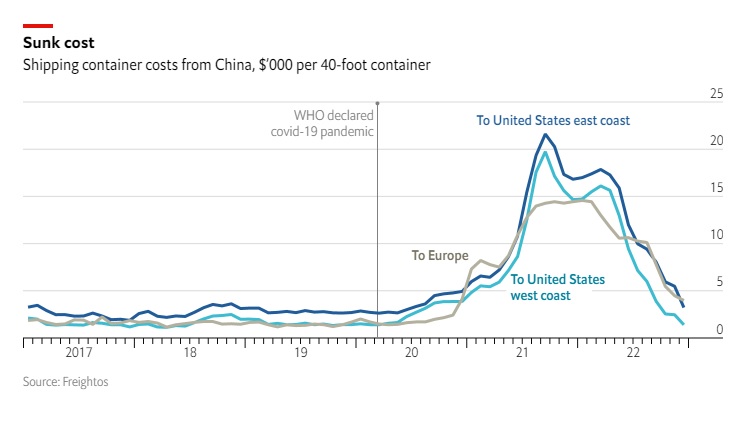

Shipping rates are a real-time indicator of excess demand and are down yuuge, now 93 percent lower than the September 2021 peak. We have always maintained that the inflation the economy is/has experienced has primarily been driven by excess demand and not supply shocks.

Durable Goods

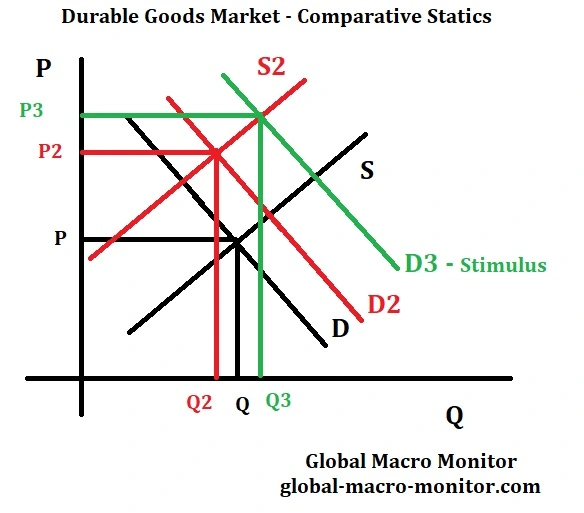

Inflation in the goods sector was initially caused by a demand shock, coupled with a supply shock. Consumers, stuck at home during the Covid lockdown, shifted their spending away from services, such as restaurants, to durable goods, such as computers, used cars, and bicycles during a time when supply was shuttered (D2 and S2). The massive stimulus packages boosted demand further, leading to higher demand (D3), higher prices (P3), and output (Q3).

Traffic Jams At The Ports

We are amused that many claim the traffic jams at the major ports over the past few years are supply shocks, which is complete nonsense. The bottleneck at the ports was fundamentally driven by too much demand caused by too much stimulus highlighted by excessive monetary injections, which short-circuited and swamped the logistics of moving goods.

We concede upstream suppliers did suffer “supply shocks” as many of their inputs or intermediate goods sat offshore waiting to dock and unload. If, however, a supply shock is caused by excess demand downstream or at point of sale demand, is it really a supply shock?

On January 9, 2022, 109 container ships sat off the coast of California waiting for their turn to unload at the ports of Los Angeles and Long Beach. One year later there are almost none. The easing of port traffic and the opening of other supply-chain bottlenecks have led to a collapse in freight rates from the all-time highs reached during the pandemic. The cost of shipping a 40-foot container from China to America’s west coast is now $1,400, down 93% from its peak of $20,600 in September 2021, according to Freightos, an online freight marketplace. – Economist

NY Fed model

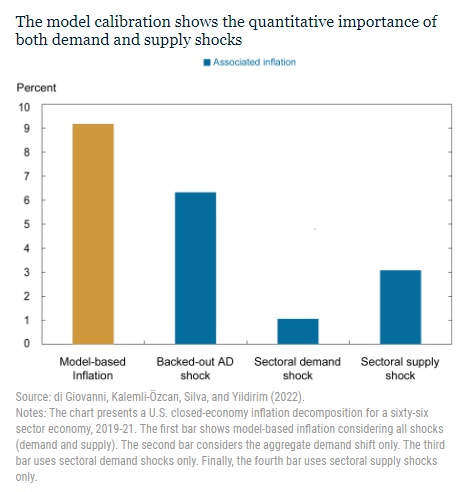

The New York Federal Reserve bank has analyzed how much of the inflation was/is caused by supply constraints,

The current debate on whether the Federal Reserve can engineer a soft landing needs to disentangle the drivers of U.S. inflation. Our work shows that inflation in the U.S. would have been 6 percent instead of 9 percent at the end of 2021 without supply bottlenecks. Our quantitative results clarify why some pundits were wrong to predict a transitory surge in inflation, while others were right in predicting high inflation, but for the wrong reasons. Put differently, fiscal stimulus and other aggregate demand factors would not have driven inflation this high without the pandemic-related supply constraints. In the absence of any new energy or other shock, it is therefore possible that the ongoing easing of supply bottlenecks will cause a substantial drop in inflation in the near term. – NY Fed

They may be right, we may be crazy. Stay tuned.