A few weeks ago I promised I would start on the "Bank X" series. What the series will be, is a way to talk about what I've experienced with various banks without of course, breaching any of the iron-clad NDAs in place. The reason why we should talk about them is because, as I've deplored many a times before, our industry is drowning in negativity in lieu of striving for better and there is no reason to let that stand when there are real life examples of Banking Heroes and Hero Banks who do great stuff.

In today's episode, this particular Bank X caught itself digging its own grave by choosing consulting-speak over growth and did something about it.

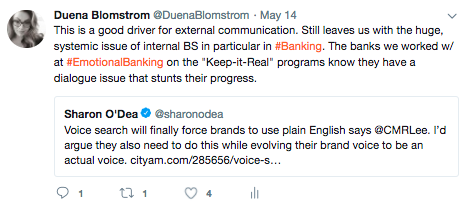

A few days ago, my amazing friend Sharon O'Dea posted someone's piece about the fact that brands will need to start using "plain English" to connect with consumers and I responded that's welcomed but insufficient if internal communications are not to undergo a complete shift towards real talk.

Of the 5 programs that are the pillars of the Emotional Banking method, the " Keep it real " program was one of the last ones I have arrived at. Designed to rapidly improve the content and truth quotient of the internal dialogue in banks, it wasn't because the importance of it escaped me that I was delayed in arriving at it, but because the main element it aims to change, namely "language" is one of the most complex ones.

In my journey to write the book and develop the method, I've known early on that unless we do something radical about the cancer of "consultitis" and get people in banks back to "speaking plan English" again, the other wins I was constructing - the kernels of passion and courage, and the way they were amassing knowledge- will be unusable.

The dialogue in banks was often neigh but impossible after years of consulting jargon that laced every sentence and stunned any communication.

When I had started the "State of our Culture" assessment with Bank X, I saw from the start that they were far from truly talking to each other and I underlined it to my executive sponsors. One of them was a newly minted CxO from a completely different industry with an unquenchable thirst for "saying what you mean".

He admitted he has been stunned by how most important meetings dissolved in acronyms and stiff, wooden language and once we both stopped rolling our eyes at the wealth of extraordinarily frustrating examples, we both agreed this was "one of the ones we have to do something about first".

Now it's important to note that Bank X had brought this future Banking Hero on board, along with a handful of other great minds with a transformation mandate around rebuilding their mobile proposition on the basis of a shiny new analytics engine they were plugging in on the back-end, and the pot of gold for this exercise, as well as the enthusiasm for the outcomes, were excitingly extensive.

In other words, the team had the money and the mandate to construct the most awesome proposition they could think of with a reasonably blue sky and all the goodness of a Human Design Led philosophy and the quick and effective agile way of work du jour.

Ideal, right?

Wrong.

Meeting after meeting passed without them moving any closer to constructing greatness even on paper and as some of the execs I had interviewed were describing it, the frustration was based on how everyone left the room thinking progress had been achieved but then realising, not long after, that wasn't true at all and the nods around "seeing what sticks" and "getting out of the building" had little if any substance.

I sat in on a couple of these digital strategy planning meetings and I was stunned at the dynamics. There was no lack of enthusiasm to start with and people would often bring in an idea and construct a vision around it but then, not long after, something would flip and the tone would shift to nearly meaningless pretentious business talk and be covered in forced political correctness. From then on, the chats quieted, the ideas dried out and the "we are now businessy adults saying what makes us look professional" replaced the initial fervour.

Having witnessed this same phenomenon in several other banks, I find it nothing short of fascinating to dissect. The best I can describe it, is akin to a switch being flipped from real conversation with meaning and passionate intent, to the automated-pilot of a bad episode of any office parody where the protagonists speak in no recognisable, every-day word.

In the middle of the most innovative, ideas birthing sentence it often takes but one of these consulting-ly Big4-like phrases being uttered by someone in the room (often as support to an objection to some big change idea) before the mood shifts and the language becomes universally unusable and the real discussion disappears in favour of a meaningless dance where everyone takes turns using the same type of expression that they believe would sit well in an official report.

This moment of mass hypnosis towards pervertedly empty language in a group that's there to reimagine what truly addictive experiences are for the consumer , is the real cause of lack of innovation and progress in banks because the more "unreal" the language, the lesser the dialogue and in its absence nothing but incremental change can and does happen.

Bank X's new Hero asked me what we should do. Was he to simply instruct the teams to "not speak consulting, use real language"? Would that be efficient? I suspected it would, eventually, but what we did was first roll out a few of my "Keep it real" workshops.

In their case, aside from the fun bits such as the "Say it again in English" exercises and the "Swear-fest" practice designed to loosen and reframe that are by default packed in my program, I focused on catching the moment they glazed over and turned into corporate drones.

I'd bring up an issue still on the agenda and ask a couple of controversial questions and watch as they launched in a debate about what should be implemented next or what technology should be used or even what some segment desires over another and let the dialogue develop to that -sadly inevitable- point where someone would slip into consultitis and jargon and halt it right then and there to analyse the triggers and show them the dynamics.

A method borrowed from individual therapy, if you need a behaviour to change, the only way to do so is to identify its triggers, develop an internal narrative to combat them and then try and catch yourself in the act. In a professional setting, group dynamic is based on a collection of individual behaviours and if they each learn to stop when they hear themselves or others slip towards meaningless and to instead go back to basics, it can prevent the rest of the session being of no value.

Related: Digital Banking and the Consumer: "It's Complicated"

In each workshop we ended up with a list of "coping mechanisms" to help them identify and fight "consultitis" and, while the formulation may be different, for the most part they can be found in an internal check-list looking much like this:

"Am I saying this to add value or to look good to my boss or my team?"

"Is this the way I would say this at the pub/around the dinner table/to friends?"

"Is this acronym or piece of jargon necessary or can this be said in English in a more efficient way?"

That quick check-list alone is a good start. Keeping each other honest and true to this -often uncomfortable- practice of language honesty is then paramount.

No one, not those in tech or those in business, those in banks or consultants, no one whp wants to see good, innovative things happening should be exempt from this "no BS, no consultitis" language pledge. We must start talking to each other in an open, honest and intently constructive way.

A few weeks back I met two people from Bank X. They were young, freshly imported from a big name consultancy and from another country than the head office we had done the "Keep it real" program with, but before I could reminisce about my time with them, they proudly informed me that their organisation is different "you should hear us in heated debates, we sound like so unprofessional!".

Here's to all the unprofessional bankers keeping it real for us.