Traditional schools of thought claim that the sales process begins when the prospect first gets introduced to a solution, but do you think that is really true?

In a highly referral-based business, one could argue that the sales process is ongoing and evergreen. Each interaction, whether a new plan sponsor introduction or current client communication, has the potential to kick off a sales cycle. Because the sales process is an infinite loop, it is important to dissect your sales process into micro units to learn if and where opportunities exist for improvement.

To begin, look within your own business and try to pinpoint if and where you think the process breaks down. For example, do you need more inbound leads? Are fresh introductions not returning your phone calls or emails? Do you get invited to finalist meetings but struggle to close the deal? Do you have a high client turnover rate? Are you losing clients more often now than in years past? These assessment questions are a starting point to learn how you can hone in your sales process to dissect each component and, ultimately, convert this soft spot into a position of strength.

Inbound Leads

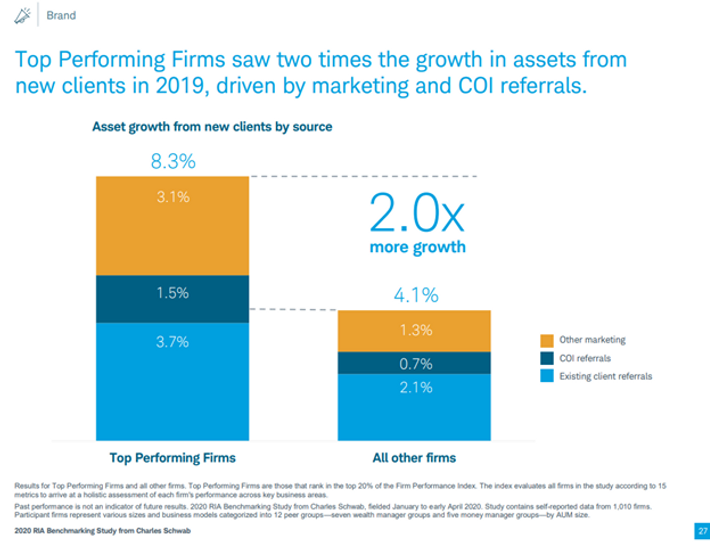

Let’s start with a traditional sales pipeline and focus on the top of the funnel activities - inbound leads. Prospect introductions generally come from three sources: client referrals, center of influence introductions, and marketing efforts. In a recent Schwab study, the researchers found that top performing teams received 3.7%, 1.5%, and 3.1% from each source, respectively whereas generalist firms saw 2.1%, 0.7%, and 1.3%. The top tier firms saw 2x more growth due to their combined efforts.

If you would like more inbound leads, take a look at where your plan sponsor introductions are coming from. Mathematically speaking, take a look inside your business and benchmark your inbound leads compared to the Schwab findings. As a top performing firm, which one of these sources is off? Then focus your efforts to enhance that metric.

This means either connecting with current clients - possibly during an upcoming client Zoom meeting - and asking for referrals. Or speak with centers of influence to co-host a webinar that highlights your retirement plan experience with a presentation on the CARES Act, SECURE Act, general fiduciary plan governance, plan design education, 2021 modification ideas, market volatility or financial wellness, etc. choose a topic that compliments both of your skill sets.

As for the last source, your marketing efforts, how are you organically growing your firm through marketing campaigns? This includes e-newsletters, social media, email campaigns, content marketing, podcasts, videos, and other awareness marketing activities. What types of content are you sharing to develop inbound requests?

Stalled Introductions

Let’s say you get a healthy volume of inbound introductions, yet plan sponsor referrals aren’t maturing into prospects. Why not? This is usually an image problem.

If you take a moment to back up and reflect on the events that needed to occur for the introduction to take place, consider this example. Let’s say your CPA referral partner is speaking with a plan sponsor. They discuss the company’s retirement plan and the CPA says, “You need to contact the best 401(k) advisor in our area. Here let me introduce you.” Then your CPA referral partner sends a friendly introduction email. This satisfies the business owner and you are delighted by the new client opportunity. Then later that day, the plan sponsor begins light due diligence to learn about you. In their search, they find a beautiful website, an active LinkedIn profile, and experience a pleasant email exchange. Then as part of the email exchange, you attach your company’s retirement plan overview. But it is full of typos and the image has a SHUTTERSTOCK watermark. How does that change their perception? Does that once professional exchange come to a screaming halt?

In a design forward society bombarded with visual candy, we are all highly sensitive. Therefore, your entire on-boarding and introduction package need to radiate professionalism, experience and expertise. This will advance the prospect forward to take the next step and setup that introduction conversation.

Final Pitch or Final Miss?

The finalist process has changed – thanks to the global pandemic. It’s harder to read the room now. It’s challenging to stay intensely focused. It’s difficult to prevent accidental interruptions (technology issues, children, dogs barking, videos freezing, you know what I’m talking about). But it’s still possible to make your pitch different, memorable, and outstanding.

To prepare for your pitch, start with the foundation. First, assess your conferencing platform. How good is the technology you use? Does it have clear audio and a crisp video? Are you familiar with the basic conferencing functions like muting, screensharing, transferring presenter roles, recording? Do you have a fast enough internet connection?

Next, is your office camera ready? Should you rearrange the furniture? Is there a fan behind your head? Is there a distracting mirror? How is the lighting? Be objective. Treat it like a Hollywood set. If it needs some sprucing up, go to your local Marshalls, Target or Home Goods store and buy artwork. Put it behind you and voila! You now have a great background to drop some retirement plan knowledge.

Last and definitely the most important, look at your pitch deck. How is the presentation communicating how you are going to support the prospect’s plan’s goals and objectives? This section will have its own article devoted, and we will work on 2020 pitch deck best practices - so stay tuned.

Leaving Faster than Entering

Retirement plan clients generally constitute “sticky” business. Once you are servicing the plan, it takes a lot to unseat the advisor. However, if you have recently lost a few clients, take a look at a few possible reasons why.

The big one right now is the coronavirus. If that has happened, please know it is not you. A business owner client could be facing a myriad of problems and sadly, they have to make a tough decision to let go of the company’s retirement plan. If you haven’t already done so, connect with them on social media, add them to your reoccurring newsletter, and follow up periodically because they may want to reinstate the plan in the future.

Other than coronavirus, let’s talk about communication.

According to Fidelity, two reasons why plan sponsors hire advisors are to understand how well the plan is working for employees and how to improve it. As a company grows, and the plan becomes more complicated to manage.

To demonstrate your acumen, communication is key. How many times are you in contact with your current clients? Are you keeping them informed and in the know? Are you sending them emails, hosting webinars, posting on social media, and writing blogs. How are you demonstrating that YOU are knowledgeable and up with the times? Regular communication is going to instill confidence in you as their trusted retirement plan advisor.

By contrast, a lack of communication is a breeding ground for doubt. For example, when plan sponsors feel like they haven’t heard from their advisor for a while, they may feel unsupported, nervous and scared. These emotions create doubt, and good prospecting campaigns love doubt. Shore up your communication strategy to stay in front of your clients regularly and deliver quality education. That way when another advisor is introduced to your plan sponsor client, they will confidently say, “We’re all set.”

By taking apart each layer of the prospect-to-client sales pipeline, you can identify areas of improvement. Once identified, transition these gaps into positions of strength. Use simple questions to pinpoint opportunities within your business. These questions should help you to effectively grow your business by converting more leads into satisfied clients.

Related: Make Your Own Luck as a Retirement Plan Professional