Written by: Len Reininger | Advisor Asset Management

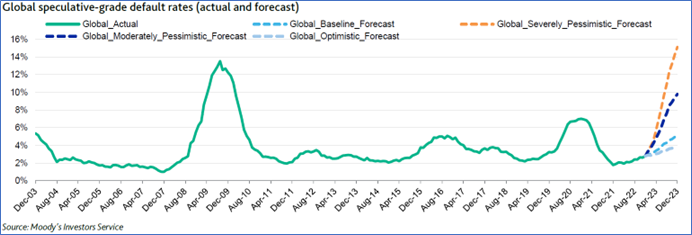

As credit quality weakens in advance of a potential recession, the market has taken comfort in the fact that following a low interest environment and benign market conditions in 2021, high yield debt maturities have been pushed out several years, easing liquidity concerns which could moderate potential growth in default rates. Supporting this view is S&P’s projected default rate of about 4% by year-end (about average), and Moody’s projected default rate of 5.1% (5.9% in the U.S.) by year-end that, while it exceeds the long-term average of 4.1%, is lower than prior spikes in the default rate.

Yet, despite the extended debt maturity schedule, S&P reports that global defaults increased 15% in 2022 with distressed exchanges accounting for nearly half of all defaults. Moody’s reports that the default tally is 64% higher in 2022 from 2021.

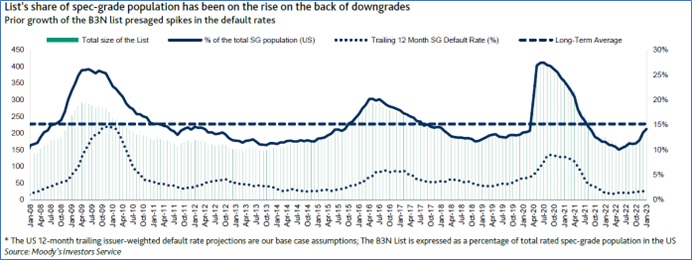

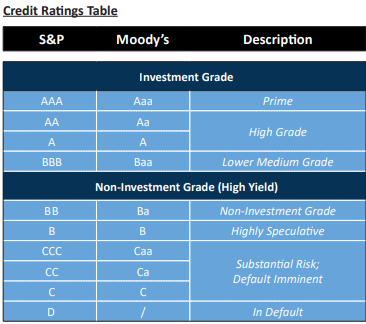

At the same time, those corporations rated in the lowest category — B3 or below (on the Moody’s rating scale) and B- or below (on the S&P rating scale), the companies most likely to default — are growing rapidly, setting the stage for more defaults in 2023. S&P reports that 'B-' rated senior secured debt increased by 13% in the fourth quarter of 2022 (4Q22), driven by ratings downgrades “reflecting continued EBITDA (earnings before interest, taxes, depreciation and amortization) margin and cash flow pressures, as higher-for-longer input costs and interest rates start to bite.” Similarly, Moody’s reports that its B3 or negative list (B3N list) jumped 23% in 4Q22 alone, from the 3rd quarter. At the end of December, the B3N List made up over 14% of the U.S. speculative-grade population, that is around 25% higher quarter-over-quarter, and 22% up year-over-year. Although the list is still just roughly half its worst reading in June 2020 (at the height of the pandemic) when it peaked at 417 (or 27.5% as the share of spec-grade population), it should, according to Moody’s, continue to grow in the months ahead which will set the stage for an accelerating default rate. With a vast majority of distressed debt issuers in the Caa2 and lower-rated space having a loan-only structure (no bonds) and a PE (private-equity) backer, more distressed exchange-related defaults are expected in 2023 that are not captured by the benign debt maturity schedule.

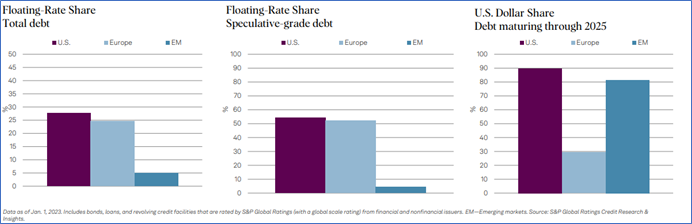

The share of distressed debt issuers with the probability of default ratings of Caa2 jumped 44% from 3Q22 to 4Q22, increasing the number of those issuers with a heavier reliance on floating rate debt and leveraged loans. Other forms of liquidity are essentially closed to these issuers.

While non-financial corporate refinancing demands for 2023 appear largely manageable — as 80% of the $994 billion maturing is investment grade — the growing proportion of the weakest credit rating, which are financed by a high concentration of floating-rate debt, are feeling the pinch of rising interest rates sooner than those issuers funded with a higher concentration of fixed-rate debt. These have the potential of experiencing a default, whether it be a payment or technical default, much sooner than the benign debt maturity schedule implies.

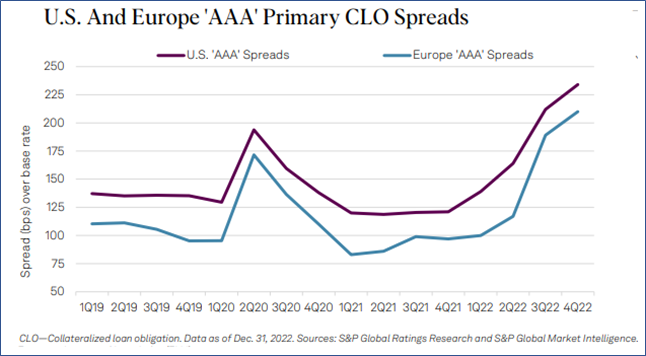

Another concerning factor relating to an increase in the default rate in 2023 is the heavy reliance by the weakest issuers on leveraged loans supported by collateralized loan obligations (CLO). This is an important source of liquidity for these issuers and more than 70% of the defaulted debt in 2022 was on leveraged loans restructured outside of bankruptcy court, according to Moody’s. The CLO market now appears to be tightening as well. CLO issuance fell further behind last year’s pace in the 4th quarter, with U.S. and European issuance down 31% and 39% respectively in 2022. This follows record U.S. volume in 2021 which supported the liquidity of these weakest issuers. As the CLO market tightens, evidenced by slowing CLO issuance, so does low rated and unrated corporate liquidity. CLO 'AAA' spreads remain well above pandemic levels from 2020, reflecting tightening financing conditions, risk-off tone in the broader market, and technical pressure. Widening CLO ‘AAA’ spreads are symptomatic of weak investor demand amid an uncertain path for rates and economic growth. In summary, the slowdown in the CLO market is a headwind for leveraged loan issuance and will likely put additional strain on the weakest credits, data not captured by the benign debt maturity schedule in 2023.

It is noted that the proportion of 'B-' assets in broadly syndicated loan CLO portfolios is now at more than 30%, up from less than 13% at the end of 2017, and any downgrades to these ratings would, by definition, land these companies in the 'CCC' range (or worse).

Moody’s believes that companies with a PE backing are much more likely to default or experience financial stress than those not relying on such backing. In the U.S., the share of PE-owned companies with weakest liquidity (rated B3 or B- and below) is more than double that of companies without PE-sponsor, according to Moody’s. These companies could find it especially harder to address their upcoming maturities, raise cash for other business needs as market access remains tight and volatility is high. In 4Q22, 90% of defaults were distressed exchanges and 60% of companies that completed these out-of-court debt restructurings were owned by private equity. In the U.S., according to Moody’s, the share of PE-owned companies with weakest liquidity is more than double that of companies without PE-sponsor. These companies potentially could find it especially hard to address their upcoming maturities or raise cash for other business needs due to the aforementioned tightness and volatility of the market for these issuers. Six PE-backed companies defaulted on their loan obligations during the quarter, accounting for 71% of the $4.4 billion in defaulted loans for the quarter.

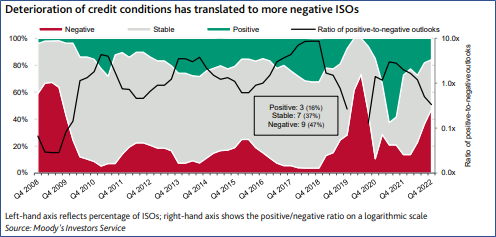

Finally, in what Moody’s considers a warning sign for growing default rates in 2023, industry sector outlooks have turned decidedly negative. Moody’s continues to see weakened outlook for most global corporate sectors with no new positive outlooks since the 2nd quarter of 2022. Moody’s sees inflation, higher interest rates, disrupted capital markets and multiple geopolitical concerns — especially Russia's ongoing invasion of Ukraine — as negatively impacting most global corporate sectors. Currently, of the 19 sectors that Moody’s recognizes, nine have negative outlooks, seven have stable outlooks and only three have positive outlooks (Aerospace/Defense, Airlines, and Hospitality with the negative outlook trend accelerating in the 2nd half of 2022. Per Moody’s, “After more than a decade of benign credit conditions, with low interest rates and abundant liquidity, the credit cycle has quickly turned and risks are rising across the credit spectrum, with defaults likely to accelerate and liquidity to remain scarce.” The rating agency goes on to state that the clearly negative signal of negative industry sector outlooks brought on by a rapid shift in the credit cycle, indicate rising company defaults, recessions in many economies, and negative 2023 outlooks for many regions and non-corporate sectors. Just as nearly all measures of business and financial conditions seem to be deteriorating, Moody’s industrial sector outlooks changes have been generally downward reflecting, per Moody’s, a sign of increasing defaults.

Related: Fed Chair Powell ‘Disinflationary Process’ Comment Launches ‘Year of Opportunity’