Written by: Stephen Duench, CFA® | AGF

The dramatic rotation in market leadership that defined equity returns during the first month of 2023 has become less acute in more recent weeks, but investors still need to be careful about its influence on portfolio positioning going forward.

Namely, it’s crucial to find a balance between this year’s early winners and losers. For instance, while some investors might want to load up more on outperforming sectors like Information Technology and real estate income trusts (REITs), this may not be prudent given the extreme nature of the outperformance that took place in January.

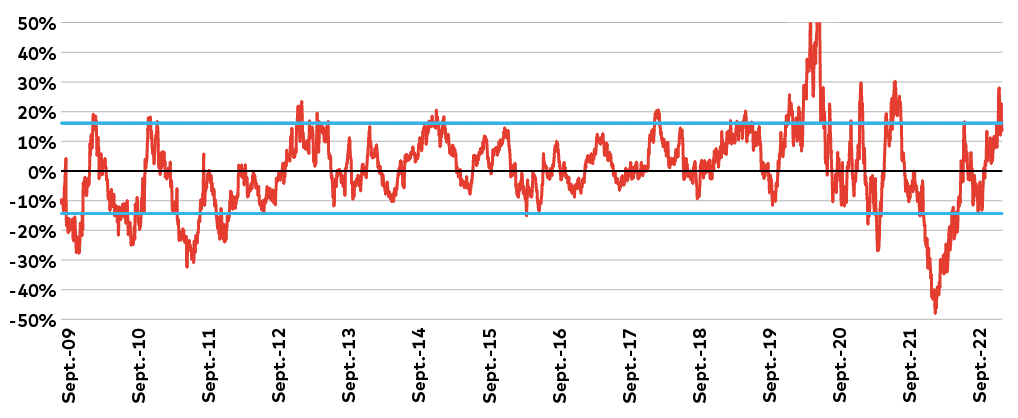

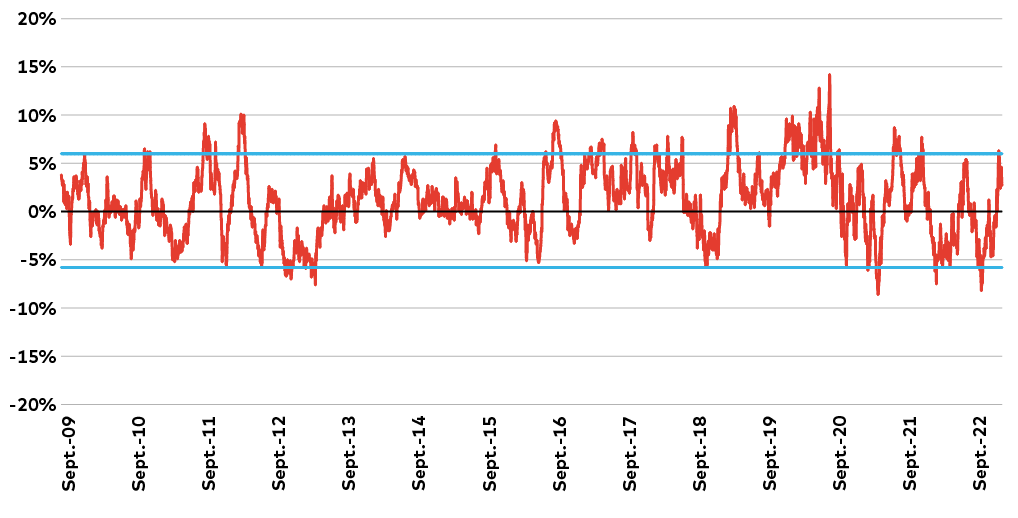

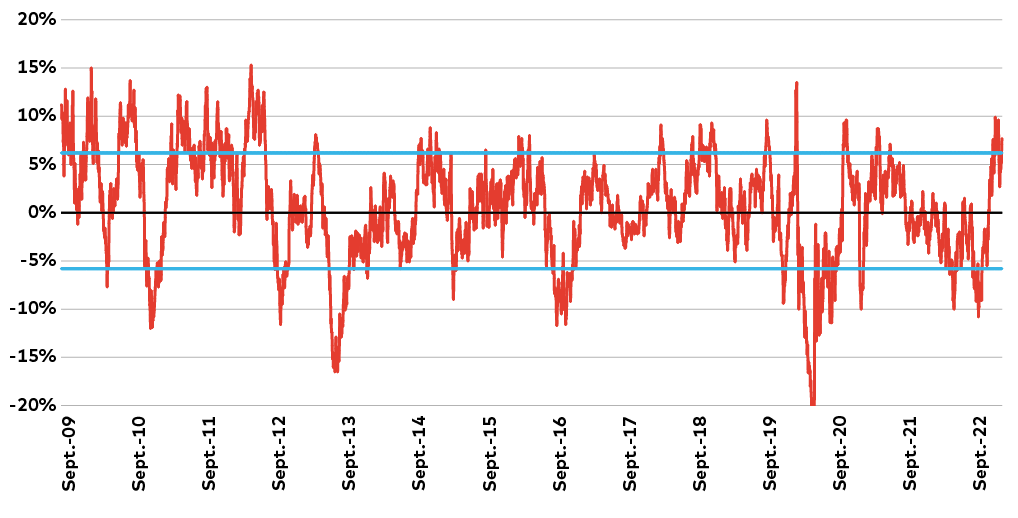

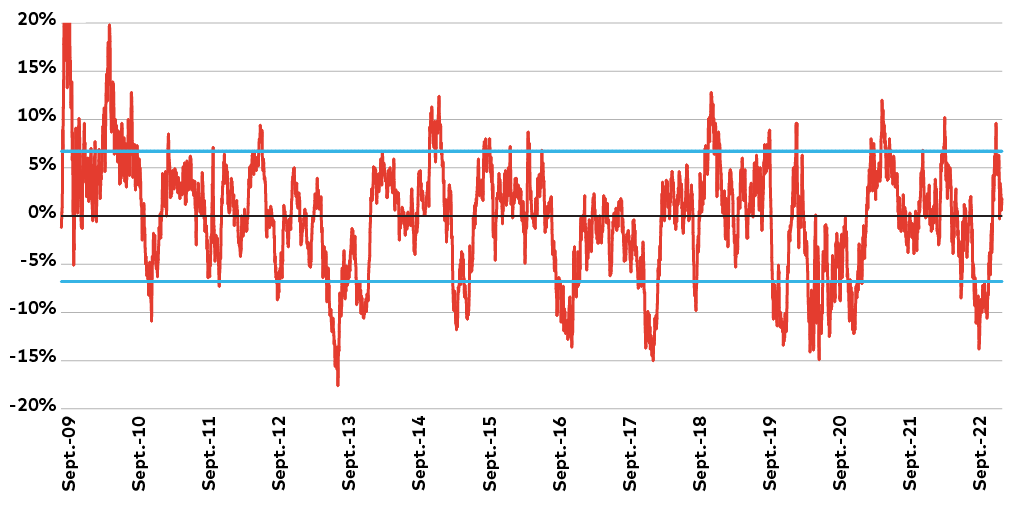

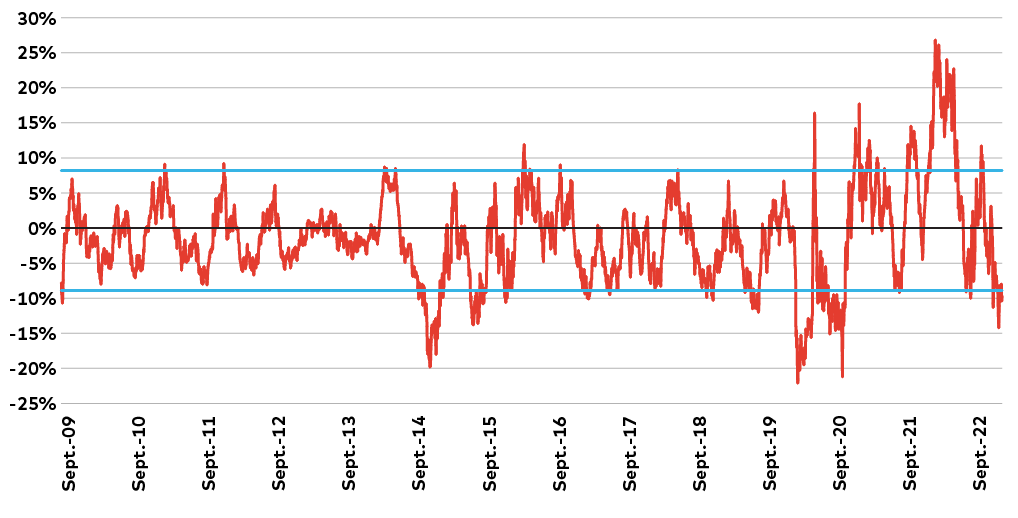

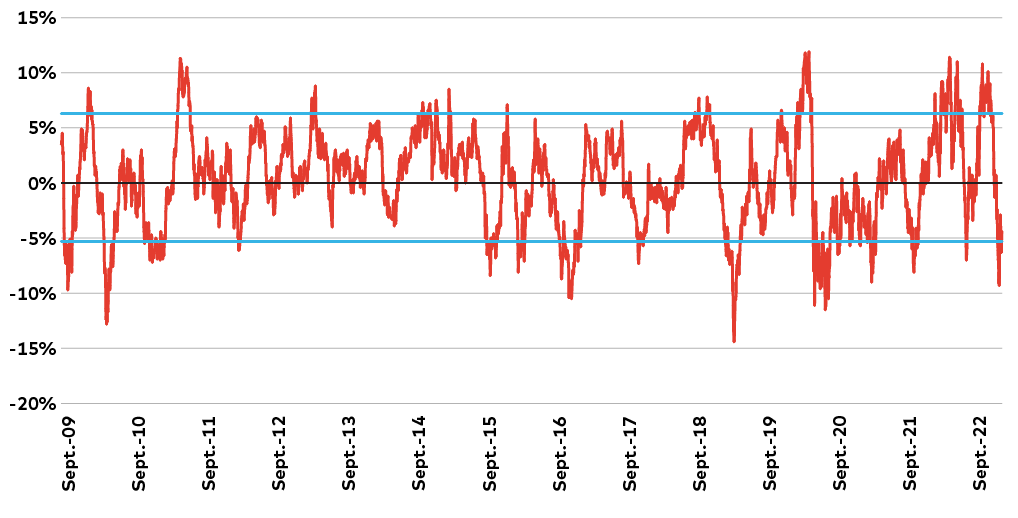

In fact, the rolling three-month relative performance of these two sectors was near or above the “upper bound” level at which future returns begin to wane – relatively speaking – both in Canada and the United States.

Canada Information Technology: Three-Month Rolling Relative Return

Source: AGF Investments Inc. using data from FactSet as of February 21, 2023. Three-month rolling relative return of the S&P/TSX Information Technology Index versus the S&P/TSX Composite Index. One cannot invest directly in an index. Past performance is not indicative of future results.

U.S. Information Technology: Three-Month Rolling Relative Return

Source: AGF Investments Inc. using data from FactSet as of February 21, 2023. Three-month rolling relative return of the S&P Information Technology Index versus the S&P 500 Index. One cannot invest directly in an index. Past performance is not indicative of future results.

Canada REITs: Three-Month Rolling Relative Return

Source: AGF Investments Inc. using data from FactSet as of February 21, 2023. Three-month rolling relative return of the S&P/TSX REIT Index versus the S&P/TSX Composite Index. One cannot invest directly in an index. Past performance is not indicative of future results.

U.S. REITs: Three-Month Rolling Relative Return

Source: AGF Investments Inc. using data from FactSet as of February 21, 2023. Three-month rolling relative return of the S&P REIT Index versus the S&P 500 Index. One cannot invest directly in an index. Past performance is not indicative of future results.

By extension, it’s probably not wise to completely neglect this year’s early losers, which include sectors like Canadian Energy and U.S. Healthcare, both of which underperformed at near or below the “lower bound” level that future relative returns begin to improve.

Canada Energy: Three-Month Rolling Relative Return

Source: AGF Investments Inc. using data from FactSet as of February 21, 2023. Three-month rolling relative return of the S&P/TSX Energy Index versus the S&P/TSX Composite Index. One cannot invest directly in an index. Past performance is not indicative of future results.

U.S. Healthcare: Three-Month Rolling Relative Return

Source: AGF Investments Inc. using data from FactSet as of February 21, 2023. Three-month rolling relative return of the S&P Healthcare Index versus the S&P 500 Index. One cannot invest directly in an index. Past performance is not indicative of future results.

To be clear, that doesn’t mean investors should do the complete opposite. Selling all your winners and buying the losers in hopes of a complete reversal in market leadership is a very difficult proposition to make given the uncertainty of the current market environment.

A better approach for many might be a “core and contrarian” strategy that maintains exposure to the strongest performing winners in a portfolio, while adding select laggards that show high conviction quality attributes.

As an example, from a dividend investing perspective, the REITs remain fertile ground for opportunities despite the sector’s outsized gains earlier this year. Moreover, there are several Energy and Healthcare names with great attributes that are even more attractive for having been on the wrong side of the rotation in market leadership. Not only are their yields higher for it today, but they’re also expected to keep growing at a time when dividend growth could become scarce as other companies brace for the potential of a severe economic downturn.

Ultimately, market extremes like those we experienced to start 2023 can be difficult to navigate, but by maintaining a balanced approach, investors are better positioned to navigate the risks, while taking advantage of the opportunities that arise.

Related: How the Different Generations Invest