“Bear squeeze,” or has the bull market returned? Over the last few weeks, that remains the question as the market rocketed off its lows, eclipsing both the 50- and 200-day moving averages. But is it safe to chase the markets higher?

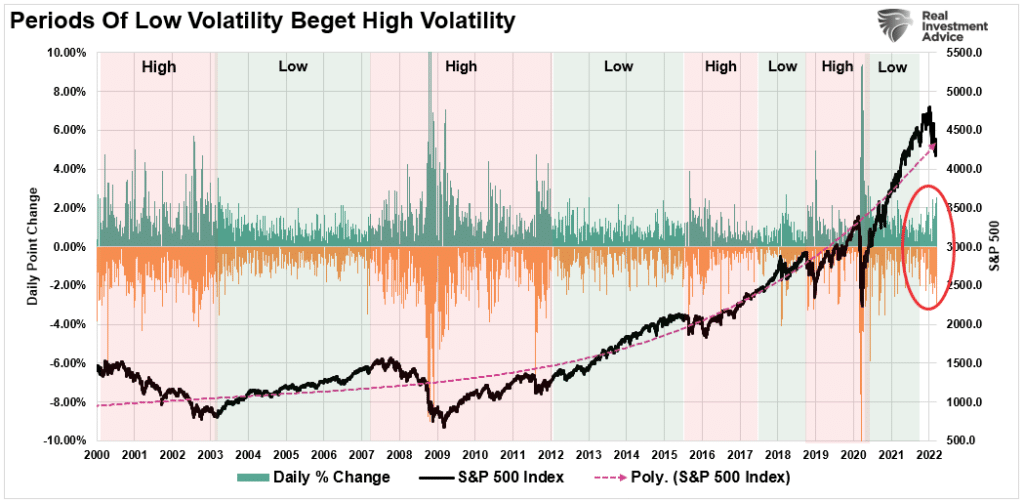

As we discussed recently, the best 10-days of the market tend to be during the worst periods.

“The firm noted this eye-popping stat while urging investors to ‘avoid panic selling,’ pointing out that the ‘best days generally follow the worst days for stocks.’” – Pippa Stevens via CNBC

Think about that for a moment

“The best days generally follow the worst days.“

The statement is correct, as the S&P 500’s most significant percentage gain days tend to occur in clusters during the worst of times for investors.

The reason that markets tend to surge during market selloffs is due to “bear squeezes.”

“A bear squeeze is a sudden change in market conditions that forces traders, attempting to profit from price declines, to buy back underlying assets at a higher price than they sold for when entering the trade. As the term implies, traders get squeezed out of their positions, usually at a loss.” – Investopedia

A bear squeeze is also known as a “short squeeze.” When prices rise, investors who have shorted either individual equities or entire markets have to close out their short positions. To close out their short position, they have to buy the stock or index and return the shares they borrowed to sell short. That buying increases the price, forcing other short sellers to cover. This cycle continues until the short-sellers are exhausted.

Is The Bull Market Back

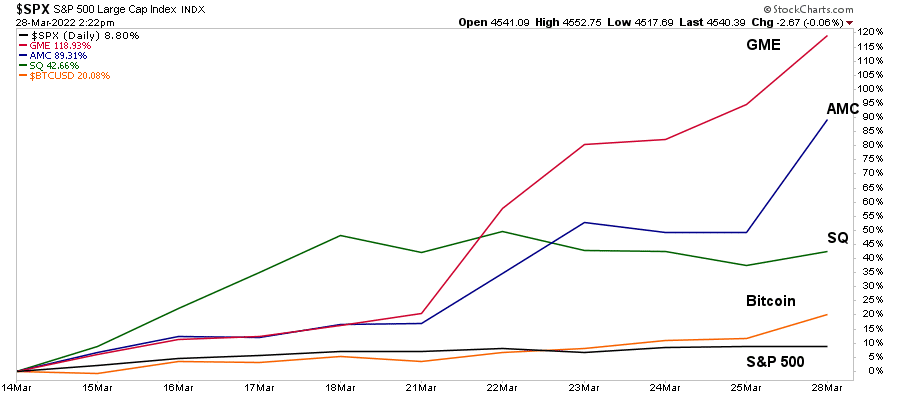

Since the lows from a few weeks ago, the market has surged sharply higher. While that surge was impressive, it had “bear squeeze” earmarks, as some of the most shorted names surged higher.

While the rally was significant, with companies like Gamestop up more than 100% in two weeks, the underlying market drivers are reversing.

- Interest rates have moved higher in advance of the Federal Reserve.

- The Federal Reserve is hiking rates and appears committed to continuing in upcoming meetings.

- Liquidity, from checks to households, unemployment, and child tax credits, is ended, and savings are declining.

- The economy is slowing.

- Inflation is remaining stubbornly higher, further tightening monetary policy.

- Earnings expectations for the S&P 500 are declining rapidly, and;

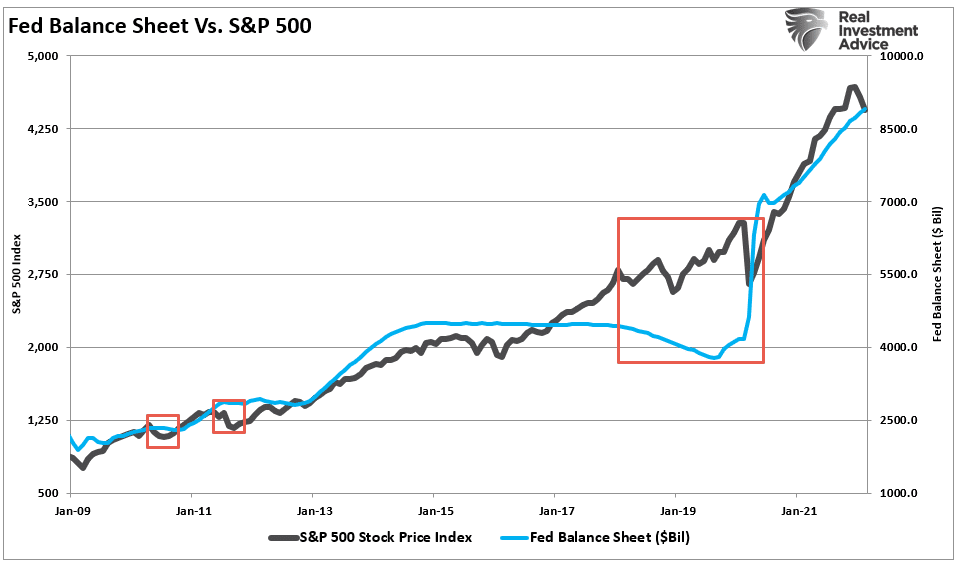

- The Federal Reserve will begin to reverse, or taper, the size of its current balance sheet.

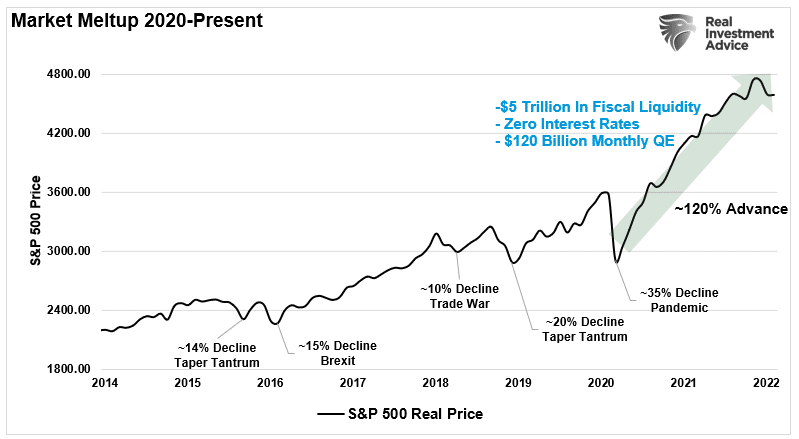

The two most critical points to continuing a bull market are the reversal of liquidity and the Fed’s taper.

We remain concerned about the reversal of liquidity as it was a crucial influence on the outsized market advance in 2020 and 2021. Such was due to the younger investing generation migrating to apps like Robinhood to substitute stock betting for sports.

Secondly, there is a direct correlation between the reversal of the Fed’s balance sheet and market corrections.

Currently, the market dynamics as we advance are less than bullish. We suspect the current rally remains an opportunity to rebalance portfolio risk and manage exposures. Historically, when “bear squeezes” are over, the sellers reemerge and drive prices lower again.

How We Are Trading It

There is no guarantee, of course, that the markets will decline again. Yes, there is a possibility that the bulls could regain control of the market and drive asset prices higher. Such would continue the bull rally that started in 2009. There are also some monetary supports for that thesis:

- Corporate buybacks remain the primary support for asset prices

- Global inflows into U.S. markets remain strong due to a lack of alternatives.

- Corporate profits, while under pressure, remain robust.

- Inflation, while high, will decline later this year, giving a boost to disinflationary trades.

However, we continue to err on the side of caution for now.

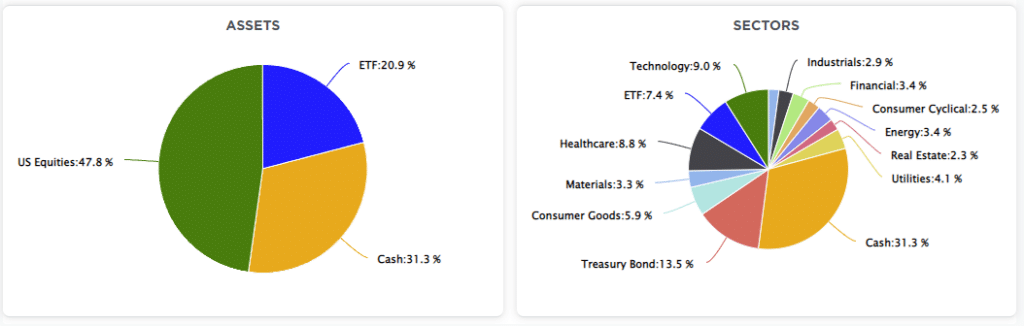

With quarter-end rapidly approaching, as noted at SimpleVisor.com, we took advantage of the rally to trim back the equity exposure that we increased a couple of weeks ago. The outsized market gain pushed our short-term indicators into more extreme overbought conditions. As such, we are entering the end of the quarter with a higher-than-normal level of cash which we are using to hedge portfolios against potential risk.

With yield curves inverting rapidly (read this past weekend’s newsletter for details) and inflation running at high levels, the risk of a recession has risen markedly. That recessionary risk is a threat making equities vulnerable to a more significant correction.

For the same reasons we are raising and holding higher levels of cash, we are adding exposure to our longer duration bond holdings. Unlike stocks, bonds are very oversold after a substantial increase in rates. Bonds will also hedge our portfolios against a decline in April should one occur.

What If You’re Wrong?

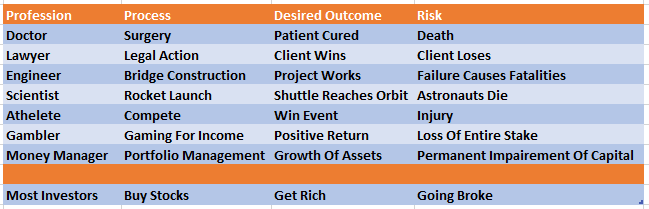

In virtually every professional field, there is “risk.”

Those who fail to focus on and recognize the inherent risk, more commonly known as “being reckless,” tend not to be around very long in any given profession. What always separates the “winners” from “losers” are those that can avoid catastrophic damage over time.

The control of “risk: is also the essence of portfolio management.

Understanding risk is essential for investors as it is a function of “loss.” The more risk taken within a portfolio, the greater the destruction of capital will be when reversions occur.

Making absolute predictions, bullish or bearish, is not only useless but inherently dangerous concerning portfolio management. All we can do is make educated “guesses” about potential outcomes based on history, statistics, trends, etc.

So, what if I’m wrong?

What if the market continues to rise and all the above risks fade away?

We invest our stored cash back into the equity markets.

It’s not complicated.

It’s just a process.

As Nobel laureate Dr. Paul Samuelson once quipped:

“Well, when events change, I change my mind. What do you do?”

As a portfolio manager, I am neither bullish nor bearish. I view the world through the lens of statistics and probabilities. My job is to manage the inherent risk to investment capital. If I protect the investment capital in the short term – the long-term capital appreciation will take care of itself.

If this is a “bear squeeze,” we will know soon enough.

Related: Bailouts And The Demise Of Capitalism And Free Markets