Written by: Alisa Maute, CIMA®, CAIA® | WisdomTree

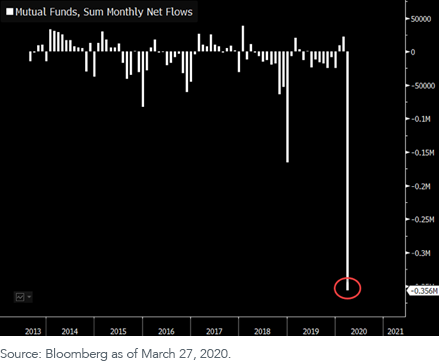

We just finished one of the most volatile months in the market on record, and the movement from mutual funds to ETFs is something to behold.

Mutual funds had $356 billion in outflows year-to-date through March 27, and all the outflows came in March. ETFs, by comparison, experienced approximately $55 billion of positive flow in the U.S. during the same period.

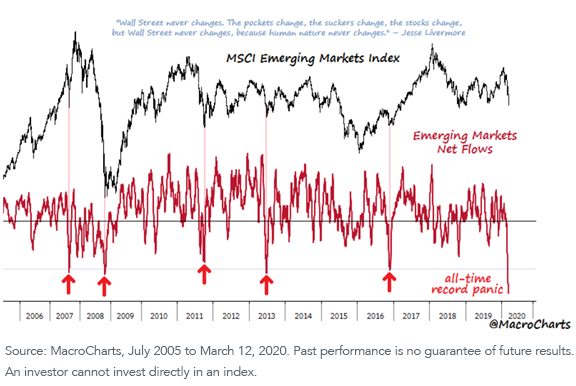

While outflows spanned asset classes and sectors, the chart below illustrates how emerging markets flows indicated all-time record panic levels—and that these past panic points were good buying opportunities.

For definitions of indexes in the chart, please visit our glossary.

Investors often utilize the market falls to clean up portfolios and move toward the more tax-efficient, transparent1, liquid and lower-cost2 wrapper: the ETF.

But it’s not just the ETF wrapper attracting investors.

The SPIVA Scorecard, produced by Standard & Poor’s, shows how active mutual fund managers perform versus passive index funds. The 2019 scorecard was just released, and there are interesting long-term findings to consider in the emerging markets space.

Less than 10% of active emerging markets (EM) equity managers outperformed their cap-weighted benchmarks during the 15-year period ended 2019. That period captures a full market cycle and includes the global financial crisis.

Did years of volatility like 2008 and 2009 give active EM managers more opportunity to navigate crisis points and add value?

No.

Less than 35% of EM funds outperformed their cap-weighted benchmark in 2008, and less than 30% of EM funds outperformed their cap-weighted benchmark during the rebound in 2009. Those are extremely low numbers—especially since the median expense ratio for active managers in the emerging markets category is 1.25%.3

WisdomTree’s Modern Alpha® Approach

ETFs are no longer just used to track traditional benchmarks. WisdomTree’s unique Modern Alpha approach incorporates a disciplined investment strategy to seek to add value versus traditional beta-oriented instruments.

We believe that by marrying our value-added approach to index construction with the benefits of the ETF structure, we have the potential to deliver a better investing experience.

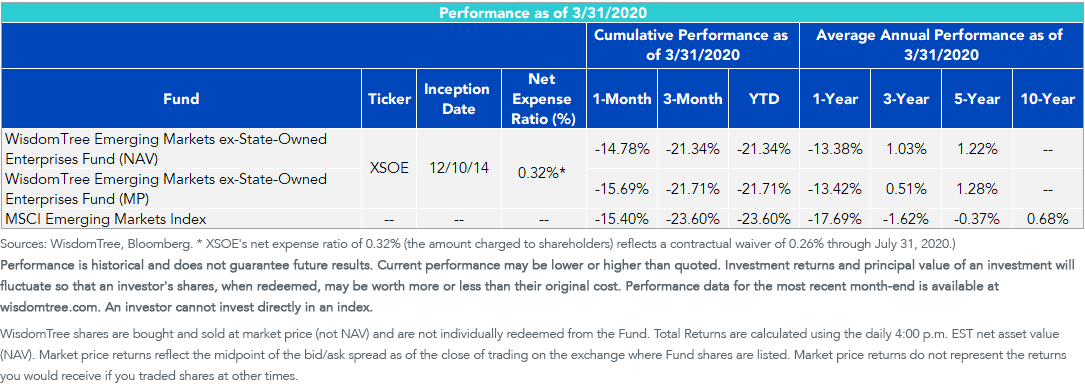

In emerging markets, the WisdomTree Emerging Markets ex-State-Owned Enterprises Fund (XSOE) has been a standout.

One of the most important risks in emerging markets is the involvement of the government in company direction through a significant ownership stake. Companies do not always act in the best interest of their shareholders when the government is involved. Think about it: Would you rather own UPS (a for-profit public company) or the United States Postal Service (a government-run entity) ? UPS as a public company is focused on maximizing shareholder value; the United States Postal Service is teetering on the edge of insolvency, according to Postmaster General Megan Brennan . We believe the same applies in emerging markets.4

Removing state-owned enterprises from our universe has resulted in:

- A core emerging markets fund tilted to growth and quality exposures

- Potential for outperformance: XSOE has provided attractive relative returns over the five years since inception

- During the recent drawdown, XSOE outperforming the MSCI Emerging Markets Index by 226 basis points in Q1 2020

Given the underperformance of active managers in the emerging markets space, it helps to ask: Why pay more for active management that hasn’t been outperforming?

1 Holdings are displayed daily on the website.

2 Ordinary brokerage commissions apply.

3 Source: Morningstar average expense ratio data, as of 12/31/19.

4 Charles Lane, “A disaster brewed for years in the Postal Service,” The Washington Post, 4/13/20.

Related: Equities Are on Sale but Alternatives May Be Preferable