Written by: Jeremy Anagnos | New York Life Investments

Infrastructure Outlook

- A confluence of forces has the potential to support listed infrastructure in 2022.

- We believe we have entered a macroeconomic period during which the asset class has historically performed very well – notably those marked by above average inflation and moderating economic growth.

- We see the potential to reverse a trend witnessed in 2021 whereby the broad market rewarded high earnings beta. Specifically, we believe the durable earnings growth of listed infrastructure will come back into favor as it surpasses growth of broad equities in an absolute context and as the second derivative of earnings growth slows materially for broad equities.

- With attractive valuations, accelerating growth, and a conducive macroeconomy, we believe the potential total return proposition of listed infrastructure is compelling for 2022 and beyond.

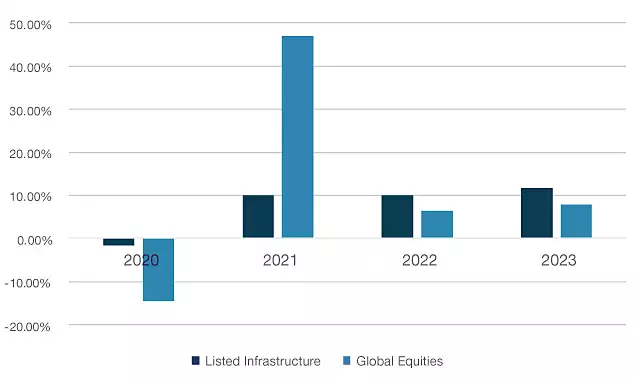

2021 saw robust equity market returns, with new leadership from 2020’s laggards, such as the energy and real estate sectors. Throughout 2021, global equity market earnings supported stocks—ultimately, equities delivered ~45% earnings growth, compared to initial expectations of 26%.1 Against this backdrop of a cyclical rebound and accelerating global earnings, infrastructure lagged, delivering a ~10% earnings increase vs. original expectations of 8.8%. Infrastructure earnings are durable and low-beta, but they are not suited to outperform during a cyclically-charged rebound.

Looking into 2022, we believe infrastructure earnings are likely to outpace global earnings for the first time in several years. Broad equity market earnings are set to decelerate while infrastructure maintains strong growth. We forecast 10% earnings growth compared to broad equity market growth of only ~7%.2 Global market revisions are moderating (they peaked in Q2 2021) and the pace of broad economic growth is slowing. Gross domestic product (GDP), industrial orders, consumer confidence, and other macroeconomic variables are healthy, but they are unlikely to improve at a faster rate in 2022 than they did in 2021.

Historically, moderating economic growth has been a positive for infrastructure. During such periods, infrastructure has delivered an ~18.5% annualized return, outpacing global equities by 5%. Moreover, during periods of above-average inflation (whether inflation is rising or falling), infrastructure has outperformed global equities by a range of 7-9% based on annualized returns. With these macro factors combined, 2022 is setting up well for the asset class.

On a fundamental basis, infrastructure’s inflation-protected cash flows are accelerating because of its essential characteristics. Companies within global utilities are building hundreds of gigawatts of wind and solar to ensure a clean energy future; such installations hit a new record in 2021, and they are essential to provide power independent of volatile (and expensive) commodities like coal. In the communications sector, secular growth in data from cloud proliferation and the still nascent 5G build-out supports the outlook for data centers and cell towers. The midstream sector should benefit from return of global economic activity that supports energy demand and volumes on existing assets. There is very limited opportunity for the companies to invest in new infrastructure, which should lead to further consolidation and return of capital focus across the group. In transports, toll roads, rails, and airport networks should continue to see steady and growing recoveries in traffic post-pandemic. In the coming years, the world will become more immune, and more normalized, to COVID and its variants: as such, global transportation infrastructure is one of the few remaining COVID recovery stories for 2022 and beyond.

The combination of secular growth, from decarbonization, asset modernization, and digital transformation, and cyclical recoveries is occurring just as the listed infrastructure market is trading at a generational-level discount against global equities. Currently, infrastructure is trading 10% below its long-term relative multiple average; this is similar to 2010, when global economic growth also moderated, and just before a multi-year period during which infrastructure outperformed global markets.

For 2022 and beyond, we are optimistic that past is prologue. Infrastructure’s relative valuation multiple is a coiled spring for the asset class. When coupled with its robust dividend yield, inflation protected earnings growth, and history of outperformance during moderating and inflationary environments—we find today’s Listed Infrastructure a compelling opportunity for investors in 2022 and beyond.

Listed Infrastructure is represented by the FTSE Global Core Infrastructure 50/50 Index. Global Equities are represented by the MSCI ACWI ETF. Source: Forecasts based on the 2022 and 2023 average earnings per share growth rates of the FTSE Global Core Infrastructure 50/50 Index (CBRE forecasts) and the MSCI ACWI ETF (Factset), respectively; actuals per Factset. As of December 21, 2021. Past performance is not indicative of future results. An investment cannot be made in an index.

1. Source: Factset for the ACWI ETF.

2. Based on the 2022 and 2023 average EPS growth rates of the FTSE Global Core Infrastructure 50/50 Index (CBRE forecasts) and the MSCI ACWI ETF (Factset), respectively.