Written by: Jordan Jackson

The hallmark of core bonds is their diversification benefits and lower volatility to risk assets, which make them an important ballast in portfolios. However, with bonds down double digits this year1, investors are struggling with their fixed income allocations. To address this, investors must consider the outlook for policy rates and the risks around those assumptions.

As of its September meeting, the Fed expects to lift rates to 4.4% by year end and 4.6% by the end of 2023. We expect the committee to remain steadfast in reaching its year-end target, though persistent inflation and resilient labor markets suggests the Fed has room to hike rates closer to 5% next year. Given the committee continues to lean hawkish, this seems set to trigger, at best, much slower economic growth and, at worst, outright recession next year.

So, what to do with Fixed Income?

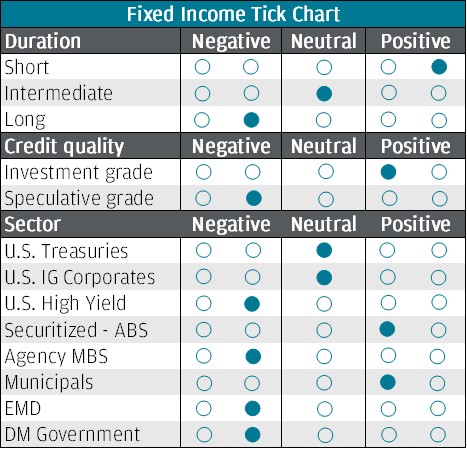

Curve management

The yield on a nominal U.S. 2-year Treasury bond is 4.5%, while the yield on the 10-year is at 4%. Investors can now generate income by investing in shorter-maturity bonds without being exposed to significant interest rate risk. Moreover, in an environment where risks are skewed to higher rates, investors may be better off maintaining a short duration overweight within portfolios. That said, the 30-year bond is yielding over 4%, and for investors concerned about a deeper recession, longer duration fixed income may be an effective insurance policy.

Credit quality

Investment grade (IG) and high yield (HY) corporate bonds now yield an attractive 6% and 9.5%, respectively. However, the increase in yields has been mostly driven by higher Treasury base rates this year. To be fair, credit spreads have widened, though given the rising risk of default amid a challenged economic backdrop, they likely have not widened enough as compensation. In previous U.S. recessions, IG and HY spreads averaged roughly 250bp and 950bp, respectively, while current spreads are at 190 bp and 570 bp. Given this, investors should have a high-quality credit bias within portfolios.

Sector allocation

- U.S. Treasuries: Given the risk of the Fed overshooting, liquidity challenges in the Treasury market, and weak demand from foreign investors, there is scope for another leg higher in yields. Still, we are closer to the end of the Fed’s hiking cycle and recommend a neutral allocation to Treasuries with a bias towards shorter duration.

- U.S. IG and HY corporates: In addition to the potential for wider spreads, IG credit (-20%) has underperformed HY credit (-14%) YTD suggesting IG spreads more accurately pricing in recession risks next year, supporting a high-quality bias in portfolios.

- Asset backed securities (ABS): ABS yields are at multi-decade highs and spreads are at the widest of the year even with a generally healthy consumer. While interest rate volatility poses a risk to the sector, its strong credit quality and shorter duration profile have allowed it to weather the storm relatively well this year and now presents some attractive opportunities.

- Agency mortgage-backed security (MBS): We outline our reasoning for a modest underweight here.

- Municipals: The tax-equivalent municipal bond yield curve is significantly steeper than that of the inverted nominal U.S. Treasury curve2, suggesting investors can pick up yield on a tax-adjusted basis. Moreover, municipal credit fundamentals are in great shape given substantial Federal aid and conservative budgeting.

- Emerging market (EM) debt: Risks continue to skew to the downside: war in Ukraine, inflation, tighter financial conditions, China lockdowns, social unrest, and USD strength. Moreover, EM remains vulnerable to capital outflows. While opportunities exist in local rates, more broadly we recommend an underweight to EMD.

- Developed market (DM) debt: DM central banks may be positioned to continue raising rates well into 2023. Moreover, the challenging economic and inflation backdrop facing Europe, UK and Japan complicate the outlook for monetary policy. Given this, we think an underweight to DM bonds is appropriate.

In summary, bond markets are likely to remain choppy, but manageable. In some ways, the market's use of the term “pivot” to describe Fed action in 2022 is analogous to “transitory” in describing inflation in 2021. While neither has yet to play out, at some point the Fed will have to pivot more dovish given a slowing U.S. economy, potentially in 1Q23. At that point, extending duration and reassessing corporate credit fundamentals will be important in adjusting bond allocations.

Market insights fixed income allocation views

Source: J.P. Morgan Asset Management.

Related: Does Inflation Impact Younger and Older Investors Differently?