Written by: Brian Clark | Knowledge Leaders Capital

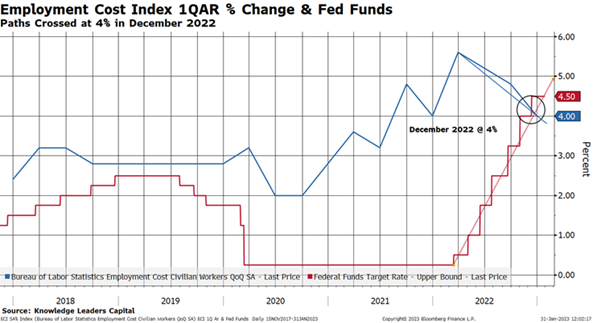

We saw another indicator this week that the Federal Reserve has been successful in stemming the tide of inflation. The Employment Cost Index for the fourth quarter of 2022 came in under expectations at 1% quarter-over-quarter, or about 4% annualized. This suggests one of the Fed’s key indicators for success, getting the Fed Funds rate above inflation, which implicitly means getting it above labor cost growth, may have been achieved.

This is similar to the PCE deflator ex-shelter, which is also below the Fed Funds rate, currently at 3.9%, and down from its high of 6.1% in the second quarter of 2022.

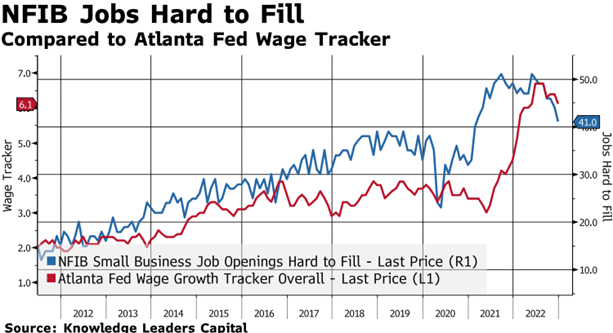

We can also see other aspects of the labor market that might support a pause in Fed Hawkishness. The most recent Beige Book survey shows that employers have on average slowed hiring, and in some instances cut hours, an early indicator of a slowing job market where layoffs typically lag due to a reluctance to proceed with layoffs.

The NFIB small business “hard to fill” indicator shows that employers might not need to sweeten the pot as much to attract employees now, reducing pressure to raise wages in order to hire workers.

As the Employment Cost Index continues its decline, we would not be surprised to hear more talk by Fed Chair Jerome Powell about a “wait and see” approach to further hawkishness.

Related: Putting Yields to Work: Short-Duration, High Yield Bonds