As more financial advisers move into fee-based work the common question seems to revolve around what fee level is right for them and their clients. High fees are not great, but higher fees are needed to run the advisory firm.

So obviously the first thing is working out what fee level is profitable, and then it is usually easy enough to work out what fee level is competitive in the market….but neither of those is the same as understanding what fee level is appropriate. What is appropriate may well be a lot more than what is competitive in the market too.

The appropriate level for any engagement can, and should be in my view, specific to a particular engagement. Of course the basic fee level should start from a point where it is profitable for you to do the business, but it should also reflect the complexity of the engagement. The more that a unique or specific set of skills or knowledge are called for, and the more difficult the problem being addressed, the higher the fee should be. In other words, perhaps the appropriate fee should be more than the competitive charged out hourly rate.

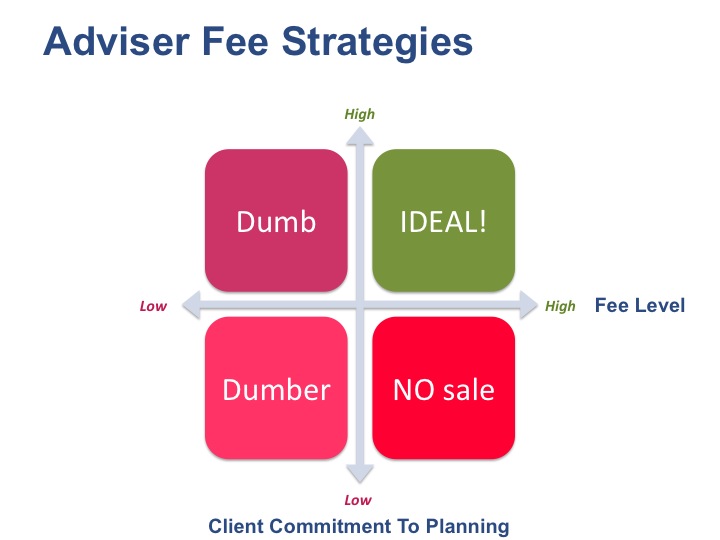

The real key to finding what is an appropriate fee level is understanding the complexity involved in the engagement, and the level of commitment by the client.

Often advisers are setting fees at a high level as a way of attempting to position expertise – if you are expensive you must be good, right? There is some merit in that, but an extraordinarily high feel level for a client who is totally nonchalant about the engagement will simply not result in much business at all.

Finding clients who want your expertise and are committed to the planning or advisory process and then giving it away for free, or low fee, is just dumb business.

Even more dumb though is setting a low fee to try and work with the non-committal client….which many advisers try in a bid to get business in the door, and hopefully create the commitment from the client once they have seen how good the adviser is. Essentially this becomes a competition based upon price discounting – a race to inslovency if ever there was.

A high fee makes sense commercially when you have a committed client who wants your time and attention. It makes more sense still when the client has a difficult or complex situation, or the client who knows that they need expert help to achieve the goals and dreams as they simply cannot achieve them alone…that is the area where high fees make sense, and still be competitive.

That is why the advisers who want to have a highly priced fee-based business model MUST ensure the client understands the extent of the complexity very quickly, and obtain high levels of commitment from the client to working with. Understanding the complexity and the need for the expertise is essential to obtaining high fee levels. That means positioning as the coach or expert, not just positioning as an adviser. The difference between the two when it comes to establishing your commercial worth is this:

The adviser can help achieve a solution and provides good guidance.

A coach takes responsibility for making it happen.

Clients will pay more for someone who steps up and says “I will make this happen for you…I will get you where you want to be“

The best advisers move into this position. Guiding people towards good outcomes is valuable and should be rewarded well as it requires skill and expertise. Doing that as well as stepping up and taking responsibility for the outcome adds another significant layer of value to any engagement.

That is why coaches tend to get paid more than advisers. So why not do that then?