What excites Vitalik Buterin (Mr. Ethereum)?

Vitalik Buterin is the leading thinker around smart contracts and blockchain, as well as being the inventor of ETH, the currency, and Ethereum, the platform. A really bright guy and always worth a listen. So, I was interested in his latest blog about the future of where all this is going, which he published this past week.

What in the Ethereum application ecosystem excites me

It’s a lengthy piece which I could summarise, but it’s also quite complex … so I’ve just picked out a few select pieces.

Vitalik starts with …

Money: the first and still most important app

… and recounts how he managed to pay for coffee in Buenos Aires on Christmas Day using ETH. The issue however, was that it was costly and slow.

A year later, however, the calculus is different. As a side effect of the Merge – [Ed: allowing Proof-of-Work and Proof-of-Stake] – transactions get included significantly more quickly and the chain has become more stable, making it safer to accept transactions after fewer confirmations. Scaling technology such as optimistic and ZK rollups* is proceeding quickly. Social recovery and multisig wallets are becoming more practical with account abstraction.

The gist of what Vitalik is getting at here is that all the issues of speed and scalability of cryptocurrency transactions are being addressed by the new developments of blockchain technologies through on- (Layer 1) and off- (Layer 2) chain services.

Cryptocurrency in wealthy countries

Here he takes a swipe at CBDCs (Central Bank Digital Currencies):

The transition to a "cashless society" is being taken advantage of by many governments as an opportunity to introduce levels of financial surveillance that would be unimaginable 100 years ago. Cryptocurrency is the only thing currently being developed that can realistically combine the benefits of digitalization with cash-like respect for personal privacy.

I understand this point, but think that most Joe’s and Jane’s do not. The person on the Clapham Omnibus – the reference to the general public in old school court language – probably is far happier using a government issued note than something Sam Bankman-Fried offers them to trade with. So, this is a difficult barrier to overcome although, as mentioned, I understand the sentiment of a DeFi system (decentralised financial system) over a CeFi one (centralised).

Stablecoins

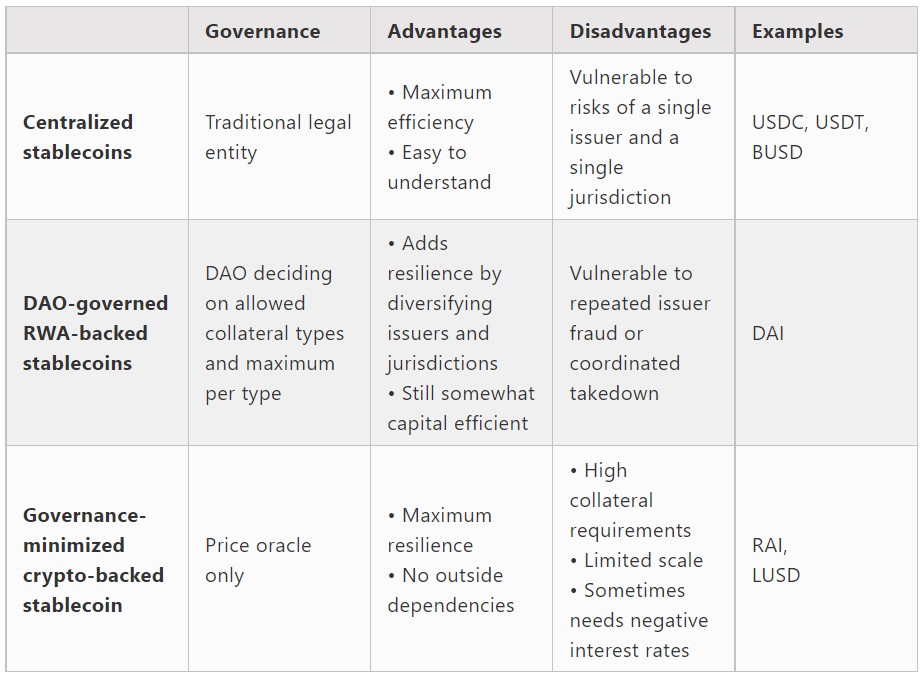

I see the stablecoin design space as basically being split into three different categories: centralized stablecoins, DAO-governed real-world-asset backed stablecoins and governance-minimized crypto-backed stablecoins.

This is an interesting one, and hits to the heart of my discussion of DeFi, CeFi or HyFi.

Going back to the previous point, will the person on main street want DeFi? Most today are happy with CeFi. But if you could combine DeFi with stablecoins that the general public recognise as being backed by real-world assets or, even more likely, real-world authorities, then I can see that working. So does Vitalik:

DAO-governed (DeFi) RWA-backed (real asset) stablecoins, if they can be made to work well, could be a happy medium.

Vitalik then goes deep into other areas like ...

DeFi:

DeFi “is now in the early stages of settling down into a stable medium, improving security and refocusing on a few applications that are particularly valuable. Decentralized stablecoins are, and probably forever will be, the most important DeFi product”.

Digital identities:

The big future challenge for this ecosystem is privacy. The status quo involves putting large amounts of information on-chain, which is something that is "fine until it's not", and eventually will become unpalatable if not outright risky to more and more people. There are ways to solve this problem by combining on-chain and off-chain information and making heavy use of ZK-SNARKs, but this is something that will actually need to be worked on

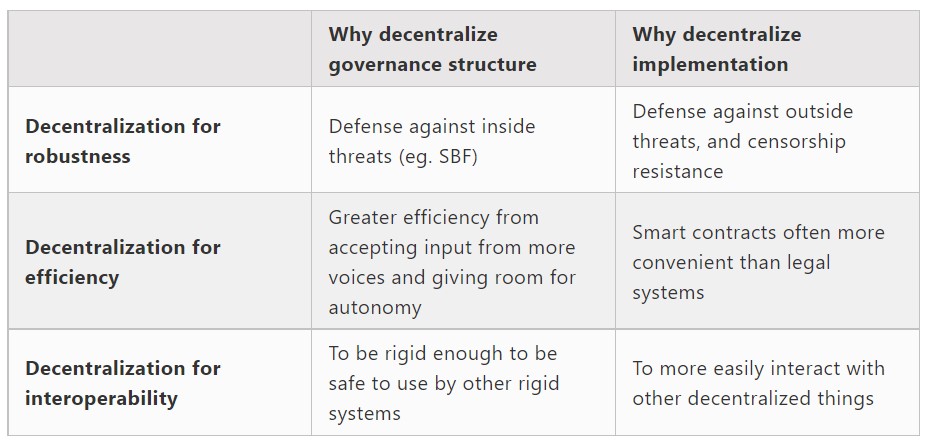

DAOs (Decentralised Autonomous Organisations):

There are two questions to answer: (1) What kinds of governance structures make sense, and for what use cases? (2) Does it make sense to implement those structures as a DAO, or through regular incorporation and legal contracts?

… and lots more.

It’s a fascinating piece and may well set the foundations of next generation financial services imho. Well worth the time to digest and read.

Related: The Crypto House of Cards