Artificial Intelligence (AI), from popular culture with Terminator warnings to some early high-profile applications like driverless cars, has built up some biases and unfavorable connotations. This has led to a great deal of skepticism in applying AI to compelling modern problems we are actively grappling with, especially in investment management. The reality is that AI is a tool born from a marriage between great need and technology to address data rich challenges and uncertainty. For investment managers, it represents a highly tech-enabled toolkit that can enhance their current research, security selection, and trading capabilities.

To better understand where we are in the process of integrating AI into investment management, we reached out to new Institute member firm South Korean-based Qraft Technologies and both Marcus Kim, Founder & CEO and Francis Geeseok Oh, Head of AI ETFs. Qraft is a pioneer in launching some of the first AI-powered ETFs on the market, a series of AI-powered electronic trading tools, and the developer of the AI Risk Indicator which forecasts risk in the U.S. equity market for the coming week.

Hortz: Can you help define for us what exactly is AI and what comprises it? Does it represent one specific monolithic type of program or an arsenal of different tools and approaches?

Kim: At its simplest, AI is designed to simulate human intelligence using machines programmed to learn and think like humans. There is a wide range of algorithms and techniques used to create intelligent machines, there isn’t just one specific program or approach. And AI is ubiquitous in everyday life, think of virtual assistants like Alexa or Siri, Google Maps for real-time navigation, Tesla’s full self-driving capability, or a Netflix show recommendation…and those are just household names. AI-powered client service chatbots are common, AI is increasingly used to distinguish abnormal from normal findings in diagnostic medical imaging, and at Qraft, we are on a mission to transform investing using artificial intelligence.

Oh: Let me jump in and add one topical AI-powered tool to the list: ChatGPT.

Kim: Yes, ChatGPT is a great example of an AI innovation that’s increasing productivity and efficiency, and its output is largely accurate. Similarly, at Qraft we are using AI to extend the skilled human’s investment capabilities by creating investment solutions that aim to withstand volatile markets and outperform over market cycles. Our AI offerings quickly learn and adapt to real-time investment data, market data, and unstructured data, seeking to identifying meaningful patterns and signals amid the noise of millions of data points and billions of data combinations.

Oh: We call our process “human-assisted AI.” While we train our AI tools to learn and automatically respond to data at a scope and speed humans alone cannot rival, AI in investments is not independent of human assistance. We often remind clients that AI means artificial intelligence, not artificial intuition, and not all situations can be addressed with an algorithm.

Kim: Intuition is what’s behind the so-called “gut instinct.”

Oh: Exactly. And Qraft could not have achieved our success to date without our teams of data scientists and data engineers, who bring their passion, inspiration, emotions, and intuition to work every day to design the algorithms and develop our investment solutions. Our teams of human investment experts are the ones who envision and define our solutions and partner with our clients to customize a solution to meet their needs, who partner with our data teams to define and develop the algorithms that drive our solutions, and finally who supervise our investment strategies.

Kim: At the core of everything we do at Qraft is our commitment to upholding the highest ethical standards as we develop and deploy our AI solutions, and ethics is guided by humans as well.

Hortz: Why use AI vs traditional quant methods? How would you compare and contrast these different investment tools?

Oh: An analogy we have used to compare the two is that investing with traditional statistical-based quant methods is like navigating with a paper map, which has static routes laid out and you, as the navigator, must research and manually plot your course on the map. Investing with an AI-driven quant strategy is like using a satellite-based navigation application to secure a fast and accurate assessment of real-time conditions, recommending the most efficient route to your destination based on data and predictive analytics that you do not see, as well as your specific parameters, like “avoid tolls,” for example.

Both methods will get you to your destination, but using the latest technology that is constantly learning from and automatically adapting to new data and changing market conditions presents a significant advantage over traditional quant methods, which may be challenged to quickly integrate new data sources and adapt to changing market environments. In our experience, most quant shops use some form of AI, but how much AI is incorporated and the degree of sophistication runs the gamut.

Kim: With traditional quant, it can be easier to explain the investment rationale for why a decision was made. Conversely, to some extent AI-driven models are seen as a “black box,” and some investors can really struggle to embrace an AI model’s output because there may not be an obvious investment rationale for a recommendation. There’s a bit of a belief that if an economic explanation is unavailable, the relationship or recommendation cannot possibly be valid.

But referring back to our tech-led approach, AI methods are purely data driven. There is no preconceived bias from prior research or investment theories which may have been applicable in some prior market environment, but which may not be valid in the current regime. That is the beauty of the AI model, the flexibility to quickly adapt to the data autonomously, without the explicit need for re-programming.

Hortz: Can you give us a few examples of how an AI technique can outperform a traditional quant method or solve a problem that a traditional quant technique could not?

Kim: Traditional quant methods take the perspective that relationships between data are linear. But today, to generate alpha above and beyond a benchmark, we really need to be looking at data and the relationships among all data points with a multi-dimensional, non-linear lens. Advances in computing power combined with massive and ever-expanding data sets have helped AI techniques really experience a breakthrough in this century.

And let’s focus on data for a moment, the fuel of AI. The adage holds here: garbage in, garbage out. Financial data can be messy, so we built a tool called Kirin API to create a bias-free environment of clean data that feeds into our models. Kirin API processes trillions of data possibilities in mere hours, looking at traditional structured data like macro data, price data, factors, and also takes in unstructured data, like patent issuance or sector assignment, for example.

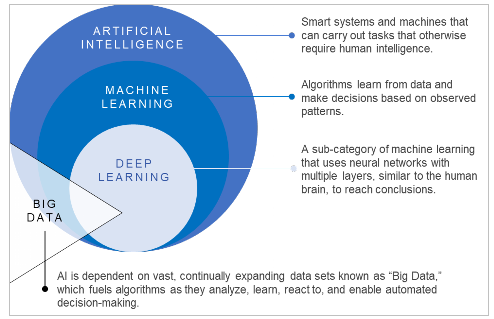

Machine learning is a subset of AI that learns from the complex data it absorbs and dynamically adjusts to enhance its comprehension of the underlying dynamics in its pursuit of meaningful signals and patterns in data. Deep learning is a type of machine learning that is based on “artificial neural networks” and is sub-set of machine learning modeled after the non-linear nature of the human brain. The non-linearity approach used in these AI techniques has the power to unveil hidden alpha opportunities amid these large and complex data sets.

Oh: To add to that, the sheer speed at which AI accomplishes what previously took years and years to discover by teams of researchers is remarkable. In 2017, Qraft began developing a framework we call “Factor Factory” that was designed to use machine learning to automatically explore data searching for signals and anomalies that could be used to generate alpha.

To showcase the effectiveness of the factor search and verification algorithm, we ran a simulation test over 24 hours and in that one-day period, Factor Factory “found” several well-known factors automatically, without human intervention. Factors that teams of human researchers spent decades researching and validating were detected by Factor Factory in a single day! We find this fascinating and a testament to the power, speed, and accuracy of AI-driven models. But the point being, AI can reveal this type of information and relationships far faster than traditional quant researchers.

Hortz: Tell us about your AI Risk Indicator and why you offer that investment tool to investors for free?

Oh: Markets have been experiencing elevated volatility for quite some time, even beyond 2022. The widely known market indicators, like the VIX or the Fear and Greed Index from CNN, don’t provide actionable insight to help navigate volatile markets. In the face of these challenges, the Qraft AI Risk Indicator was born.

We publish the Risk Indicator every Monday on our website, https://www.qraftec.com/ai-risk-indicator. The Risk Indicator provides an assessment of expected market risk for the coming week in the form of a score that ranges from one to 100. The weekly score falls into one of three risk regimes: risk on, with scores from one to 14; neutral, with scores from 15 to 49; and risk off, with scores from 50 to 100. As we discussed earlier, this is a key strength of machine learning: it can provide real-time market predictions even when the environment includes some unknown outcome.

Kim: We first put a model like this in in place in 2019 for a Korean client’s pension fund. We also have a partnership with the MK Business Daily, Korea’s most popular financial newspaper, to publish our Boom & Shock Index. The AI Risk Indicator on our website is a similar model, but with a global reach as it’s published in English and demonstrates our expertise and knowledge in AI applications in investments. For Qraft, a relative newcomer to the investment space, this is an opportunity to engage with and excite investors on the possibilities of AI in investing.

Oh: Beyond predicting the risk regime, the weekly score can be aligned to an equity/cash allocation in an equity portfolio. We have several model portfolios that apply this concept, and we are currently exploring product development opportunities to bring this strategy to retail investors in the US.

Hortz: Why did you decide to launch an ETF and how did you design the vehicle around your AI capabilities?

Kim: I started Qraft in 2016 with some engineering colleagues who shared my passion for quantitative investing and algorithmic trading models. At our start, we began perfecting our AXE trading insights platform, which was one of the world’s first commercialized deep reinforcement learning AI trading systems. We continued to add to our team and began developing a number of AI models to perfect the art and science of security selection and portfolio construction. Today, we call these models “Alpha Factory,” and they represent the artificially intelligent investment research analyst team and portfolio managers. Alpha Factory - which is comprised of a number of AI applications including machine learning and deep learning models - produces customized, actively managed equity portfolios, the first of which were developed and are still in operation today for some of our Korean institutional clients.

Oh: It was a natural part of Qraft’s growth and progression to enter the US market, and the ease of access and rising acceptance of active ETFs presented the perfect opportunity for Qraft to launch a US ETF. We currently have three active ETFs listed on the NYSE: the Qraft AI-Enhanced U.S. Large Cap ETF (ticker QRFT), the Qraft AI-Enhanced U.S. Large Cap Momentum ETF (ticker AMOM), and the Qraft AI-Enhanced U.S. Next Value ETF (ticker NVQ). Each of the ETFs have performed well since their launch and each has really stood out amid its peer group results in what has been an incredibly volatile period, which is exactly the environment where AI thrives.

Hortz: Can AI be applied to any investment style or methodology?

Oh: Yes! Remember, AI is fueled by data. With appropriate data sources, AI algorithms can be designed to assess individual equities, bonds, asset classes, market risk…it’s nearly without limit what AI can be modeled to accomplish. Notably, AI is not capable of predicting or learning outside of its defined, limited programming. For example, a machine-learning algorithm designed to make predictions on market risk cannot be repurposed to use its intelligence to select securities for an equity portfolio.

Ultimately, AI is technology designed and enabled by humans to address a perceived “problem” or challenge. At Qraft, this begins with the insights from our human investment and data experts who develop the AI model architecture with the goal of solving the specific problem, of transforming the challenge into an opportunity. As we said before, AI extends the skilled human investment capabilities. AI applications in investments span a huge range of capabilities, and at Qraft alone we employ models that rank individual securities, construct portfolios, provide signals for tactical shifts among asset classes, and we have our trade and order execution tools.

Hortz: Any advice or recommendations you can offer advisors and asset managers about why and how to add AI and its expanded investment toolkit to their investing process?

Kim: First off, you could build this capability in house. While AI is computationally intensive, costs have fallen dramatically in recent years. There are also robust opensource packages that have lowered the barriers to entry. That said, building out experienced data teams is a challenge, and there is a lot of competition to recruit for AI roles in investments as AI is just getting a foothold in this space.

Oh: Our team is currently working to develop a fully integrated AI-powered platform, which in beta we are calling AI Studio. AI Studio features AI-powered strategy discovery, portfolio analytics, and trade execution signals. AI Studio will allow asset and wealth managers to develop and operate new strategies with greater efficiency while lowering the barriers to entry for using artificial intelligence to drive investment decisions.

Kim: Ultimately, investors will either use AI, or risk falling behind. Like it or not, we live in a world surrounded by billions of data points. Masked in the massive universe of data are patterns and signals on which we can act to achieve superior results. Harnessing AI to farm those valuable insights will be the defining characteristic of the most successful firms in asset management.

Related: Investing at the Intersection of Social Justice and Environmental Sustainability