Written by: Jack Manley and Sharon Carson

In the aftermath of the COVID pandemic, global economies are reeling in the face of decades-high inflation, brought about first by unprecedented levels of fiscal stimulus and more recently by supply-chain snarls, which in turn are largely attributable to China’s continued COVID-zero policy and the ongoing war in Ukraine. This inflation has eroded both consumer and business confidence, and threatens, either directly or through interest rate policy, recession both at home and abroad.

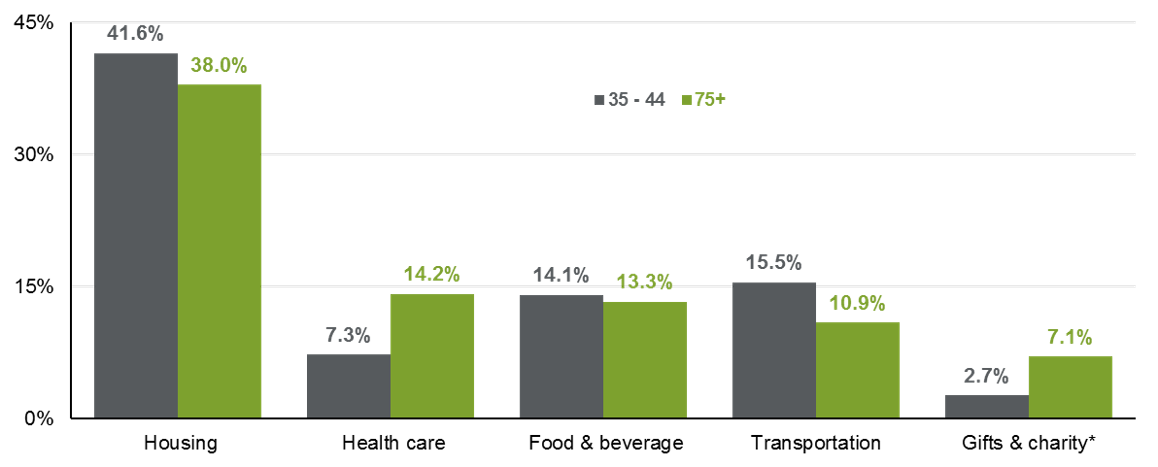

Soaring inflation is a challenge for everyone: the demand for food, fuel and shelter, categories that have recently increased at the fastest pace in 40 years, is near-universal and largely inelastic. However, based on demographics, the impact can vary on the margin. For example, younger households (aged 35 to 44) tend to allocate roughly 10% more of their spending to these categories than households over the age of 75, and many are renters or first-time home buyers.

For these younger individuals, many of whom are in their peak earnings years, multi-decade high wage increases can at least partially offset inflation, and in some cases present savings opportunities if spending behavior is only minimally changed. However, given the magnitude of this problem, wage growth will likely be insufficient. Younger households must make the most of savings, starting with an emergency fund and then contributing to a company-matched retirement plan; tax-advantaged accounts for health care and college are even more crucial in inflationary times; and for long-term objectives, investing is critical, since the equity market is a proven and effective hedge against inflation over the long run, in clear contrast to cash, which will lose money in real terms.

For older households, the issues present differently. Homeowners and Social Security recipients who receive cost-of-living increases have a hedge against inflation. However, older renters, those with fixed pensions and some newly retired households face significant challenges, and a market decline coupled with high inflation early in retirement can be problematic for those who are dependent on their portfolio to fund their lifestyle. Some financial professionals who develop personalized plans may make recommendations that can help mitigate market risk early in retirement while keeping their retired clients positioned for long-term cost growth, including health care costs.

Looking forward, investors of all ages must realize that while inflation may impact them at an individual level, the “big picture” is worth paying close attention to, too. Given the inherent uncertainty surrounding the global issues that are contributing to inflation, it is impossible to claim with certainty when, and to what level, inflation will cool. As a result, younger or older, investors must take appropriate risk and work with financial professionals to diversify their portfolios.

Source: Bureau of Labor Statistics, 2017-2019 annual average Consumer Expenditure Survey, college educated. 2017-2019 data is used to reflect spending behavior over the long term; excludes pandemic impact. Additional spending categories for age 35-44 and 75+, respectively: entertainment, 6% and 5%; travel 4% and 4%; other 3% and 4%; apparel 4% and 2%; education 2% and 1%. J.P. Morgan Asset Management. Guide to Retirement.

Related: Are Falling Job Openings a Sign of Cooling Labor Markets?