Written by: David Nelson, CFA CMT

Futures are pointing to a sharp decline in part reacting to reports that infection rates in some parts of the country are on the rise. Add the fact that China has reported new cases in Beijing tied to a meat and vegetable market and conditions are set for investors to reduce exposure.

This follows last week's slide triggered by Fed commentary and remarks from Chairman Powell. The good news is that the Fed is going to keep rates at zero for as far as the eye can see, and it seems willing to use any weapon in its arsenal short of negative rates to keep monetary conditions loose. The bad news is that we need it. My favorite line from the press conference: "We're not even thinking about thinking about raising rates."

Even as America goes back to work, it's pretty clear that recovery will be stair steps higher, occasionally stumbling in response to the latest news cycle. Politics aside, each state has chosen a different timetable to return to work and, of course, some industries are in a better position to take advantage of the ending lockdown. I am indeed fortunate to work in an industry where I can do my job just as well at home as I can in the office. Even the daily media interviews, whether by phone or Skype, are easy to manage in a high-speed broadband world.

Unfortunately, other Americans are not as lucky. While the construction industry might be able to employ social distancing, it's a bigger challenge for restaurants, hair salons, gyms, traditional retail and other close proximity businesses. The industrial sector seems better suited to adjust. Even here it takes lots of planning and, in the end, money to make the necessary changes to improve health conditions for employees. Any business model that results in processing fewer customers and or product during a business day has to translate into less revenue. The only way out is higher prices which can be difficult to sustain in an economic downturn.

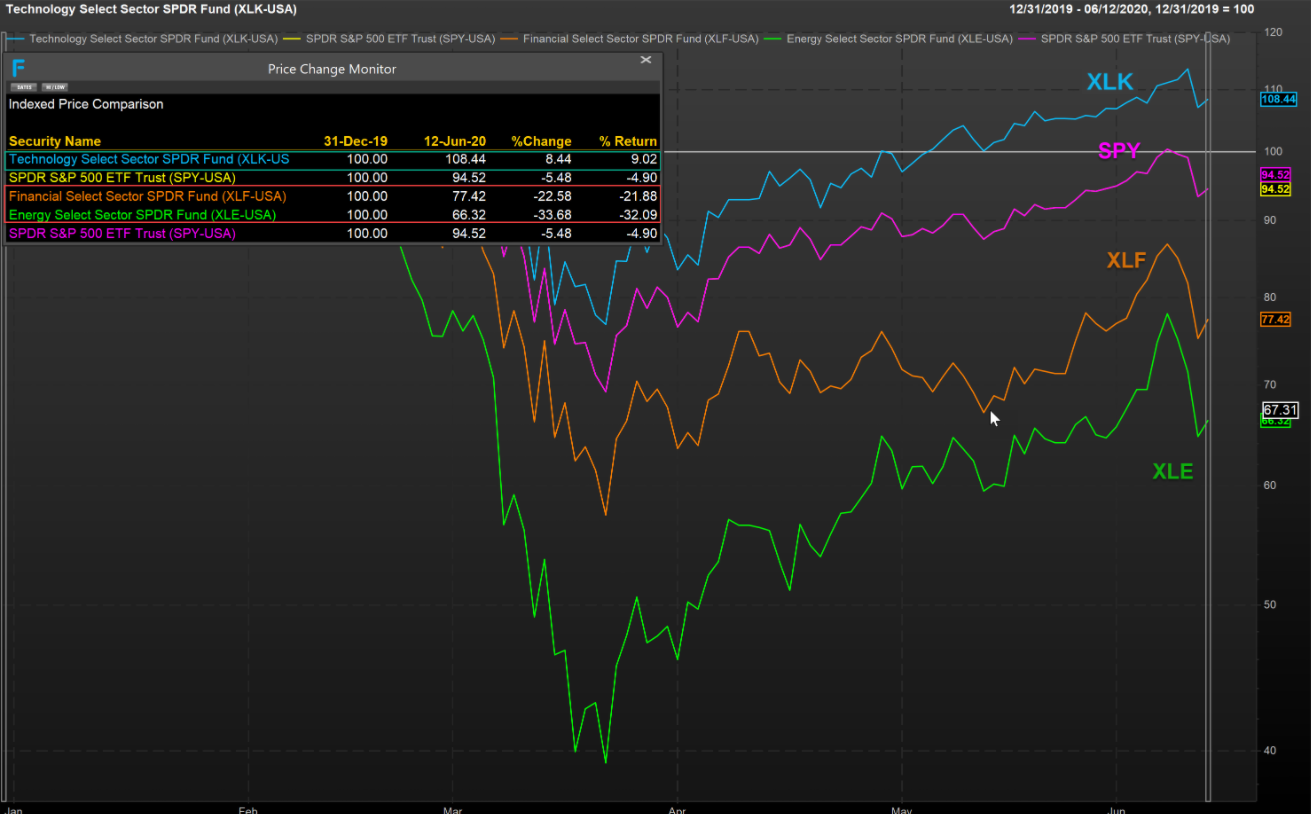

Technology (XLK) - Financials (XLF) - Energy (XLE) vs S&P 500 (SPY) YTD

In that context it's not surprising that Technology (XLX) and other related industries have done the best in 2020. Up more than 9% year to date with Financials (XLF) and Energy (XLE) down (-21%) and (-32%) respectively, investors took refuge in a sector that offers cash rich balance sheets and for some little fall off in demand for products and services.

In the last couple of weeks we've seen investors rush from one side of the lifeboat to the other hoping to jump onto a cyclical train buying up everything from banks, airlines and energy stocks to even bankrupt car rental companies like Hertz. Just when everyone has boarded the train, the engineer throws it into reverse, and you get a day like last Thursday with the cyclical trade getting hit hardest.

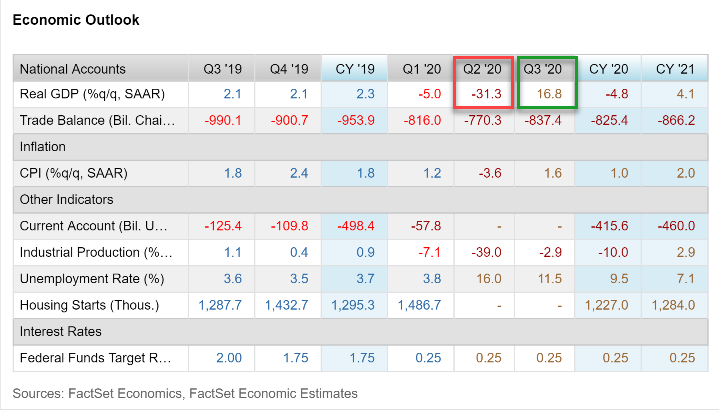

Look, it makes sense to have some exposure here despite the roller coaster ride. It's clear that April was the economic bottom. Even though projections for Q2 are for an astounding -31% GDP print, Q3 is likely to come back positively in the low teens. With the economy starting to repair and valuations in some of our favorite tech names stretched, it's natural to move down the valuation curve. There's room for both at this point in the cycle.

Biggest Concerns

Outside of the election, China and the virus, in that order, my biggest concern is in consumer discretionary and for all Americans working in close proximity businesses. The consumer is 70% of our economy. Even as the consumer comes back, we must ask if they will they choose to alter previous spending habits.

Online is no longer just a convenience. Retailers that have ignored the secular shift will find it difficult if not impossible to compete. How many Americans who figured out how to build a competitive home gym will renew their memberships as states continue the process of opening?

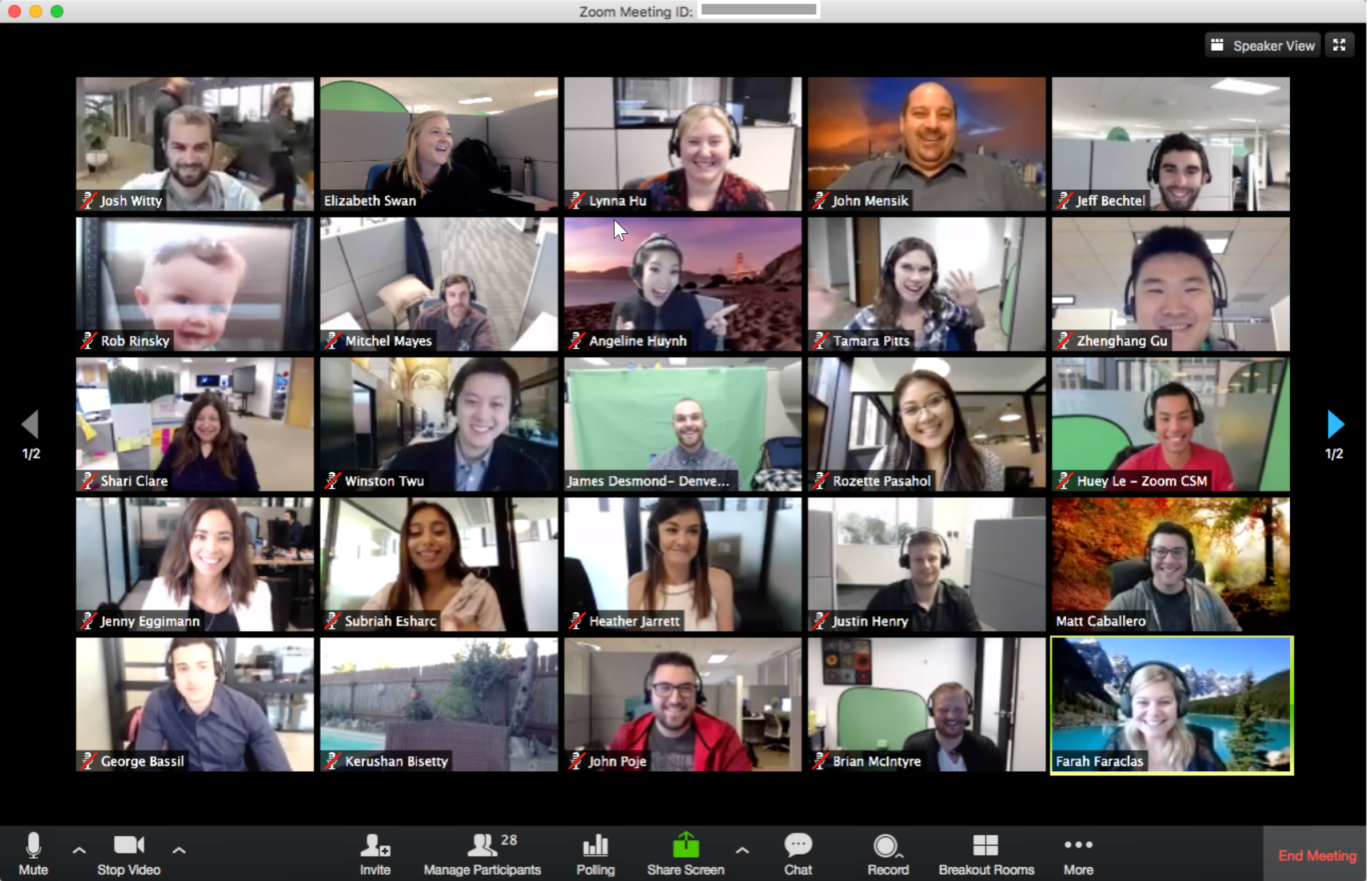

Zoom (ZM) Workplace

For the banking sector cash cows like commercial real estate could become an albatross. Banks will be forced to take larger loan loss reserves. Coast to coast non-essential businesses were forced close offices and have their workers shelter in place. Companies that could function with an at home workforce may rethink their corporate footprint. How many will choose to not renew leases or at the least downsize allowing many of their employees to continue working from home?

Almost everything in 2020 has been off the charts unpredictable. From a peak to trough bear market taking just 23 trading days to unfold to a monster move higher pushing the S&P briefly into positive territory, investors have learned to live with 1000-point swings in both directions.

Uncharted Waters

There is no road map for the journey ahead. We've never been here before. This isn't the aftermath of a recession brought about from some imbalance in the economy. A meteor in the form of a global pandemic called COVID-19 hit the earth, and the world digs out. The best we can do is navigate the news cycle using a tactical mindset and adjust to the incoming data as it unfolds. We are in uncharted waters.

Related: Rationalizing High Valuations Won’t Improve Outcomes