From: DoubleLine

Inflation Proofing

“There is no such thing as a riskless hedge against inflation.” – Edgar Fiedler

What is an effective way to guard against inflation? To most investors, U.S. Treasury Inflation-Protected Securities (TIPS) are a unique asset class defined as inflation-protected bonds. This is achieved by indexing the principal payment using the U.S. headline Consumer Price Index (CPI). In other words, the face value of TIPS changes with the actual inflation rate and is repaid at maturity subject to a minimum of par. In addition, semi-annual coupons paid on TIPS are based on the inflation-adjusted principal. This means that interest payments are also inflation adjusted.

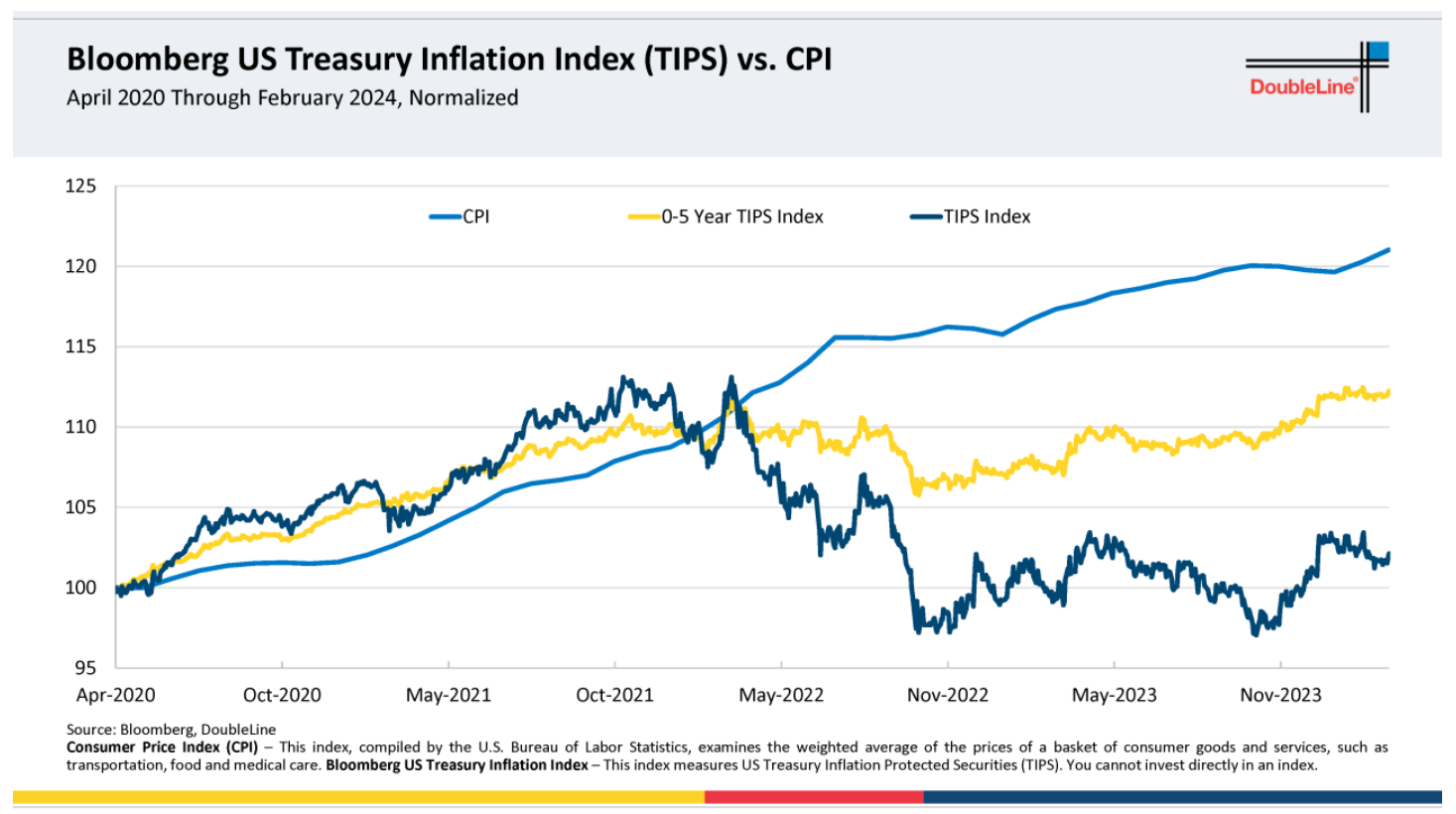

However, TIPS are not a free lunch. In the recent inflation cycle, April 30, 2020, through Feb. 29, 2024, U.S. inflation, based on headline CPI, rose 21% while TIPS, based on the Bloomberg US Treasury Inflation Index, gained only 2%, severely underperforming the overall inflation rate in the U.S. When American investors needed inflation protection the most, TIPS as an asset class underdelivered significantly.

Why? We think there is a misconception about TIPS. Since TIPS is traded on “real” rate, which equals the nominal interest rate minus the rate of inflation, TIPS offers a “real” rate of return. Like all bonds, TIPS are subject to interest rate risk, in this case “real” interest-rate risk. If the real rate rises, TIPS tend to decline in price. Over the recent inflation cycle from April 2020 through February 2024, real yields on the U.S. 10-year Treasury climbed by over 200 basis points from negative 0.42% to 1.93%. Such a sharp increase in real rates fully explains the underperformance of the TIPS index versus the U.S. inflation rate.

What was a better inflation hedge? Short-term TIPS or TIPS with a maturity of less than five years. Compared to the overall TIPS benchmark, short-term TIPS by design not only have a lower sensitivity to real interest-rate risk but also guarantee an inflation-adjusted return. As shown in the chart, the zero-five-year component of the TIPS index rose more than 12% percent versus the 2% of the overall TIPS index with lower realized volatility as well. While higher inflation going forward is not our base case, short-term TIPS can potentially be an effective portfolio diversification tool in the unforeseen scenario of reaccelerating inflation.