It starts with understanding how market cycles work

What is a stock bear market? Ask a typical investor, professional or otherwise, and impulse might be to say it’s when stock prices go down. Or, if you use the TV pundit definition, it would be when the market falls by 20% from its peak.

Both of these are just “sound bites” about a bear market. As a serious investor, bear markets need to be understood, no matter how long-term your thinking is.

To me, a bear market is a period of time, usually measured in years, not weeks. During that period, the stock market goes up, and it goes down. What distinguishes a bear market from a bull market is what the net result is of all of those price gyrations. In a bear market, it boils down to a lot of up and down, a lot of volatility, and it leads to no net gain. Not over a few weeks or even a few months. It occurs over years.

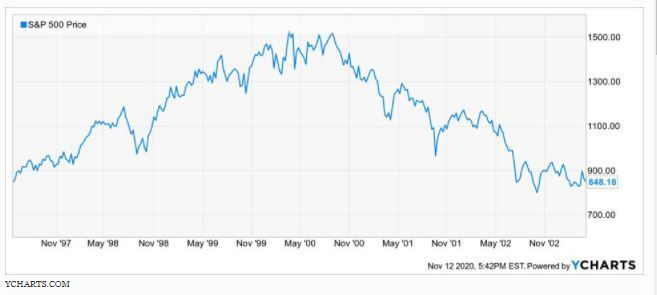

Bear market cycle, circa 2000

Here is a picture of a classic “bear market cycle” as I see it. It’s affectionately known in investment circles as the “Dot-Com Bubble.” This is a graph of the S&P 500 Index from May 30, 1997 to March 31, 2003. That’s about 6 years. The S&P 500’s net return during that time. Zero. THAT’s a bear market cycle.

Note that the first few years of that period saw strong gains in the stock market. However, this was the late-in-the-cycle, speculative period of what had been a more reasonable period of stock market appreciation in the years prior. But as time went on, 1998 and 1999 increasingly saw a small number of giant Nasdaq NDAQ +1.9%-listed stocks dominate the market. They essentially took over the S&P 500, with their weighting in that index peaking at over 1/3 of the index’s total weighting.

Then, reality and gravity set in, as they always do, eventually. The down side of the mountain took shape. When it was done, the S&P 500 had been cut just about in half.

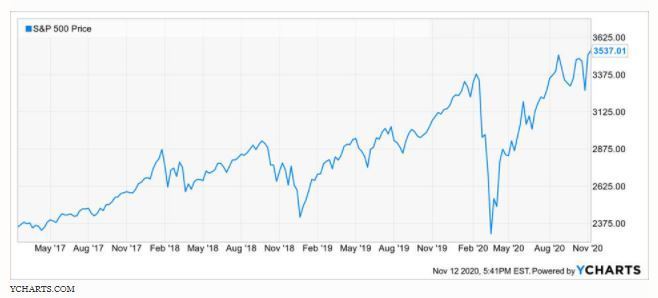

2020 and the bear market cycle (or not)

Now, fast-forward to today. Here is what the S&P 500 looks like now. The past few years have been straight up, except for a 3-week, 15% plunge in late 2018, and a 5-week, 33% Covid-induced drop in February and March of this year.

Frankly, in the context of the longer-term market cycle, the Covid drop earlier this year is not very relevant. The recovery from that news-bomb was so fast, it can’t really be considered a bear market.

And if you block out that lightning-fast 5-week period from the graph, it does look a lot like the Dot-Com Bubble building period, from 1997-2000. The similarities are many, not the least of which is the severe narrowing of market “breadth.” That is, once again, a small number of Nasdaq stocks are carrying most of the S&P 500’s performance. This has been the case since nearly 3 years ago, just like in the late 1990s.

I think it’s quite possible that we will look back on 2020 as a time when the market peaked as Covid took over the U.S.’s attention, and the recent all-time highs were more of an after-burner than some new bull cycle.

Perspective, for bears and bulls alike

Frankly, it doesn’t matter what I think. What matters is that you avail yourself of the possibilities beyond the over-simplified stuff you hear and see thrown at investors at times like this. A little perspective goes a long way.

What remains to be seen is whether it becomes a bear like the Dot-Com Bubble did, or if it ends up in the category of the 1987 Crash. In that latter case, the market fell 23% in one day, over 30% within a few months, but recovered fast. Then, the S&P 500 picked back up like nothing happened.

All of that history aside, the key point is to be aware that a “bear market” is a process, not an event. And, in the case of the current investment environment, the jury is still out on what we are going through right now.

So, keep your eyes on the bigger trend, and recognize that the potential exists for a much longer period of “net-zero” before this cycle is finished. And, with that as a real possibility, it makes sense to get more familiar with things like portfolio hedging techniques and tactical investing. Because by the time history labels a true end to a bear cycle, it is way too late for you to do anything about it.

Related: How To Cut Your 2020 Capital Gains Taxes With Just A Few Moves