Written by: Thomas Van Spankeren, CFA, CFP® | RISE Investments

- Several types of financial advisory fee structures exist, with a percentage of your assets that the financial advisor manages for you, known as an Assets Under Management (“AUM”) fee, being most popular

- Surveys are helpful to pinpoint what a market rate AUM fee is by portfolio size

- Awareness of the AUM fee you are being charged by your financial advisor is an important step in building long term wealth

Financial Advisory Fees: What You Need to Know

Financial advisory fees come in various forms. For instance, certain financial advisors may charge a flat fee for service, such as a one-time fee for a financial plan. Additionally, while antiquated and less prevalent, certain financial advisors charge commissions on trades for their fee structure.

However, the most popular fee structure is an annual percentage of AUM. In this structure, the financial advisor has a vested interest in how well your investments are performing. Typically, AUM fee percentage breakpoints are determined based on the size of your investment portfolio. The larger your investment portfolio is, the lower the AUM fee percentage.

What AUM Fees Do Clients Typically Pay Financial Advisors?

There are several factors that determine the AUM fee percentage a client pays, such as the scope of services the client is receiving from the financial advisor. For instance, a client may be receiving estate and or financial planning in addition to investment management services. Alternatively, a client may just be receiving investment management services.

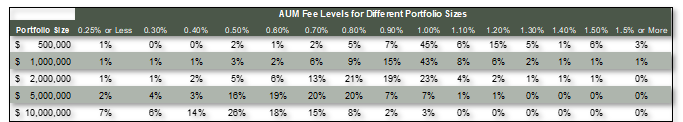

The chart below references the 2024 Inside Information Fee Survey by Bob Veres, which sampled 941 financial advisors. The surveyor asked the financial advisors what percentage of AUM fee they typically charge for client portfolios of various sizes.

*AUM fee levels are shown in white text and the percentage of surveyed financial advisors that charge each AUM fee for the corresponding portfolio size are show in black text.

For example, the most common AUM fee charged for a client with a $2 million portfolio is between 0.7% and 1.0%. Less than 10% of financial advisors would charge the same client an AUM fee above 1.0%.

How Do High AUM Fees Affect Client’s Long-Term Wealth?

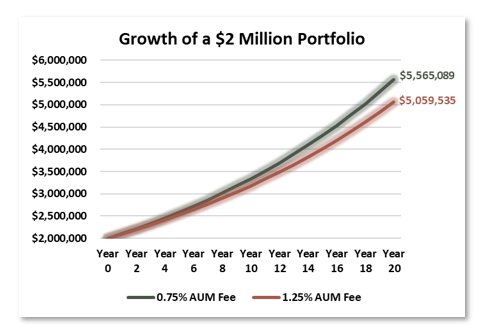

While the difference between paying an AUM fee of 0.75% and 1.25% may not seem meaningful today, paying too high of an AUM fee over many years can be destructive to building long-term wealth.

Consider a 60-year-old couple with a $2 million portfolio consisting of 60% equities and 40% fixed income which we assume generates a 6% annualized return before AUM fees. After 20 years of staying invested with the same asset mix and paying a 0.75% AUM fee to their financial advisor, the ending wealth of the couple would reach over $5.5 million.

Conversely, if the couple had been paying a 1.25% AUM fee, their ending wealth would be over $500,000 lower.

Conclusion

While AUM fees may seem small, over time they can have a major impact on the growth of your wealth over the long-term. Being informed about what is typical in the industry and evaluating whether your financial advisor’s AUM fees align with the value you receive is an important step in managing your financial future.

Related: Health Savings Accounts Unlocking Tax-Free Growth

Disclosure

RISE Investment Management, LLC ("RISE" or "RISE Investments") is an investment adviser registered under the Investment Advisers Act of 1940. Registration of an investment adviser does not imply any level of skill or training. This publication is solely for informational purposes and past performance is not indicative of future results. Securities investments are subject to risk and may lose value. Any historical returns, expected returns, or projections are provided for informational purposes only. Any description of products, services, and performance results of RISE contained in this publication are not an offering or a solicitation of any kind. No advice may be rendered by RISE Investments unless a client service agreement is in place. Advisory services are only offered to clients or prospective clients where RISE Investments and its representatives are properly licensed or exempt from licensure. All of the information in this publication is believed to be accurate and correct as the date set forth. RISE does not have or accept responsibility or an obligation to update such information.