Video game publishers and related gaming companies have excelled at identifying and leveraging emerging technologies as new platforms to distribute their games. Mobile gaming encapsulates this phenomenon.

Gaming revenues can be segmented by different platforms that represent how consumers access and play the game. The first widely available video game platform was the arcade, which was then followed by personal computers (PC) and consoles such as Xbox and PlayStation.

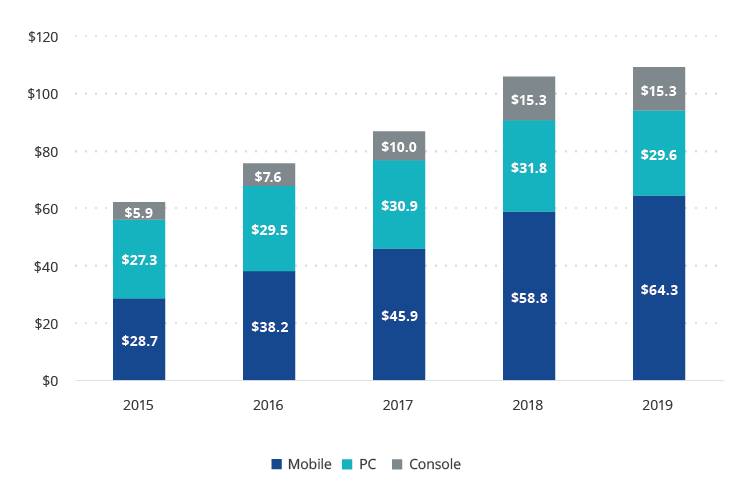

Mobile gaming represents both the largest platform by revenues and the fastest growing one. Since 2015, mobile revenues have grown at an annualized rate of 22%, outpacing the total gaming revenues growth rate of 15%.

Mobile Is the Largest and Fastest Growing Gaming Platform

Source: SuperData, a Nielsen Company. Data as of 2019.

Prior to the iPhone’s release in 2007, mobile did not exist as a category for gaming platforms. Rudimentary games like Snake and Tetris were available on early cell phones, but the invention of the iPhone created a new category of games out of thin air. Mobile apps have become synonymous with the mobile phone experience, and mobile games are some of the most popular and widely downloaded apps available to consumers.

Strong Demand from Emerging Markets Consumers

Game publishers and developers are catering to emerging markets consumers by releasing “Lite” versions of games, which can run on phones with less processing power (i.e., cheaper phones that are more accessible to emerging market consumers). This broadens the reach of a specific title by making the game more accessible to consumers who might not be able to afford the fastest, best mobile phones.

Emerging markets consumers are driving revenues for publishers and gaming companies focused on those areas of the world. Consumers from China and Southeast Asia are generating massive revenues from mobile gaming. By and large, emerging markets companies are the ones who are profiting from this mobile gaming boom in emerging markets countries.

Let’s use China’s mobile market as an example. According to some estimates, mobile game revenues in China were $15.6B in 2018.1 All of the top 10 most popular mobile game titles were published by the same two Chinese companies: Tencent and NetEase. China is unique in that the government has to approve any new games that are released, which creates a bias towards domestic Chinese publishing companies. However, other companies are also tapping into domestic consumer demand in these markets.

Singapore-based powerhouse Sea Limited is another company dominating the emerging markets mobile game marketplace. Sea’s Garena Free Fire is a massively popular mobile battle royale game among users concentrated in Southeast Asia and Brazil. Sea has focused almost exclusively on gaining marketshare within emerging markets countries, and this strategy appears to be paying off. Garena Free Fire was the third most-downloaded mobile game app in Google Play in Q1 of 2020, and according to Sea, 80 million people are considered DAU (daily active users). Sea’s revenues primarily come from Indonesia, Thailand, Malaysia, and other Southeast Asia countries.

Mobile Gaming in the Current Environment

Video gaming stocks have weathered the volatility in 2020 extremely well. Mobile gaming may even provide further protection for publishers.

Newzoo has identified three reasons why mobile gaming revenue growth will continue to surpass both console and PC in the current market environment as many businesses remain closed.

- Lowest barrier to entry: All that is required to play is a mobile phone, and as mentioned above, publishers are targeting lower-end phones with Lite versions of popular games. Compared with purchasing a PC or console, mobile phones are much cheaper and more ubiquitous.

- Alternative to PC cafes: Although not popular in the U.S., mobile cafes are where gamers congregate to play games and socialize with other gamers. With mobile cafes closed due to the COVID-19 pandemic, gamers may turn to mobile games.

- Mobile development is less complex: Developing a AAA—or high-budget blockbuster—game title on a PC or console platform is an arduous, complex process requiring many iterations of testing and tweaking before the game can be released. Many titles have been delayed due to the effects of the mass shutdown, but mobile gaming may sidestep some of those delays because the development process is more simple and straightforward.

Investing in Gaming and Esports

Determining which games will become hits is difficult, and investors may wish to invest in a diversified basket of gaming and esports stocks. Such an approach may allow investors to express a view on the sector without having to know which specific stock will outperform over the future. The index methodology which guides VanEck Vectors® Video Gaming and eSports ETF (ESPO) provides exposure to companies in the video gaming and esports industries.

Currently, the MVIS® Global Video Gaming and eSports Index is heavily tilted towards game publishers (including the publicly traded companies that operate the largest esports leagues) and semiconductor companies. As the esports industry matures, smaller esports names, such as streamers like HUYA and Modern Times Group, could grow to become a meaningful part of the Index. In the interim, the Index captures the esports phenomenon as part of the broader evolution of video gaming, creating awareness of the industry’s potential to reshape how people spend their time and entertainment dollars.

To learn more about ESPO and the high growth potential of the global video gaming and esports industry, visit vaneck.com/esports/.

DISCLOSURE 1 https://nikopartners.com/china-mobile-games/