The Challenge: Getting prospects to buy into your financial advice planning process.

The Solution: Show them HOW the process works before asking them to commit.

The keywords there are “show” and “how“….and it is because so many advisers do not focus on these 2 words in the earliest stages of engagement that they struggle to get good prospects to engage in the full financial advice process.

Regardless of an advisers area of specialisation the primary objective of the advice process is to help the client get from where they are now to where they want to go whilst avoiding as many foreseeable risks as possible along the way.

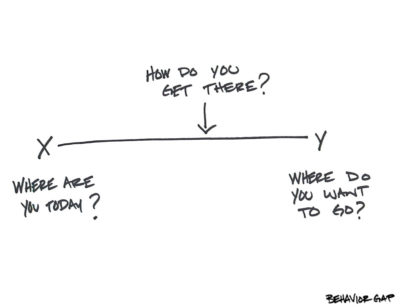

Carl Richards, who is the master of using great visuals to convey complex ideas quickly and easily, shows the objectives of the process this way:

As a way of explaining what the advisers role is and what the process is about in a way that a prospect can get it in 5 seconds this is really effective.

One of the reasons why it is so effective of course is that it does not get bogged down in what the process is to begin with.

I don’t care what regulators and consumer advocacy groups say about that because in my experience consumers generally don’t give a toss usually about what the process is.

They just don’t give a flying #&!# about the forms and cool spreadsheets and pie charts and the rigor mortis of written disclaimers and disclosures generally speaking until after they have decided whether HOW you do things can help them get where they want to go.

All of those extra details do matter for a number of good reasons (and I do absolutely support the need to have the documented details as part of the process), but they need to be put and kept in their proper place. The rigor mortis stuff is for after prospects have decided that you can help them….it is the stuff that we have to do when we are doing the job.

But it is not the stuff to showcase when trying to get the job.

So a simple diagram such as Carl’s is perfect for explaining what the objective is. The next thing we need to do though is show them how the whole planning thing works for them in their world. This is how I like to do it, and my preference is overwhelmingly to actually physically draw it in front of prospects while talking about it. But if you don’t like drawing diagrams in front of clients then the pre-made version is this:

“The entire process is about how we improve your financial position over time. The end game, regardless of when that point in time is, is firmly focussed on how you get what you need to live the life you want to live. The whole point of financial planning is to have enough money to use in living how you want to isn’t it?

So how we go about it is by figuring out where you are now, and identifying the stuff that can totally de-rail things. We try and make sure those risks are sorted or avoided as far as we can so that we can then focus on building up and holding onto the capital, or net worth, which takes the place of your labour. Where we are trying to get to is the point where the money you have produces the life you want so that you don’t have to keep selling your soul for a pay-packet each week. Your money replaces your labour.

The final – and most fun part of the planning process – is working out how and when to use it. If we get it absolutely right then the last cheque you write should just about bounce at the undertakers….but planning is never quite that perfect of course.

That’s how we try to develop financial plans for clients though….”

When advisers position then entire planning process like this and show prospects what it is all about and how it is going to be done then they get it. It is about them and their dreams. It is personalised and there is a point to it all.

They get it.

They become clients.

Try it. You just might get more prospective clients buying into what you can do for them.