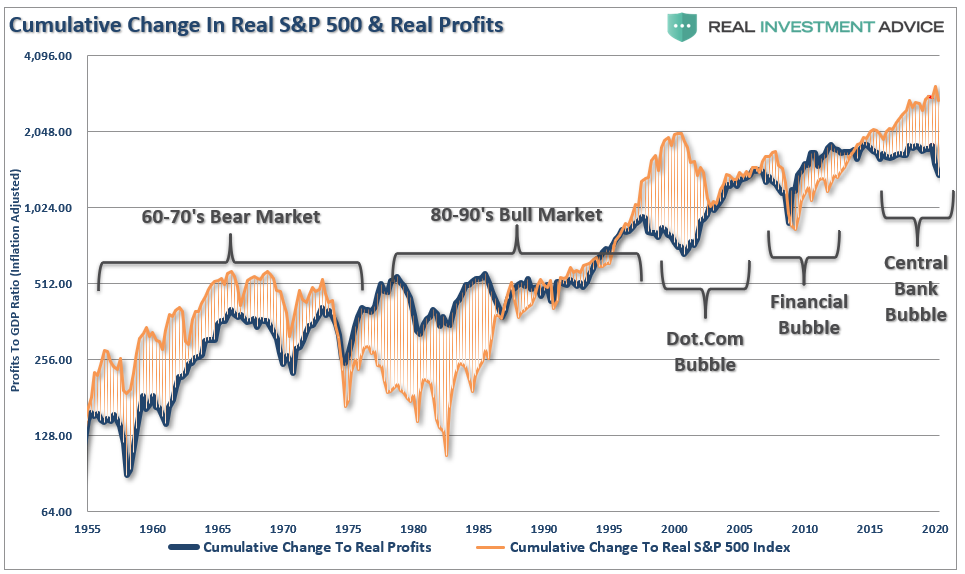

It is critical to remember the stock market is NOT the economy. The stock market should be reflective of underlying economic growth, which drives actual revenue growth. However, when investors pay more than $1 for a $1 worth of profits, there is an eventual reversal of those excesses.

The correlation is more evident when looking at the market versus the ratio of corporate profits to GDP. Again, since corporate profits are ultimately a function of economic growth, the correlation is not unexpected. Hence, neither should the impending reversion in both series.

To this point, it has seemed to be a simple formula that as long as the Fed remains active in supporting asset prices, the deviation between fundamentals and fantasy doesn’t matter. It has been a hard point to argue.

However, what has started, and has yet to complete, is the historical “mean reversion” process which has always followed bull markets. Such should not be a surprise to anyone, as asset prices eventually reflect the underlying reality of corporate profitability.

Valuations

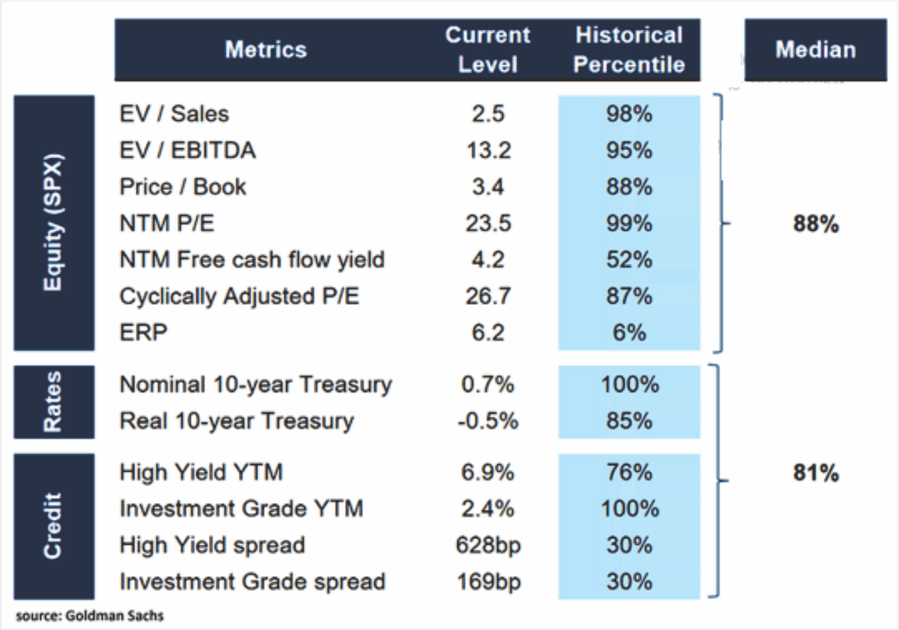

Equity valuations are higher than average by many measures, as shown in the table. Currently, the median is in the 88th percentile, and rate measures are in the 81st percentile. Only multiples from the 2000 and 2008 bubble periods were comparable to today.

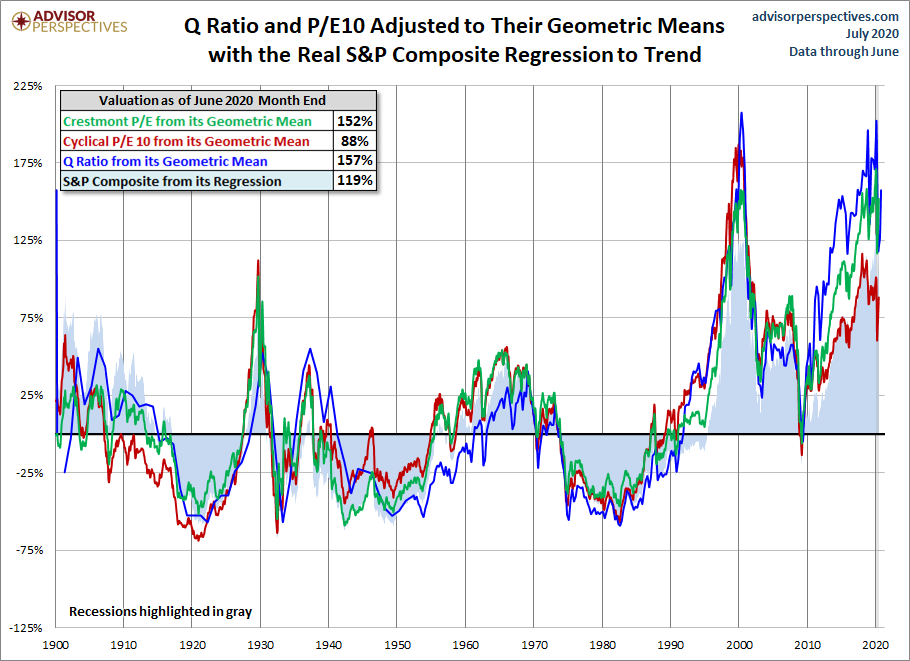

Jill Mislinki, via Advisor Perspectives, also produced a similar chart of valuation measures, which shows the same thing in graphical form. The chart below shows two valuation ratios (P/E and Q) adjusted to their geometric mean rather than their arithmetic mean. Unsurprisingly, the range of overvaluation would be from 88% to 157%, up from last month’s 77% to 141%.

Suggesting that equities are at lofty valuations and prices is not an overstatement. Historically speaking, future returns from such valuations have been low and in line with slower economic growth. While in the short-term prices can certainly deviate from valuations and economic growth, as shown, they tend not to stay that way.

By nearly any metric, stocks are extremely expensive. There are limits to pulling forward “future growth.”

Summary

This article provides more supporting evidence that the odds are stacked against equity investors. That does not mean the market cannot go higher and exhibit even greater speculative fervor.

However, as fiduciaries, we must consider the long-term benefit of limiting drawdowns, especially when there is historical reason to believe they could be extreme. While it is not easy going against popular wisdom, we recommend exercising prudence and taking some chips off the table as we did this past week.

Besides, if you take profits, and rebalance risk, what is the worst that could happen?