Written by: Bryce Coward | Knowledge Leaders Capital

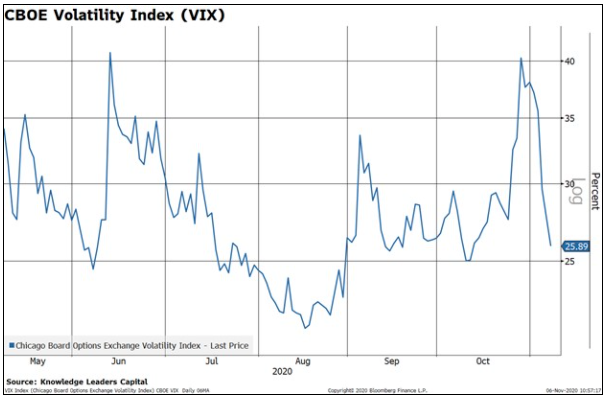

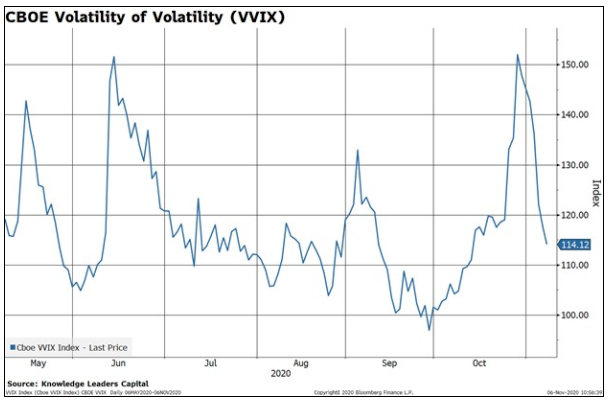

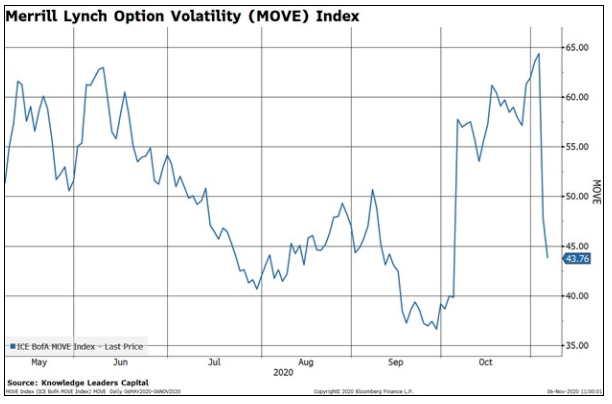

While Joe Biden will be the next president, there still remains a bit of uncertainty with respect the final electoral vote tally as well as any legal challenges that will emerge in the coming days. Even still, the tail risk scenarios of a constitutional crisis or the US Supreme Court casting the deciding vote seem to have been significantly mitigated…at least that is what the market is pricing. We know this because expected volatility across asset classes is plunging as demand for tail risk hedges is dissipating. In the charts below we show stock market volatility (chart 1), stock market volatility of volatility (chart 2), bond market volatility (chart 3), and foreign exchange volatility (chart 4). In each case, the market’s pricing of volatility has plunged from pre-election levels back into the lower-middle part of the range over the last six months.

This has implications for positioning moving into year end. As expected volatility comes down, value at risk (VaR) – the projected loss of a portfolio – is reduced, which allows institutional investors to add to risky positions. This somewhat technical feature of the market is one significant reason for the melt-up we’ve seen over the last few days. Should election results become more clear, we’d expect volatility to come down even further, potentially somewhat counterbalancing other significant risks like COVID lockdowns, lack of fiscal stimulus, etc.

Related: Investing After the 2020 Election