At What Age Should You Catch Them?

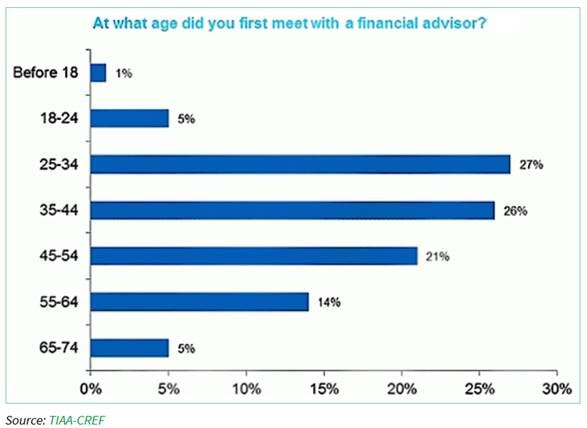

A recent Horsesmouth Chart Talk feature, “Prospecting the Younger Investor,” reported that about 60% of affluent investors met with their first financial advisor before the age of 45. Here’s that chart again, showing that about 33% of people in the group have already met with an FA before they are 35. Many, if not most, FAs (and in fact the entire industry) have increased their focus on millennials, not least because it is known that 98% of children will move inherited money to a new financial advisor.

Figure 1: Get to Know That Millennial Before Another FA Does

To me, it’s apparent that FAs need to establish relationships with millennials before they reach the age of 35.

Although many wealthy clients want to leave an inheritance to their children, only 25% strongly agree that their children are prepared to inherit the family fortune. In addition, while most wealthy clients say their family would benefit from establishing a set of principles to guide the purpose of their wealth, only 10% have done so. I suggest these are good talking points for discussion with your wealthy clients. I also suggest putting a plan in place today to develop relationships with the adult children of your best clients.

Do Millennial Assets Make It Worthwhile?

During an exchange about these statistics with one advisor, he asked if I knew the level of assets in the millennial marketplace. The question got me thinking about the broader issue of how and why to approach millennials.

The question suggests concern about whether or not the millennial marketplace has enough assets to warrant the effort. In the case of this successful FA, it was not a concern, because he meets with prospects where they are regardless of their assets and has “always maintained that the interest of the client must come first.” Nevertheless, it’s a consideration in most cases. It’s a good and important question as part of a strategy that considers a number of factors, such as wealth and age of parents, age and occupation of children, where they went or are going to school, their family situation, their interests, the interest of their parents to have you work with their children, the number of and relationship with their children and so on.

Figure 2, below, shows AUM by age group. As you may already have guessed, it is not likely that millennials generally have enough wealth to warrant marketing to them as a specialty for practices with sizable AUM. Even with smaller practices, most millennials will not have enough assets to warrant a special focus on this group. Rather, your contact with the millennial group is about developing a multigenerational practice as a longer-term plan to retain the assets of your HNW clients—and in certain cases, the assets of your competitors’ HNW clients.

Your Millennial Service Strategy

I don’t think a millennial strategy should take an inordinate amount of time. You would have to strike a balance between time spent and potential for asset retention or growth based on your particular clients.

First of all, a millennial strategy would primarily address only a subset of your clients, e.g., the top 20% of your clients that provide 80% of your revenue and assets. I am thinking of clients who have or will have, perhaps $2 million to $3 million or more and who have three or fewer adult children. I should also note that the FA must have the agreement of the parents to engage in a relationship with their adult children.

You would have “regular contact” with adult children of HNW clients, but there would not likely be extensive meetings (unless the millennial becomes an independent client). For non-client millennials who are children of clients, you may want to speak with them several times a year and meet periodically, depending on the millennial. Included in the strategy would be educational events, among many other events, and emails of pertinent articles and research and even your experience in educational, personal and career development if appropriate.

If the millennial becomes a client, they will be offered your core set of deliverables, including, but not limited to, financial planning, liability, estate and risk planning as appropriate, and so on. Once they become clients, scheduled meetings will in part be a function of their asset level and that of their parents, assuming they are also clients.

Who are the Millennial Investors?

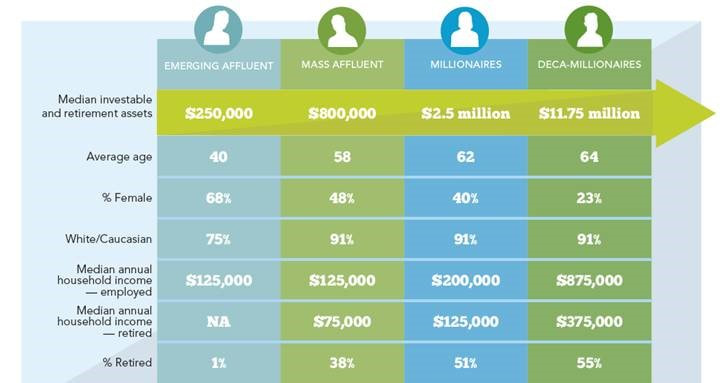

Let’s learn a little more about millennials as potential investors. Fidelity shares a wealth of relevant data on millennial wealth in “Exploring Wealth Potential Across the Spectrum of Investors: Findings from the 2014 Fidelity ® Millionaire Outlook Study.” Here’s an interesting chart that gives an overview of the wealthy demographic:

Figure 2: Who Are the Affluent?

Source: Fidelity

The study remarks that “the emerging affluent may soon be seeking advice, because the majority (90%) who don’t use an advisor feel they aren’t knowledgeable enough about investments to make decisions on their own.” Most millennials are likely to be in the “emerging affluent” class at best, unless their parents are ultra-high-net-worth ($30 million plus) and you have found a trust fund baby or Silicon Valley entrepreneur.

In another study, “Wealth gap calculator: Are you in the millennial one percent?” authors Rob Wile and Fusion Interactive state that it “takes an income of about $106,500 a year to be in the millennial one percent, according to data from the U.S. Census Bureau’s Current Population Survey. That’s a group of about 720,000 young adults.” As an advisor, the salary or potential income of the millennial may be another criterion used to determine whether or not you will want to work with this person. The same article notes that “a salary of about $60,000, the typical starting rate for a computer science or engineering major, would put a recent undergrad in the top 10% of potential earners between the ages of 18 and 34”—a marketplace of about 7 million.

What Do Young High-Net-Worth Individuals Want?

Of course, there are those who already are enjoying substantial wealth. Phoenix Marketing International did a study of young high-net-worth individuals on behalf of Merrill Lynch’s Private Banking and Investment Group in early 2013 that offers some interesting insights. The study surveyed a small number of individuals (153) with net worth exceeding $1 million and “included those who have inherited most of their wealth (28%) as well as those who acquired it through entrepreneurial ventures (26%) or by working their way up at lucrative jobs (58%).”

“These young people aren’t rebelling against the traditional investment approaches advocated by their parents—not only do most say they would have no objection to using their parents’ financial advisors, they are also most likely to describe their investment philosophy as ‘buy and hold.’ They aren’t turning to their friends and peers in their digitally managed social networks for investment guidance, and don’t uniformly spurn professional advice. To the contrary, eager to learn, they seem to value expertise.…”

The study reported six primary observations for your consideration.

Millennials take nothing at face value

These investors want to see the math and often “ask how they can best accomplish their goals.” Many have the attitude:

“If I invest, I will probably lose, unless I’m extremely careful.”

Hypothesis: FAs must make strong, logical, and proven cases for their recommendations.

Wealth creators, in particular, want to remain in the driver’s seat when it comes to their investments

A full 72% of respondents describe themselves as being “self-directed” in their investing, with 41% reporting having “no financial advisor of any kind.” While 40% of the group takes a “buy and hold” attitude, the group as a whole takes a “variety of investment approaches.”

There is skepticism in this group. It was also reported that the group has “a hard time believing that advisors necessarily have their best interests in mind. According to our survey, only 19% agree with this notion. (Another 40% disagree with it.)” In addition, “As a generation intently focused on the value add of almost every service or product they buy, millennials simply seem to question whether paying for financial advice is worth it.” There is a tendency towards index funds—ETFs and mutual funds that simply track a host of indexes.

Hypothesis: FAs will face a self-directed population and must establish deep trust and show specific value add and differentiation. There is also fee sensitivity. Don’t rush the sale! The study itself suggests, “One of the most important roles an advisor can play is serving as a kind of behavior coach who can help maintain discipline through the various (market) cycles.” Also, see my paper “Why Should I Do Business With You?”

Inheritors want to be empowered to realize their own ambitions

However, this section of the report also suggests, “many of these young people have a perfectly natural response—the stakes seem high, so they’re afraid of failing.” This comes from studies that show “even quite considerable family wealth is completely lost by the second generation 70% of the time, and by the third generation 90% of the time.” Millennials conclude that “No matter how difficult the discussion of money might seem, transparency is critical.”

There may also be perceived challenges living up to the older generation’s legendary standards. “The older generation, in turn, ‘sometimes doesn’t want to share too much, because they don’t want to demotivate their children’.”

Hypothesis: FAs can play an important role in helping these constituents develop a healthy relationship with money and investing—if one does not exist—in part by helping to educate the individuals if they are inexperienced regarding financial subjects. A delicate balance is required here.

Millennials don’t want their lives to revolve around money

Millennials believe that “the real path to wealth is through business innovation—not through investing… which can translate into a reluctance to have their money tied up in ways they cannot access.”

“Most young inheritors want to exit the shadow cast by their successful parents by putting their own stamp on the world.”

The study also reports young inheritors have said, “I don’t need more” and “I want to do something with what I’ve been given.”

How would they like to make their mark? What are their entrepreneurial, social, and/or philanthropic interests?

Hypothesis: FAs need to understand the drivers and deep interests of millennials beyond money. A strategy of investing a portion of the assets of the millennial while retaining the flexibility to invest in their businesses may be appropriate in some cases.

Providing connections to other authorities is of vital importance to young investors

The study states that for millennials, “in selecting a wealth management provider, two attributes topped the list: understanding the needs of investors in their twenties and thirties and an ability to communicate in a way that resonates with people in their twenties and thirties. Other factors that rated highly included values based investing (3), access to products and services not found elsewhere (4), and access to funding for one’s own business (5).”

The study participants are also looking for “connections to people or to expertise that might help them with their livelihoods or with their businesses.”

Hypothesis: As above, FAs need to understand the needs and wants of this group and communicate in the way they want to be communicated with. The report also states that “members of the Facebook and LinkedIn generation want to know that your network will help them expand and deepen their network.… In a world of intense connectivity, young people value relationships very, very highly.”

Millennials may not yet fully appreciate the degree to which wealth management firms have evolved to meet their needs

FAs can be more successful with millennials, as in an example from the study, “by asking questions, listening, and coming to understand that what the client was most concerned about had to do with securing the financial future of his young children and helping strengthen the community that he’d grown up in… The plan involved a lot beyond investing.” In addition, “advisors must continue to carefully listen to clients in order to gain a clear understanding of their anxieties and aspirations.”

Hypothesis: Ensure your prospects understand that you offer a holistic set of wealth management solutions and that you are able to deliver them in the context of the client’s real wants and needs.

More data, more details

Here are a few other observations to flesh out your view of the millennial generation. An article from CNBC, “Millennials Make Most of Massive Inheritance,” reported “that knowledge seems to have made them better savers, more risk averse, and more worried about their retirements than their parents or their grandparents.” In addition, “They are even worried about their parents.”

Millennials are also interested in community service and are more politically involved than their immediate predecessors are. Many mistrust financial systems and are concerned about inflation, national debt, and Washington’s inability to take action because of partisan politics. Two groups heavily represented in the study, physicians and entrepreneurs in the tech sector, often have “some altruistic endeavor in the mix.”

Finally, the “Wealth gap calculator” article mentioned above also notes that “the No. 1 profession among millennial one percenters is lawyers, followed closely by miscellaneous managers. The more high profile CEOs come in third. Such positions, of course, require a college education, and usually of the prestigious variety. As a result, they tend to favor individuals who grew up in more affluent households…” Software developers come in fourth among wealthy millennials.

Also note that millennials are the most stressed out generation in America, according to a new survey from the American Psychological Association (APA).

Summary: Why the millennial marketplace?

Here then are the arguments for why you should be paying attention to millennials:

- Asset retention of your high-net-worth clients. Again, 98% of children will move inherited money to a new financial advisor.

- Millennial FAs know millennials, so it’s a good way for a millennial FA to grow a book.

- As part of a senior team, millennial FAs should be able to better relate to the marketplace and the millennial children of your clients, yet have your expertise available—as well as your contact database.

- It’s an excellent learning opportunity, especially for millennial FAs.

- If you collaborate with the right millennials, they can grow into top clients.

Summary: Who is your ideal millennial prospect?

Your prospective millennial client is:

- Often the child of high-net-worth parents, ideally your clients, because this is where you want to start your millennial strategy. Preferably, the parents and their adult children have a very good relationship and the parents are willing and even happy to have you work with their children.

- Probably 28 to 32 years of age, because 70% to 80% of them have not as yet met with a financial advisor. The data say that by 34 years of age, 33% have met with a financial advisor. I am assuming this is nonlinear, and, in suggesting you start working with millennials at 28 to 32 years of age, that that percentage is likely higher.

- Most probably, a college graduate. It would be advantageous for your millennial client to have advanced degrees and to have attended prestigious schools.

- Employed in a job paying over $60,000, for a recent college graduate, and close to $100,000 for older millennial prospects or they have the prospect of such a job before reaching 35 years of age.

- Possibly an attorney, manager, high profile CEO, physician, entrepreneur in the tech sector, or software developer.

- Ambitious

- A saver

- Interested in topics beyond money. They are entrepreneurial and have social and/or philanthropic interests.

I have not included asset level as a criterion, because if the millennial is a child of a high-net-worth client, you will most likely not have a minimum for them. If the millennial is not the child of a high-net-worth client, the other factors above and your practice should drive your decision on any minimum.

I do not suggest that you need to have millennial prospects that are seeking advice, are self-directed, are not fee sensitive, and trust the financial system. These are issues you address regularly with at least some of your clients and prospects. Of course it’s appropriate to be aware of these potential objections, but I believe you can likely address these concerns. During your discovery process you should of course look for these concerns and even bring them up so you can “preframe” the objection.

Discovery should also validate your prospects’ beliefs regarding their savings approach, risk aversion, thoughts about their future, including even retirement, as well as their parents’ health situation and potential future monetary needs. As millennials are also interested in community service and are more politically involved than their immediate predecessors, discover those interests as well. Find out any other concerns they have about inflation, national debt, and even Washington’s inability to take action because of partisan politics. Raise questions that may be on their minds so you show an understanding of issues important to millennials.

Each of these factors is part of your discovery process, the process by which you get to know your clients and their families. This is especially important with your high-net-worth clients—those whose assets you would like to retain in perpetuity.

It’s time to get your millennial strategy in place.