Written by: Michael Lai, CFA | Franklin Templeton

As China’s equity markets gradually open up to foreign investors, Chinese companies could face greater scrutiny.

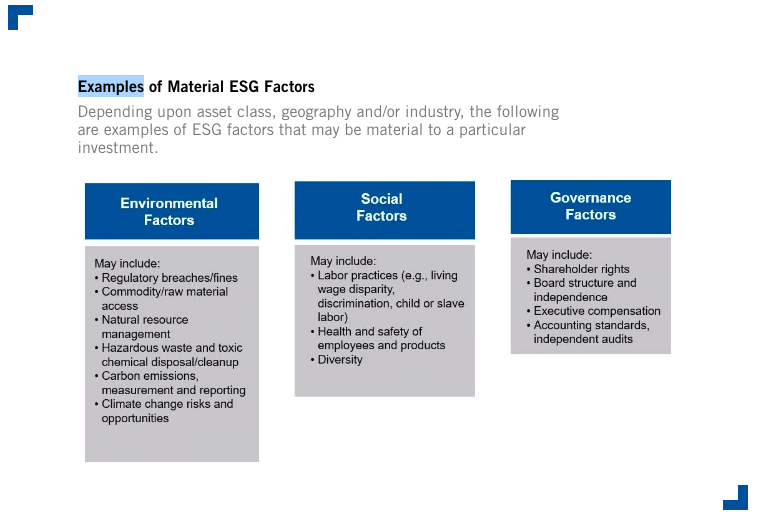

Awareness of environmental, social and governance (ESG) issues has increased in China, and government initiatives and increased foreign investor participation in China’s markets are largely driving it.

Over the years, China has slowly opened up its equity markets to foreign investors. The introduction of the Shanghai-Hong Kong Stock Connect program in 2014 was a milestone, followed by the government’s decision to lift restrictions on foreign investment in China in 2019. The rapid expansion of China’s equity markets is evident—foreign holdings of Chinese equities hit a record of 1.77 trillion yuan (US$253.14 billion) in the third quarter of 2019.1

As China’s equity markets hit the international stage, it also propelled ESG issues to the forefront.

As the participation of foreign institutional investors in the China A-share market rises, Chinese companies are likely to face greater scrutiny from these investors, who often have high ESG requirements. This in turn should lead Chinese companies to improve their ESG standards. However, at this point in time, China is still in the early stages of embracing ESG. As such, disclosures remain fairly weak compared to Western markets where ESG awareness is ahead of China.

We see signs confirming the above trends, as outlined below.

ESG disclosures are rising, but there’s ample room for improvement. The number of A-share companies disclosing ESG information has been rising over the past few years, yet there is still ample room to improve. As of September 2019, 945 companies issued a corporate social responsibility (CSR) report, representing about 26% of all China A-share listed companies.2 Within the CSR reports, the quality and frequency of key ESG data were also relatively low compared to international standards.

For example, with the constituents of the Shanghai Shenzhen CSI 300 Index, corporate governance has the highest disclosure average rate of 66%, while the average disclosure rate was lower for environmental and social responsibility factors at 40% and 29% respectively.3 Due to the new regulatory requirements, all China A-listed companies must now report on environmental measures/metrics and disclose the volume of total emissions of air pollutants such as nitrogen oxide, sulfur dioxide and water pollutants.

A growing number of domestic ESG-themed funds have emerged. We have observed an increase in the number of China-domiciled mutual funds with some ESG theme or focus on at least one aspect of ESG, such as energy saving.

We’ve found that while funds are generally listed as ESG-focused, standards may differ from practices observed overseas; therefore, further in-depth analysis of whether ESG factors are truly integrated into its investment philosophy and process should be warranted. That said, this trend also seems to point to a rising willingness to adopt higher ESG standards.

Higher ESG awareness among large-capitalization (cap), internationally exposed companies. We find that companies with a larger share of foreign ownership and large cap private-sector companies—typically sector leaders or those with a larger overseas exposure—tend to be more advanced in their adoption of ESG disclosures and policies. The reasoning is that these stakeholders have higher ESG expectations and may need to align with overseas competitors’ practices in order to remain competitive outside of China.

Large companies also have more resources on issuing ESG-specific reports relative to smaller companies, which tend to have a less diversified, more domestically oriented investor base that, for now, remains less sensitive to ESG matters. However, this is gradually changing.

More often than not, we have found that a rise in awareness from a social responsibility standpoint can contribute to better outcomes for the company—with greater social consideration there will likely be improved disclosure and ESG practices, which generally leads to a positive outcome for shareholders and stakeholders. For example, Chinese technology companies tend to benchmark themselves and compete against competitors in Western countries which operate in regions where ESG awareness is ahead of China. As a result, they often place more importance on ESG practices than companies operating in so-called “old economy” sectors, such as industrial manufacturing.

VARYING DEGREES OF ESG STANDARDS

Overall, companies in China are increasingly aware of the need to incorporate ESG and improve their information disclosure. We have observed varying degrees of adoption depending on company structures and sectors, and we also see varying degrees of ESG standards among companies: some companies proactively began to issue ESG reports, even before regulators required them to do so, while others complied simply because it was a regulatory exercise. We find that some companies, mostly in the private sector, strive to establish and follow even stricter standards than required.

By contrast, state-owned enterprises (SOEs) tend to lack high standards of corporate governance. That said, we favor SOEs with good management teams that align with minority shareholders’ interests, and believe solid ESG practices are important as part of a long-term corporate strategy.

ESG ISSUES GAINING ATTENTION OF CHINESE AUTHORITIES

ESG investment has gained increasing attention from China’s capital market participants, helped by the release of more policies and guidance from regulators. For example, as part of the Chinese government’s efforts to reduce pollution and improve environmental standards, a new regulation required listed companies to disclose environmental information from 2020. Therefore, national interest is one of the drivers of improved practices the government is pushing.

In 2018, the Asset Management Association of China (AMAC) circulated China’s first comprehensive and systematic self-regulation standards for the asset management sector on green investment with Green Investment Guidelines, which encourages fund managers to focus on sustainable, responsible investment. Likewise, starting July 2020, Hong Kong will require locally listed companies to disclose the board’s consideration of ESG risks, and how it determines which ESG matters are material to the business. This could help accelerate the adoption of ESG by companies listed both onshore and in Hong Kong.

A 360-DEGREE VIEW

From our observations, having a local presence and strong global footprint helps us source ESG information from Chinese companies listed onshore. As part of our routine due diligence, we use a range of information sources, including financial statement analysis, corporate reports and reference to third-party providers of dedicated ESG research where available, along with industry news reports and/or social media. More importantly, we rely on engagement with company management but also with employees operating in various departments. We strive to form a 360-degree view and also reference industry experts and competitors.

While ESG standards may not be as high in China as in the West just yet, we believe improvements in this area will continue. We do recognize that the pace of adoption may vary across industries and across companies, but believe a research-driven approach focused on quality and sustainability remains crucial to investing in China equities.

What Are the Risks?

All investments involve risks, including possible loss of principal. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments; investments in emerging markets involve heightened risks related to the same factors. To the extent a strategy focuses on particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such areas of focus than a strategy that invests in a wider variety of countries, regions, industries, sectors or investments.

Related: Surveying the Importance of Responsible Investing in Private Equity

ENDNOTES

-

Sources: Bloomberg, People’s Bank of China, September 20, 2019.

-

Source: China Sustainable Investment Review, 2019.

-

Ibid. The CSI 300 Index is a free-float weighted index that consists of 300 A-share stocks listed on the Shanghai or Shenzhen Stock Exchanges.