In a final perspective around women and technology and finance, I welcome the thoughts of Ron Shevlin, the snark himself. In a recent article on Forbes, Ron wrote about what women want from banking. The research his company Cornerstone produced some interesting results. Enjoy …

The Four Things Women Want (From Financial Services)

There are two sides of the coin regarding the state of women and financial services. On one hand, women now:

- Control two-thirds of consumer spending;

- Hold 40% of total global wealth;

- Account for 40% of entrepreneurs world-wide; and

- Are the main breadwinner in 49% of US households.

On the other hand, however, women:

- Have 30% to 40% lower retirement account balances than men;

- Are 30% less likely to have sufficient access to funding for their entrepreneurial efforts;

- Are eight times more likely than men to look after sick children which impacts their work day or other daily responsibilities; and

- Are more likely than men to switch to a job with greater work-from-home flexibility—which can result in lower pay—after becoming a parent.

There’s no shortage of statistics that depict the challenges or shortcomings that women face in managing their financial lives.

The key question to address, however is: What should financial services providers do to improve the delivery of services to women?

To help answer that question, Cornerstone Advisors surveyed US consumers to understand how consumers manage their finances, and to identify their perceptions, attitudes, and beliefs about financial management and financial providers.

How Women’s Financial Lives Differ From Men’s

The study—which was commissioned by Acxiom and conducted a month before the Covid crisis—discovered gender differences regarding:

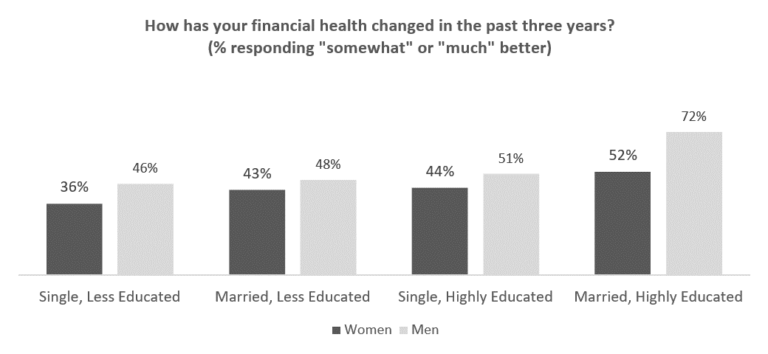

- Financial health and performance. Fewer women said their financial health had improved from three years ago. Compared to men, fewer women said they’re earning higher returns on their investments, have a higher credit score, and are paying less in checking account fees than they did three years ago.

- Financial behaviors. Women rely on fewer sources of help managing their financial lives than men do, and rate the sources they use as less helpful than men do. One reason why women use fewer sources of help is that they aren’t comfortable discussing their financial lives with various types of financial providers.

- Financial confidence and literacy. Overall, few members of either gender are highly confident that they make good financial decisions—with fewer women confident than men. Women’s perceptions that they aren’t very financially literate may help to explain this confidence gap.

SOURCE: ACXIOM/CORNERSTONE ADVISORS

Tactics That Won’t Work

Simply creating or improving “marketing to women” efforts won’t do the trick.

According to Desiree Dosch, Chief Marketing Officer at SmartPurse and former Head of Women Segment at UBS Global Wealth Management:

“It’s dangerous to market to women as a group—the diversity of women is broader than it is among men.”

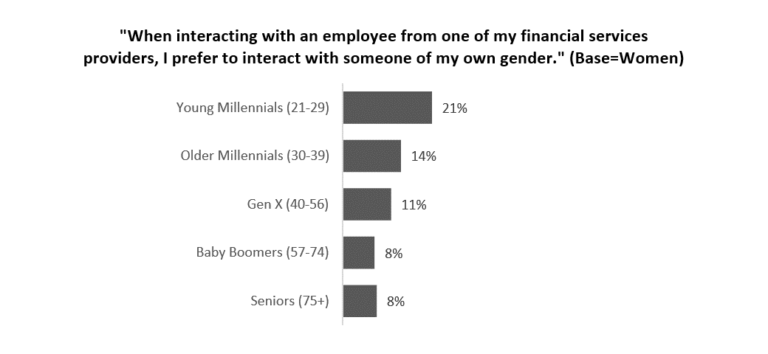

Putting more women on the front-lines of support and delivery may not be the answer, either. According to the Acxiom study, just 12% of women would prefer to interact with an employee of a financial services provider of the same gender.

SOURCE: ACXIOM/CORNERSTONE ADVISORS

Four Things Women Want From Financial Services

Correcting the gender gaps requires creating and improving customer experiences that help women achieve:

1) More confidence. Improving financial confidence—versus financial literacy—is important because, according to a study from the Social Research and Demonstration Corporation of Canada, financial confidence is a better predictor than financial knowledge when it comes to outcomes associated with day-to-day money and debt management.

2) More convenience. Women’s low ratings on the level of convenience delivered by their primary providers suggests that there’s more that banks could be doing. According to Kathryn Petralia, CEO of Kabbage:

“Successful products embraced by working women—such as grocery delivery services, meal-kit subscriptions, and dog-walking apps—save users time.”

Banks need to create tools that help women control their finances—and their time—from where ever they are.

3) Better communication. Many women aren’t very comfortable discussing their finances with others. Some demonstrate some non-intuitive communication patterns altogether. According to a female executive at a wealth management firm interviewed for the study:

“Older women tend to get their financial advice from their oldest son, even if their daughter is an accountant. They rely more on their daughters for healthcare advice even if their son is a doctor.”

Blogs may be one way of engaging women and overcoming the communication gap. Verity Credit Union, for example, created a “mommy blog” and hired a Mom to blog, tweet, and be the face of Verity to women in the 25 to 45 year-old age range.

A word of caution, however, from Julie Kustoff, Principal Consultant at Acxiom:

“Written content from financial institutions can sound like ‘mansplaining’.”

Podcasts don’t suffer from that problem. A study from Edison Research found that the percentage of women who listen to podcasts grew by 50% between 2017 and 2019. In addition, women spent 20% more hours per week listening to podcasts in 2018 than they did in 2017.

4) Better collaboration. There’s a disconnect between married couples regarding the management of their financial lives. Among highly-educated, married women, 40% say they split financial management responsibilities with their significant other. Then 40% of men should be saying they split responsibilities, right? They don’t—the actual percentage is only half of that.

In a survey of Millennial couples, fintech firm Honeyfi found that couples who have specific goals and consistently save for them are happier, fight less, and feel more secure. According to Honeyfi CEO Ramy Serageldin:

“Even when married couples split responsibilities for managing their finances, they often take on separate tasks—and one person often doesn’t know what the other is or isn’t doing.”

A collaboration platform that aggregates accounts and provides a capability for messaging can help address this challenge.

For a copy of the study Improving Financial Services For Women, click here.

Related: FinTech Can’t Tackle Financial Services Without Tackling Its Diversity Problem