Written by: Meera Pandit and Stephanie Aliaga

November’s CPI report showed a second month of softening inflation despite still-elevated price growth. Headline CPI increased 0.1% month-over-month (m/m) and 7.1% year-over-year (y/y), while core CPI (ex-food and energy) increased 0.2% m/m and 6.0% y/y, all below consensus expectations.

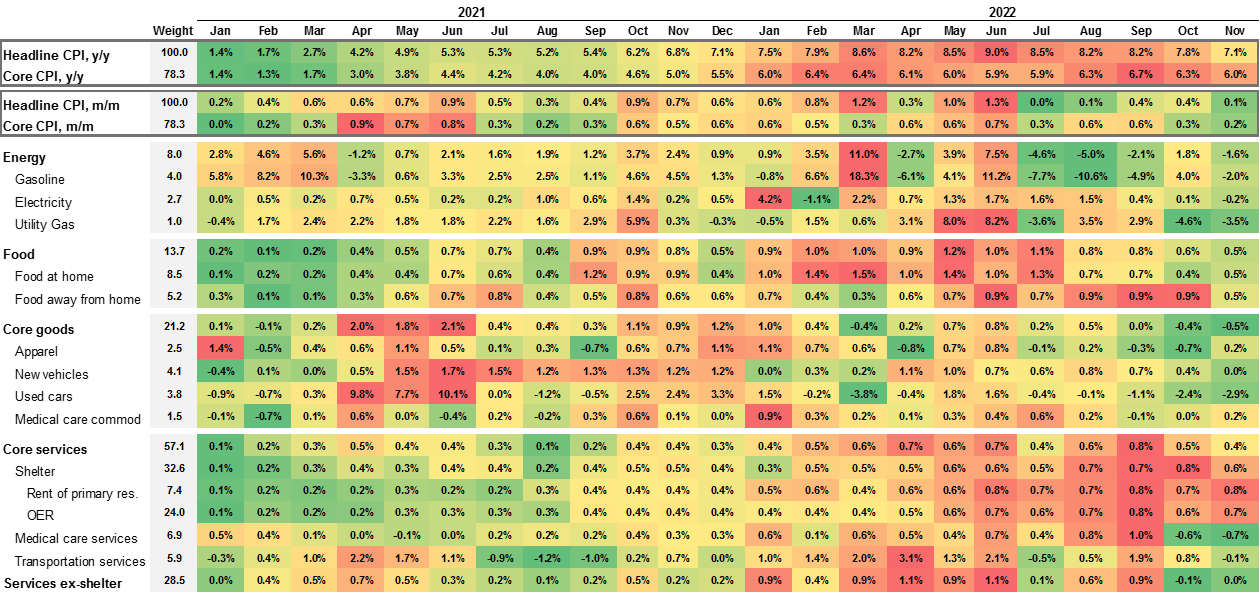

How will the Federal Reserve (Fed) interpret this CPI report in the final meeting of the year? On November 30, Chair Powell gave a speech at the Brookings Institution and shared that the FOMC is thinking about three categories of inflation: core goods, housing services, and services ex-housing. These categories experienced the following developments in November:

Core goods – Core goods fell 0.5% m/m, reflecting declines used car prices, flat new car prices, and modest increases in apparel. Demand for goods is slowing and supply chain challenges have mostly normalized. Outside of core goods, higher commodity prices had been a key driver of higher inflation, but after a surge in energy prices earlier this year, both WTI oil and gas prices are essentially flat compared to one year ago.

Housing services – Shelter continues to increase at a strong pace, up 0.6% m/m. However, the shelter measure is comprised of rent and owner’s equivalent rent, not housing prices, so there is typically a lagged impact. Shelter prices are likely to continue to increase into 2023 before moderating.

Services ex-housing – Due to the lagged effect on shelter prices, the Fed is focused on services outside of housing to gauge services demand, which was flat m/m. In November, airline fares, hotels, and medical services declined. Restaurant prices continued to rise, although at the slowest pace since March.

This report reflects welcome progress on both core goods and services ex-housing. Shelter was the largest contributor to the monthly increase and will take some time to subside, although that is well-understood by the Fed as they assess inflation. Softer inflation could allow for a lower terminal federal funds rate, with the Fed pausing and holding in early 2023. A Fed pause, slowing inflation, and weakening economic growth should result in falling yields next year, so investors should consider adding duration. Although equities have rallied on this cooler inflation print, headwinds to growth and earnings could put a ceiling on equity prices.

Inflation components

m/m % change

Source: BLS, FactSet, J.P. Morgan Asset Management. Heatmap shading is intra-category and relative to the two-year period shown. Component weights may not add to 100. OER refers to owner’s equivalent rent. Data are as of December 13, 2022.

Related: Have International Equity Markets Already Priced in the Worst?