Written by: Raina Oberoi, Abhishek Gupta and Jean-Maurice Ladure | MSCI

- Factor and sector indexes demonstrated differentiated performance compared to their parent indexes over different parts of the business cycle including the current COVID-19-related market downturn.

- Regardless of whether investors include a tactical approach or invest strategically for the long term, diversifying across factors, sectors and geographies has historically played an important role in portfolio construction.

- A well-diversified global equity index was historically less volatile and would have avoided the worst drawdowns compared to some purely domestic markets during bear markets.

The global contagion of coronavirus is causing a widespread slowdown in economic activity and significant depletion of investor wealth. Global stocks, represented by the MSCI ACWI Index and the developed markets, represented by the MSCI World Index, were down 16.3% and 15.8%, respectively, through April 10, 2020. While many investors are heavily focused on how to position their portfolios in the current environment, some are also looking beyond the current market turmoil.

Regardless of whether investors fully embrace strategic long-term investment or include a tactical approach, diversifying across factors, sectors and geographies has been shown to play a role in countering the cyclical nature of individual allocations.

Cyclicality in factors and sectors

Even as global equity markets in aggregate have fallen, the performance of different segments has varied. For instance, factor and sector indexes have demonstrated differentiated performance compared to their parent indexes. Prior MSCI research has found that, historically, factors and sectors have displayed quite distinct performance over different parts of the business cycle.1

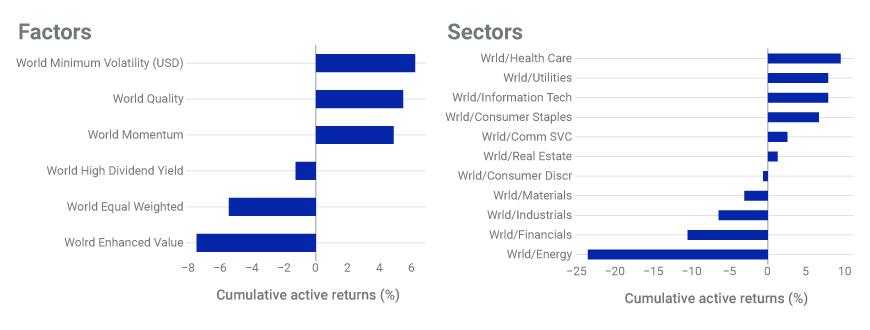

In the recent market downturn, defensive factor indexes such as the MSCI Minimum Volatility Index and the MSCI Quality Index, as well as the more persistent MSCI Momentum Indexes outperformed whereas the MSCI Equal Weighted Index (that reflects the historical smaller stock premium) and the MSCI Enhanced Value Index underperformed. Among sectors, the defensive baskets such as health care, utilities and consumer staples outperformed whereas energy, financials and industrials underperformed. Surprisingly, information technology, typically considered a cyclical sector, has outperformed, which is inconsistent with historical trends.

Factor- and sector-index performance YTD

Active returns for the MSCI World Factor and MSCI World Sector Indexes from Dec. 31, 2019 to April 10, 2020.

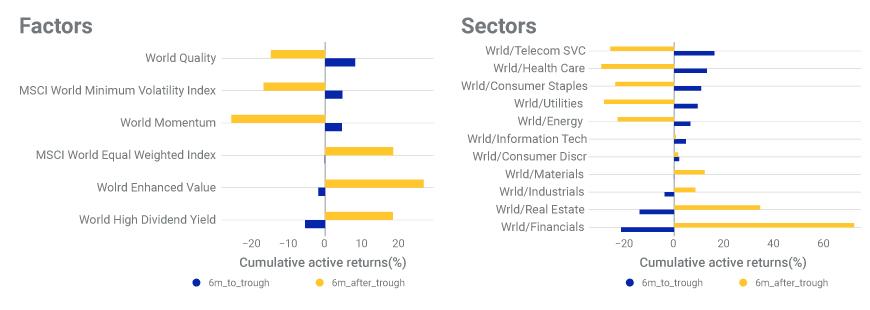

What if the coronavirus abated and volatility dropped? We take a cue from the 2008 global financial crisis (GFC). We find that a similar set of factors and sectors outperformed during the GFC, but that their fortunes reversed as the market rebounded in March 2009.

Factor- and sector-index performance during and immediately after the GFC trough

Following the GFC, the MSCI World Index bottomed on March 9, 2009. Active returns for the MSCI World Factor and MSCI World Sector Indexes are reported for a period of six months prior to and post the rebound.

Diversification approaches

Selecting factors and sectors can be challenging and calling inflection points in the market is a rare skill. Instead, many investors may choose to diversify across factors or sectors. Some may choose to complement this approach with high-conviction bets.

First, we discuss diversification among factors within a strategic allocation framework. The MSCI Diversified Factor Mix Index equally weights six single-factor indexes in a top-down construct whereas the MSCI Diversified Multiple-Factor Low Volatility Index targets five factors in a bottom-up stock-selection approach.2 These two multi-factor indexes represent two different approaches to diversifying across factors. Funds that aim to replicate these indexes often seek to obtain long-term risk premia and smoother returns. Such diversification historically has been helpful during turbulent market conditions.

Relative performance across factors

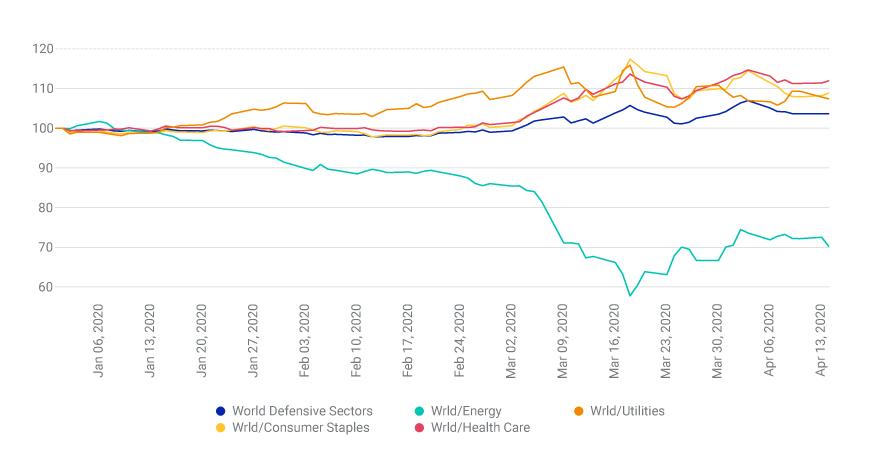

Second, we analyze diversification among sectors within a tactical framework. Unlike a combination of all factors, combining all 11 of the Global Industry Classification Standard (GICS®)3 sectors could provide market-like exposure; hence diversifying across a subset of sectors could be considered more opportunistic and tactical. In the current coronavirus-related market downturn, defensive sectors such as consumer staples, utilities and health care outperformed, while energy significantly underperformed, partly as a result of the oil price war between Russia and Saudi Arabia. Note: The energy sector outperformed like other defensive sectors in the run-up to the GFC (shown earlier). Diversifying among sectors in this basket could have reduced the idiosyncratic effect of individual sectors.

Defensive sectors’ relative performance

Attacking the home bias

The final piece of the puzzle involves diversifying across geographies, for which we look to the full investment universe using the MSCI ACWI Index, which contains no home bias, and compare it to respective domestic investments for American, Japanese, Canadian, Australian, British or European investors (using the 10 countries in the European Economic and Monetary Union.)4

Looking at volatility over the last 30-plus years, we see in the exhibit below that an index diversified across geographies (including emerging markets, which displayed a volatility of 21% over the same period) was less volatile than each of the domestic indexes in our analysis, except for the Australia index.

Historical volatility since 1987

Attacking the home bias

The final piece of the puzzle involves diversifying across geographies, for which we look to the full investment universe using the MSCI ACWI Index, which contains no home bias, and compare it to respective domestic investments for American, Japanese, Canadian, Australian, British or European investors (using the 10 countries in the European Economic and Monetary Union.)4

Looking at volatility over the last 30-plus years, we see in the exhibit below that an index diversified across geographies (including emerging markets, which displayed a volatility of 21% over the same period) was less volatile than each of the domestic indexes in our analysis, except for the Australia index.

Historical volatility since 1987

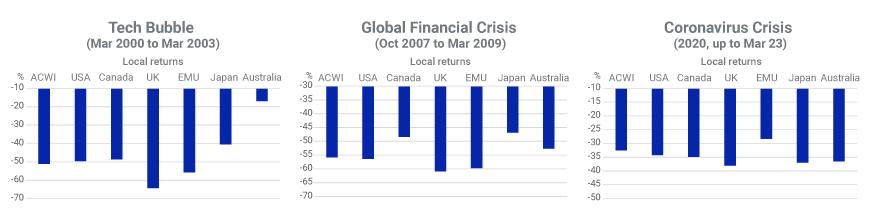

Another way of analyzing downside risk is realized maximum drawdown. The exhibit below looks at maximum drawdowns during the three major market downturns of the last 20 years – the bursting of the tech bubble, the GFC and the current crisis. Investing in a fund that replicated a global index during those three periods of bear markets would have avoided the worst drawdowns we saw in some that replicated purely domestic indexes.

Drawdowns during three market crises

While no one knows how long the current market crisis will continue, or which direction it will take, based on our analysis, diversifying across factors, sectors and geography has historically, as well as during the current crisis, played a role in countering the cyclical nature of individual allocations.

1Gupta, A., Kassam, A., Suryanarayanan, R., and Varga, K. 2014. “Index performance in changing economic environments.” MSCI Research Insight.

2The MSCI Diversified Factor Mix Index equally weights MSCI Enhanced Value Index, MSCI Momentum Index, MSCI Quality Index, MSCI Minimum Volatility Index, MSCI Equal Weighted Index and MSCI High Dividend Yield Index. The MSCI Diversified Multiple-Factor Low Volatility Index targets value, momentum, quality, low volatility and size factors; the yield factor was excluded as it exhibited higher historical active correlation with value and quality.

3GICS, the global industry classification standard jointly developed by MSCI and Standard & Poor’s.

4Austria, Belgium, Finland, France, Germany, Ireland, Italy, the Netherlands, Portugal and Spain.

Related: The Six Deadly Sins of Institutional Money Management